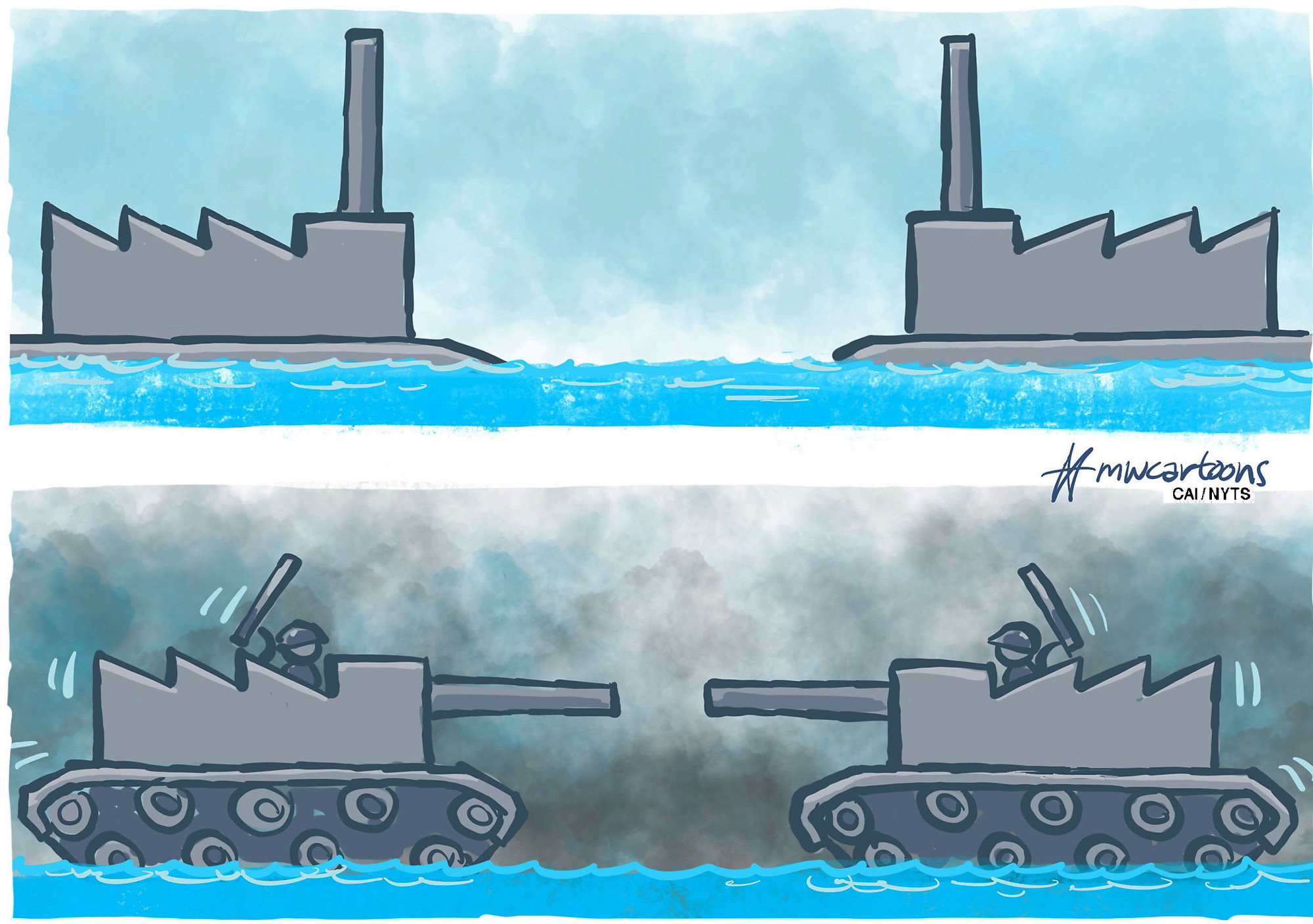

When all is said and done, U.S. President Trump's trade war may be fated to fail. There are many reasons why. One is that the target countries — prominently, China, Japan and Germany — won't accede to his demands. This is already happening. Another threat is a backlash among U.S. firms, hurt by tariffs that raise their products' prices. This, too, is happening.

But even if all these possibilities were avoided, the larger threat to Trump's trade agenda is the dollar's role as the major world currency. It dictates trade policy in ways not widely understood and is the ultimate cause of chronic U.S. trade deficits.

The dollar's role as the major world currency means it's used to settle trade transactions and make cross-border investments, even when Americans are not involved. The extra dollar demand boosts its value on foreign exchange markets. U.S. exports become more expensive and U.S. imports less so.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.