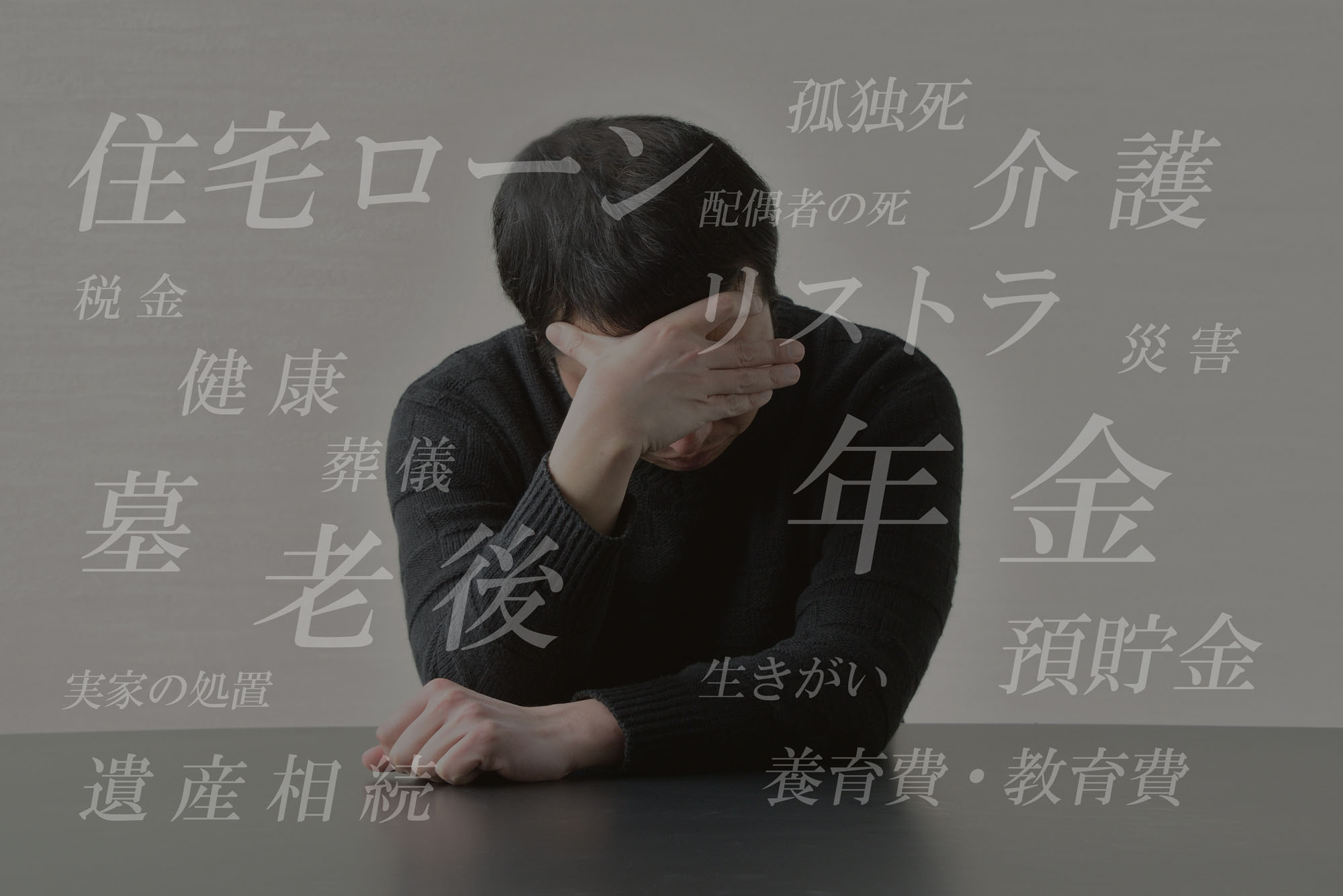

Emperor Akihito will be facing a lot of changes to his routine when he retires this week, but presumably the Imperial Household Agency will take care of all the details of his retirement planning. The rest of us, however, are on our own.

That means we need to arm ourselves with as much information as possible, just in case we end up permanently settling in Japan. For example, did you know that Japanese pensions are paid only six times a year?

"That means the pre-Christmas payment has to last through the New Year's holidays and all the way up to Valentine's Day," says Wm. (Wilhelmina) Penn, author of "The Expat's Guide to Growing Old in Japan," which was first published in 2017. The book was updated in December last year to reflect recent changes in Japan's inheritance law.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.