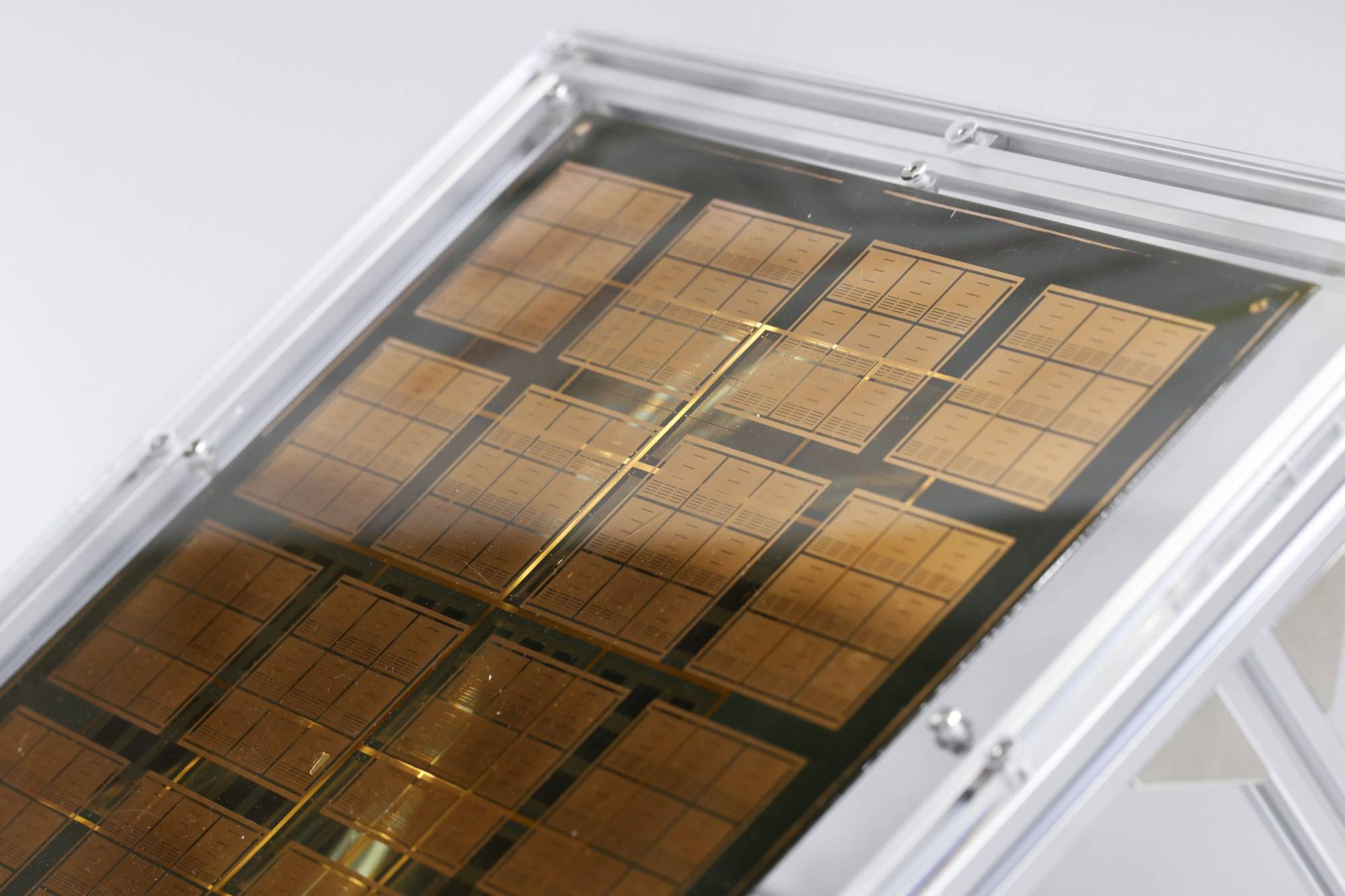

Resonac Holdings is ready to spend hundreds of billions of yen on chip acquisitions, as the 84-year-old chemicals giant seeks to boost its role as a pivotal supplier to global giants like Taiwan Semiconductor Manufacturing Co. and Samsung Electronics, the firm's CEO has said.

The Japanese company, which last year outlined a ¥250 billion ($1.9 billion) blueprint to beef up its chip facilities by 2027, aims to capitalize on a much-needed consolidation of the $580 billion semiconductor industry, said CEO Hidehito Takahashi. Resonac — which changed its name from Showa Denko this month to reflect its changing focus — must seek out partners to thrive in an increasingly politicized and economically uncertain environment, he said.

Takahashi said there weren’t many attractive acquisition targets at the moment, within an industry in a state of flux. Resonac is meanwhile looking to invest, and one promising country was the U.S., as its major customers from Samsung to TSMC spend billions to build plants there. The Japanese company will remain cautious about spending in China, given Washington’s escalating campaign to curb that country’s semiconductor industry.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.