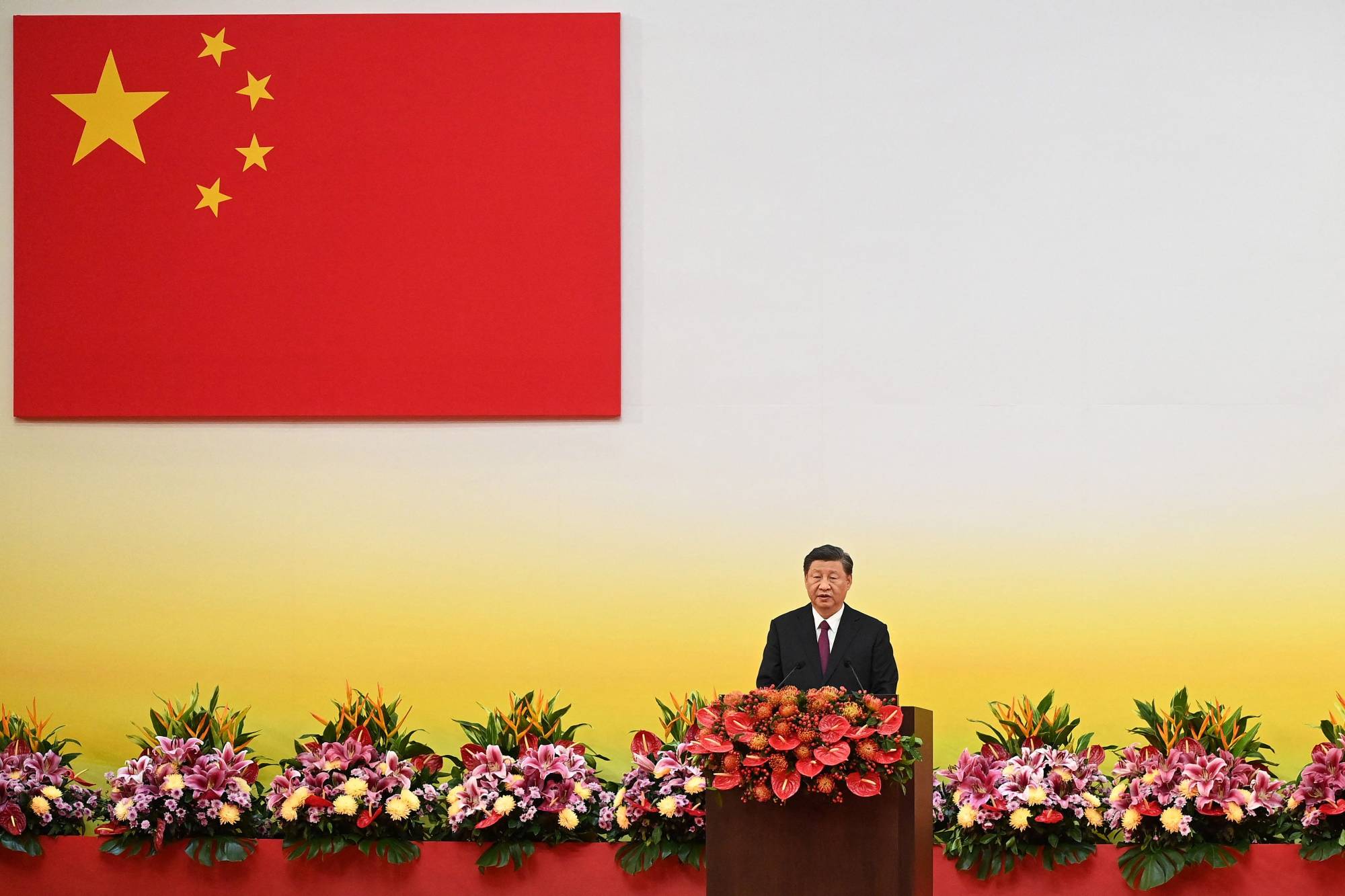

After drawing foreign capital into China’s markets for years, Chinese President Xi Jinping is now facing the risk of a nasty period of financial de-globalization. Investors point to one main reason why: Xi’s own policies.

Money managers once enticed by China’s juicy yields and huge tech companies now say reasons to avoid the country outweigh incentives to buy. They cite everything from unpredictable regulatory campaigns to economic damage caused by strict COVID-19 policies, not to mention growing risks stemming from a wobbly real-estate market and even Xi’s coziness with Russian President Vladimir Putin.

It all marks a dramatic about-face for a market that had been developing into a magnet for investors from around the globe, a role that seemed to be China’s destiny as the second-largest economy.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.