While withdrawing or transferring cash through a bank teller may already seem old-fashioned, it could completely disappear in Japan within a few years as banks revamp their branches to adapt to the digital age.

With a changing business environment stemming from ultralow interest rates prodding the nation's banks to rethink their strategies — and with money transactions online becoming more safe and convenient than ever amid the pandemic — their physical outlets are starting to take on a different look, focusing more on consultation services rather than traditional transactions.

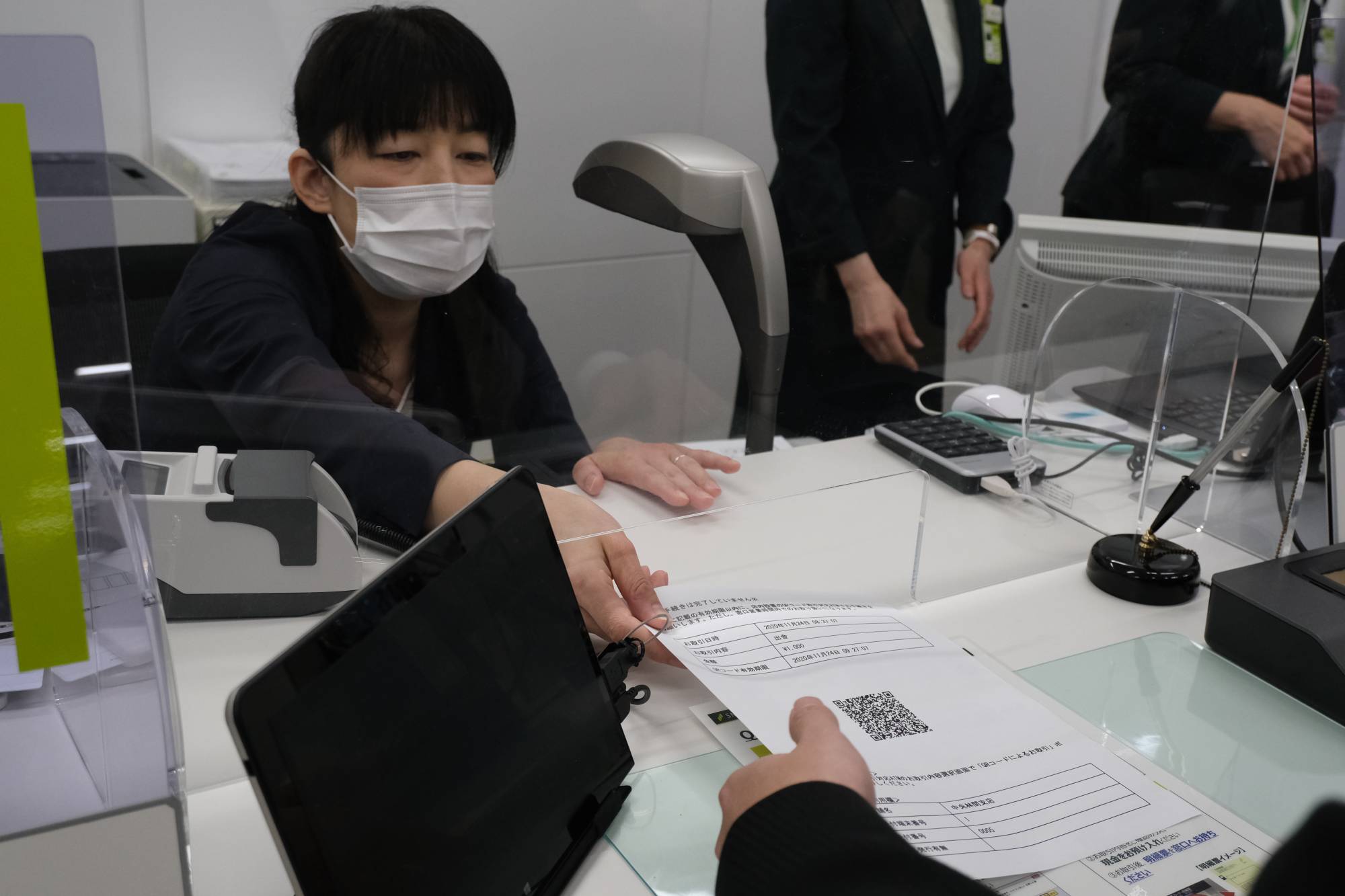

On Tuesday, Sumitomo Mitsui Banking Corp., one of the nation's three megabanks, unveiled a new branch that has basically eliminated cash transaction services by bank tellers.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.