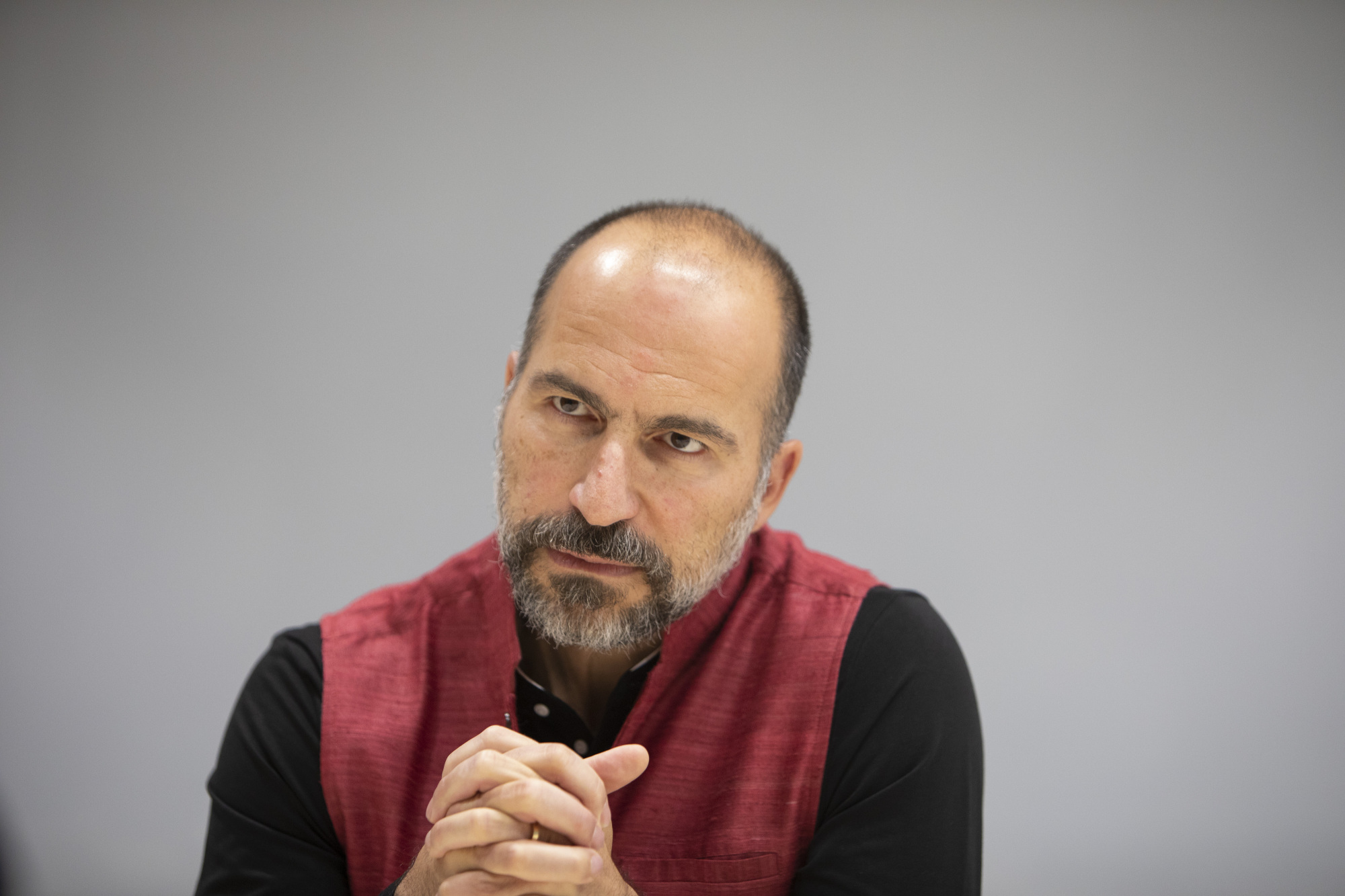

Uber Technologies Inc. Chief Executive Officer Dara Khosrowshahi is vowing to make his company profitable while pursuing growth from emerging arenas such as India, addressing investors' concerns about the ride-sharing company's mounting losses and global regulatory challenges.

Uber, which lost about $5.2 billion in the second quarter alone, is having a tough time convincing the market of its growth potential — or that it can turn a profit anytime soon.

Its stock has plummeted 27 percent since a disappointing initial public offering in May. Khosrowshahi, who this month unveiled a final round of job cuts, said the core rides business would achieve profitability even as newer lines, such as Eats, gained traction.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.