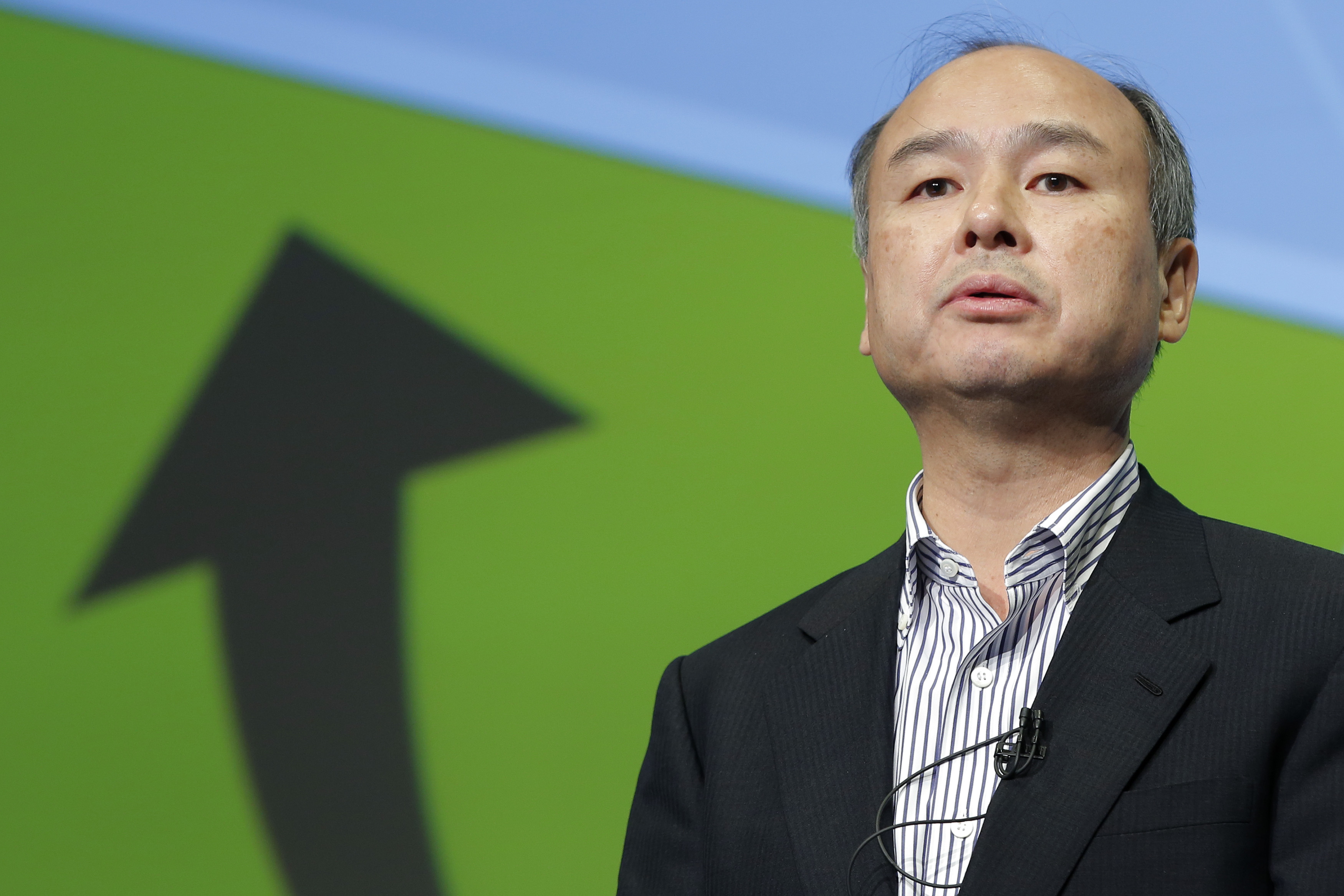

Months after Masayoshi Son is said to have shelved a plan for a management buyout of SoftBank Group Corp., there are still 13 billion reasons to take the company private.

That's the difference in dollars between the value of SoftBank itself and its investments in companies, including Alibaba Group Holding Ltd.

Son considered teaming with a partner for a management buyout earlier this year in response to a sagging share price, sources familiar with the matter said last week. With SoftBank down 16 percent since this year's peak in April, it's now cheaper for the billionaire to take private the company he founded more than three decades ago.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.