It was unprecedented.

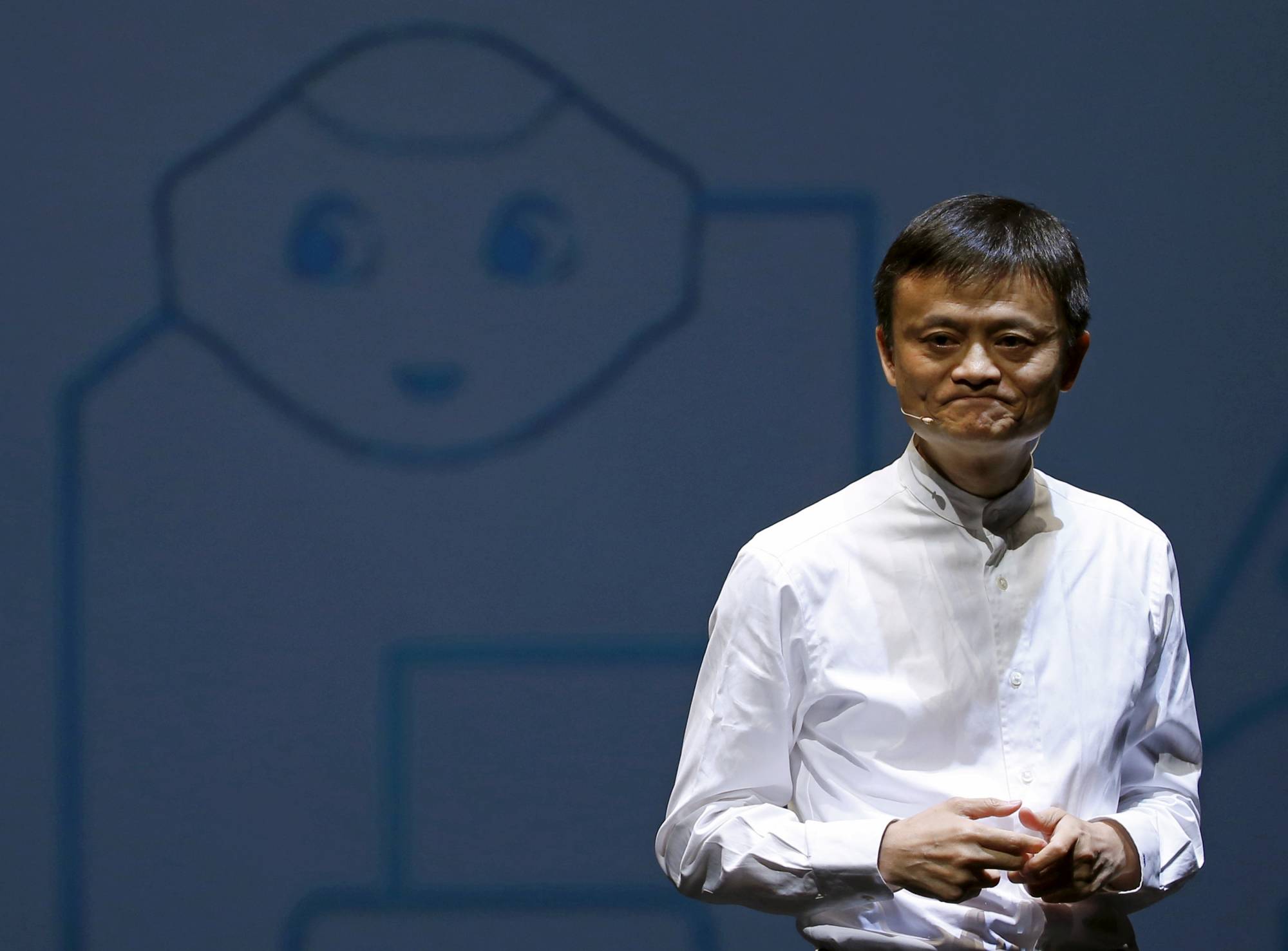

On Nov. 2, China suspended a blockbuster initial public offering of financial technology giant Ant Group Co. two days before its planned debut on the Hong Kong and Shanghai stock exchanges. Ant was on track to rake in about $34.5 billion (about ¥3.6 trillion) with investors already subscribing to the IPO.

The fact that a single digital financial company was about to raise ¥3.6 trillion quite easily proved the market’s confidence in the future of China's digital society.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.