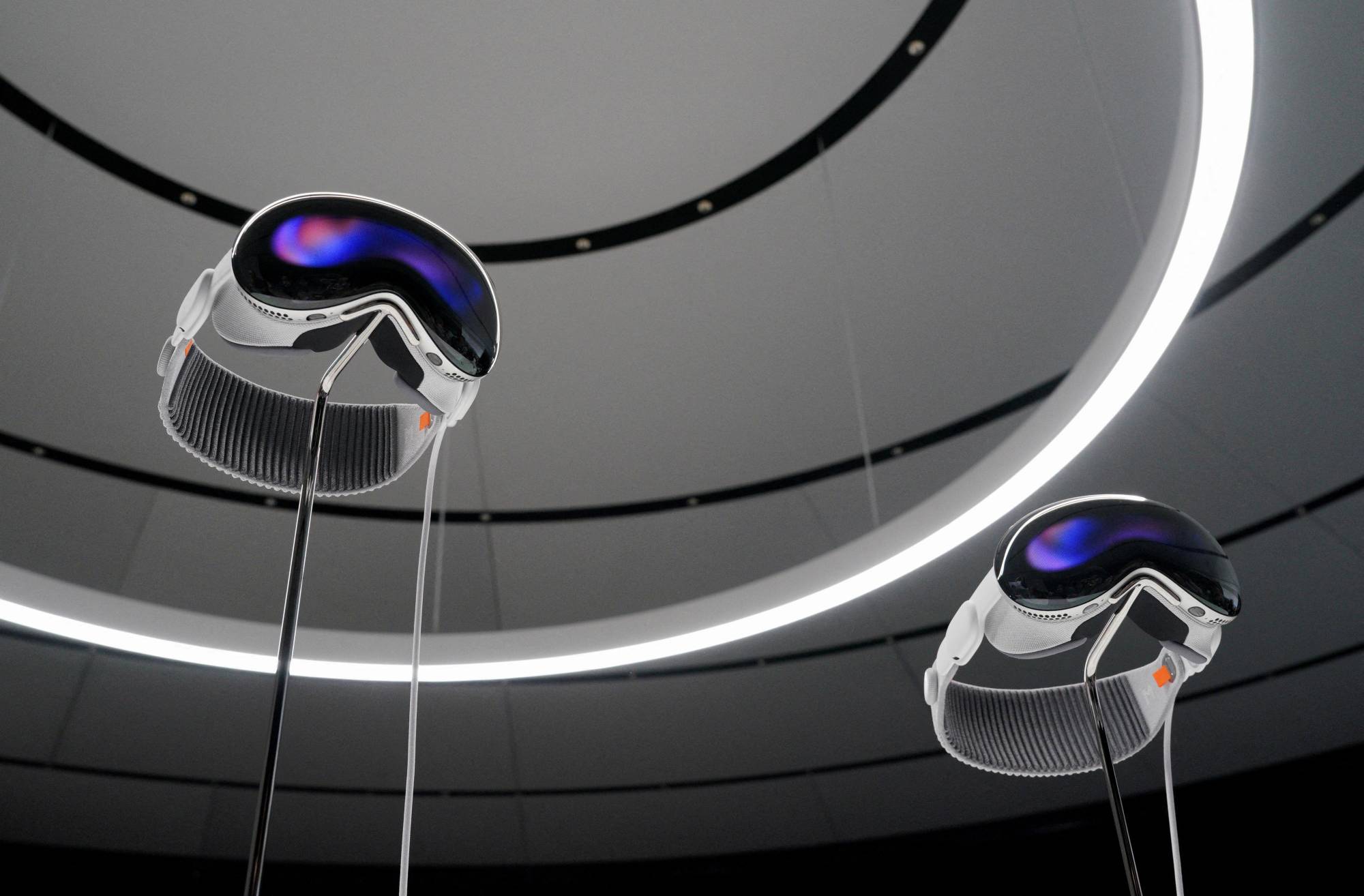

With Apple entering the virtual and augmented reality race with its newly announced $3,499 Vision Pro headset, its success in Asia — a key market for VR — will be closely watched.

While VR remains a niche interest outside gaming in much of the world, in Asia the technology has found favor with a wider range of users and sectors — including education — with Japan, South Korea and China ranking among the most advanced markets for headset adoption. According to Statista Market Insights, in 2023 the top three markets by value are the U.S., China and Japan.

Underlining the region’s importance, Apple will base half of its six Vision Pro developer labs in Asian cities: Tokyo, Singapore and Shanghai.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.