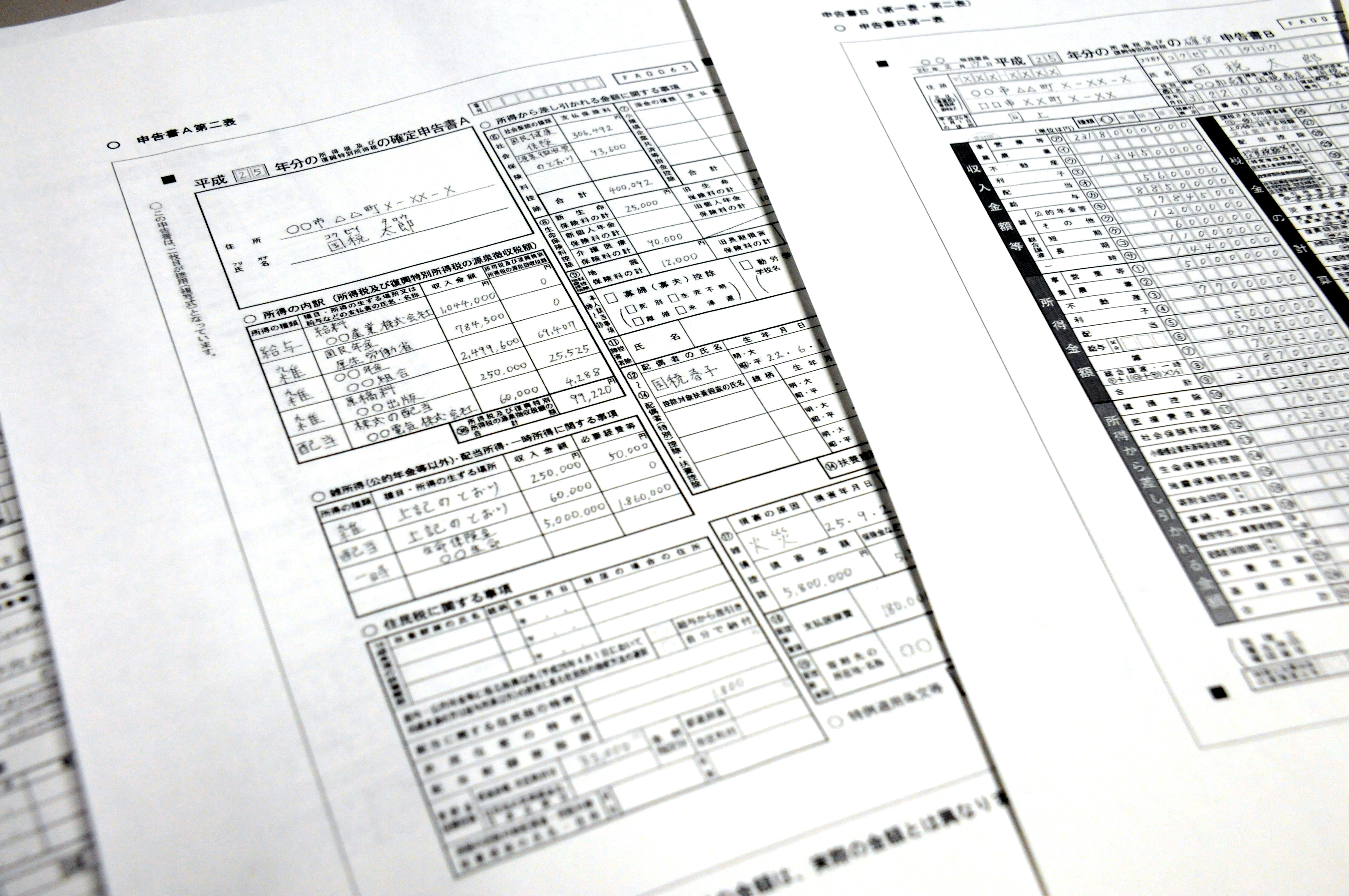

Filing a tax return isn't easy at the best of times, but doing it in another country can be particularly challenging. Fortunately, if you work for a company and that's your sole source of income in Japan, they will take care of everything for you. However, those who are self-employed or have multiple sources of income will have to file a tax return (kakutei shinkoku, 確定申告).

Lisa, who has built up a freelance business as a copywriter and proofreader, has a question about her tax return:

I have received my tax pack from the city office for filing under the Blue Form system, and I've collected the tax certificates from the various client companies I work for showing how much I was paid and how much tax was withheld. However, I noticed that one company had split the payment between two certificates. One certificate showed tax withheld and the other didn't. When I called their accounting department to see if there was a mistake, they said that depending on the category of the work, some isn't liable to tax. I thought the whole thing was strange, though. Is this going to be an issue when I file my return?

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.