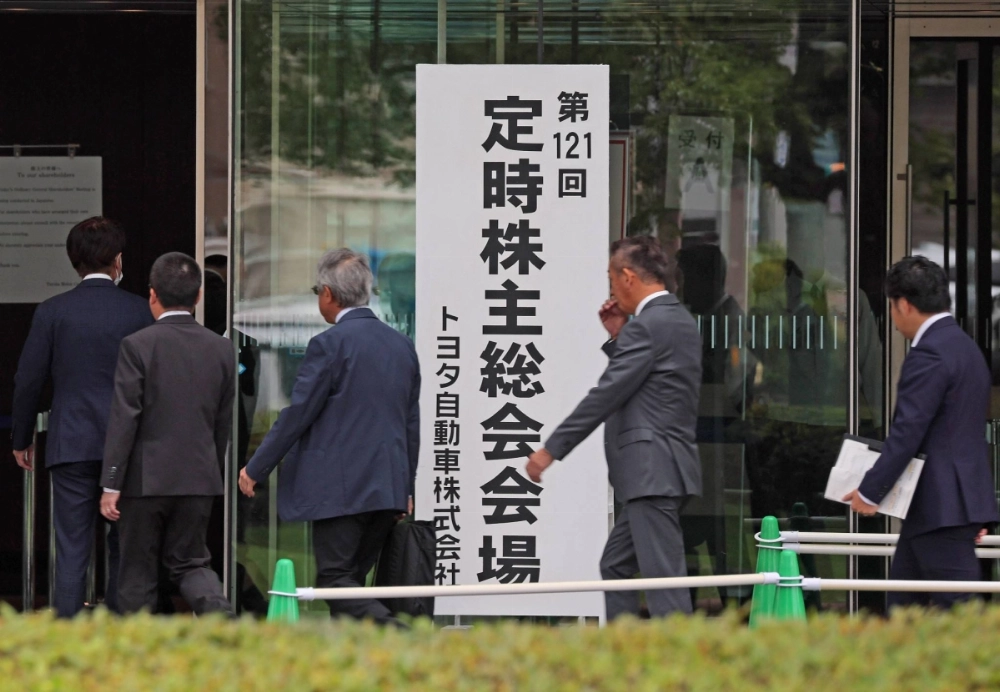

Activist investors are inundating Japanese companies with an unprecedented number of proposals that will keep executives on their toes at annual general meetings (AGMs).

Firms have received a record 137 requests from activists, according to data compiled by Mitsubishi UFJ Trust & Banking. The shareholders are delving deeper into management decisions and demanding changes to board structures and privatizations.

The country’s jammed AGM season matters more than ever this year as investors seek signs that Japanese stocks — which have underperformed most major markets this year — can get out of a rut. The proposals are putting added pressure on management to deliver tangible growth strategies, rather than simply turning to the quick fix of more buybacks or dividends.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.