Followers of John Maynard Keynes are very happy. They are convinced their time has come, or rather has returned. What the great British economist recommended in the 1930s, which was for governments to spend, spend, spend to counter the collapse of demand and drag economies out of the morass of appallingly high unemployment, seems suddenly relevant again in the current global pandemic crisis.

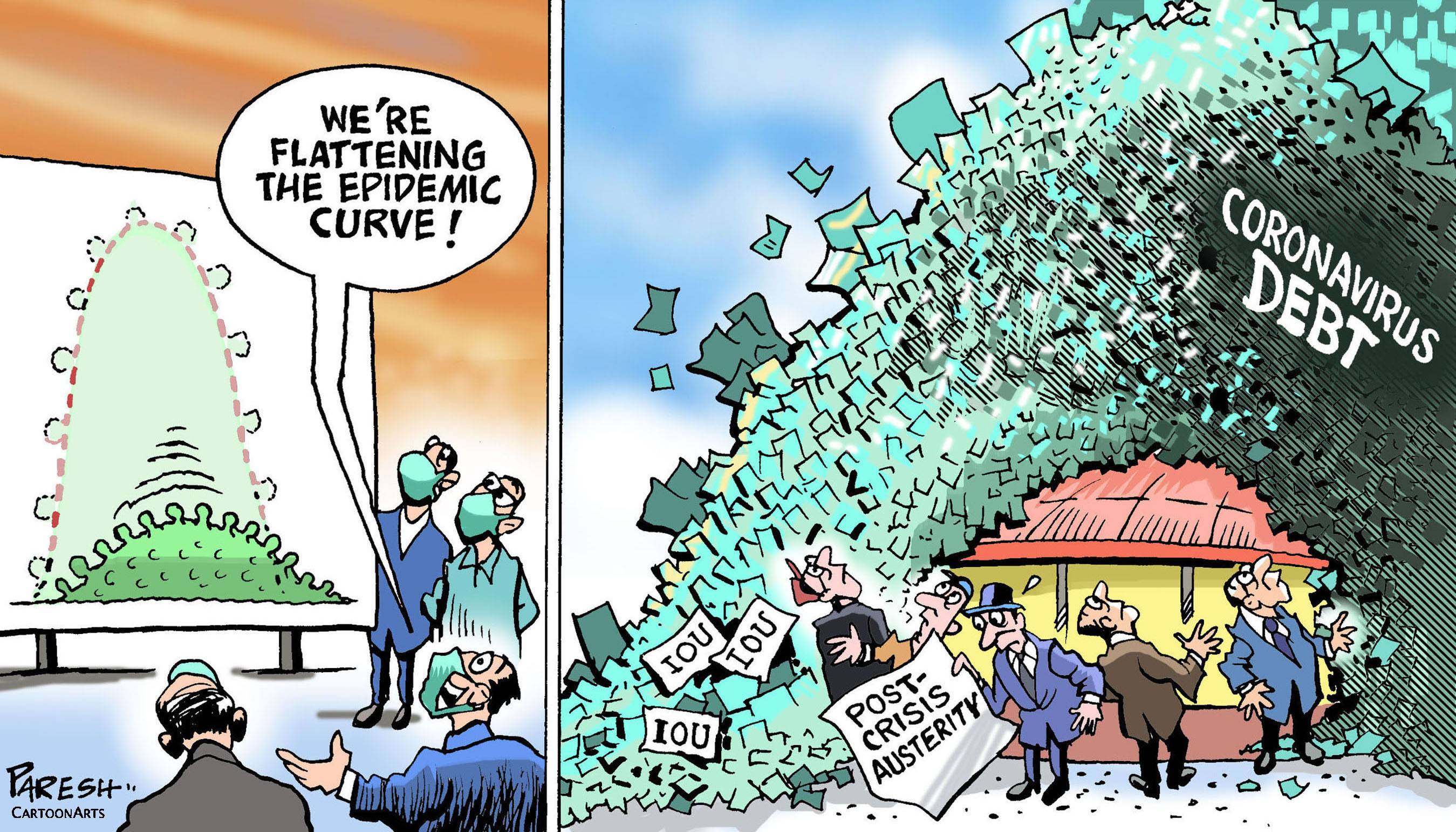

Now millions are once again out of work. This time there has been no hesitation and the taps of public spending have been well and truly opened. How it is all going to be paid for is being postponed into the future, whether by taxes as demand recovers and economic life resumes, or by borrowing on a gargantuan scale, which could of course lift interest rates above the minimal levels they have been at since the last financial crisis in 2008-2009, or just by inflation shrinking the debt away, or by a mixture of all these routes.

In the meantime, goes the claim, the big state is back, pouring out resources. This, of course, greatly pleases not only the political left, which has been pining for a return to large-scale state intervention and control since the rise of markets and the demise of state socialism in the last century, but also the school of economists that has been demanding more Keynes-type public spending all along over the last decade since the banking crisis and financial collapse a decade ago.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.