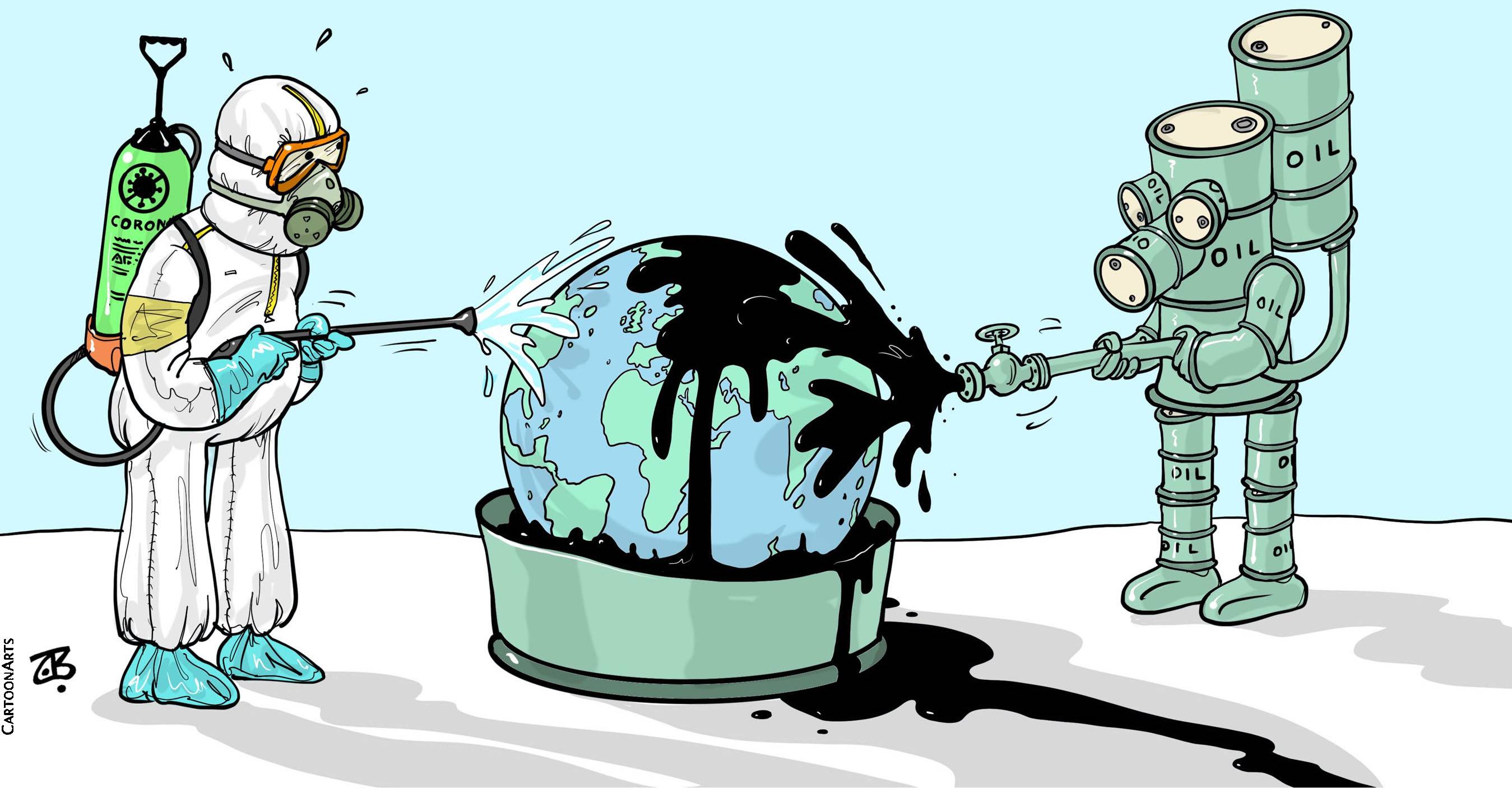

For the global oil industry, it has been a double whammy. First a foolish price war between two of the world’s three biggest producers, Russia and Saudi Arabia, drove the price per barrel down from almost $70 in early January to under $50 in early March. They were fighting each other for market share, and they were also hoping that lower prices would kill off U.S. shale oil, whose production costs are higher.

Then the second whammy: The COVID-19 lockdowns that started spreading across the world in early March cut total demand for oil by 30 percent in the next six weeks. By last weekend a barrel of "Brent crude" was selling for only around $20. (There are two oil prices: "West Texas Intermediate" mainly for U.S. oil and "Brent," always a few dollars higher, for the rest of the world.)

Actually, on Monday the U.S. oil price briefly dropped another $60 to minus $40, because demand has dropped so far below supply that the world is running out of places to store the excess oil. The producers can’t just pour it on the ground and it’s very expensive to shut wells down, so they’ll pay somebody who still has storage capacity to take it away.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.