It is said by some that history unfolds in decades-long waves or swings of the pendulum, each phase tending to counter or reverse the philosophies, beliefs and fashions of the previous one. If that is so then the political and economic history of the last 60 years or so at first glance fits the theory rather well.

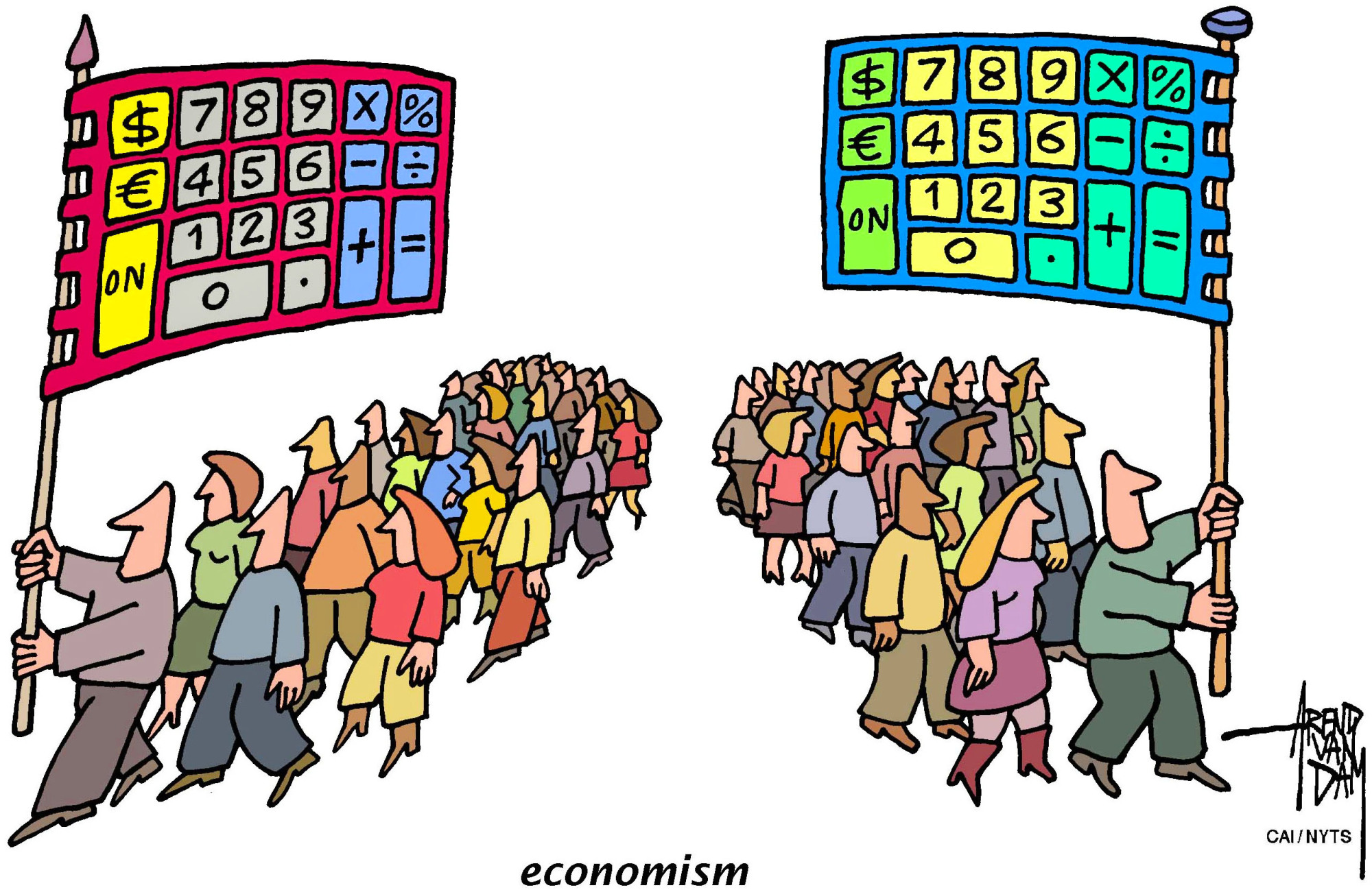

There can be no doubt that round about 1970 the world began to get tired of the dominant and powerful state, which seemed to have reached its limits, and started looking to markets and capitalism as the way forward.

That was then. But 40 years or so later, market capitalism, too, reached its limits, boiling over into world financial chaos around 2010.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.