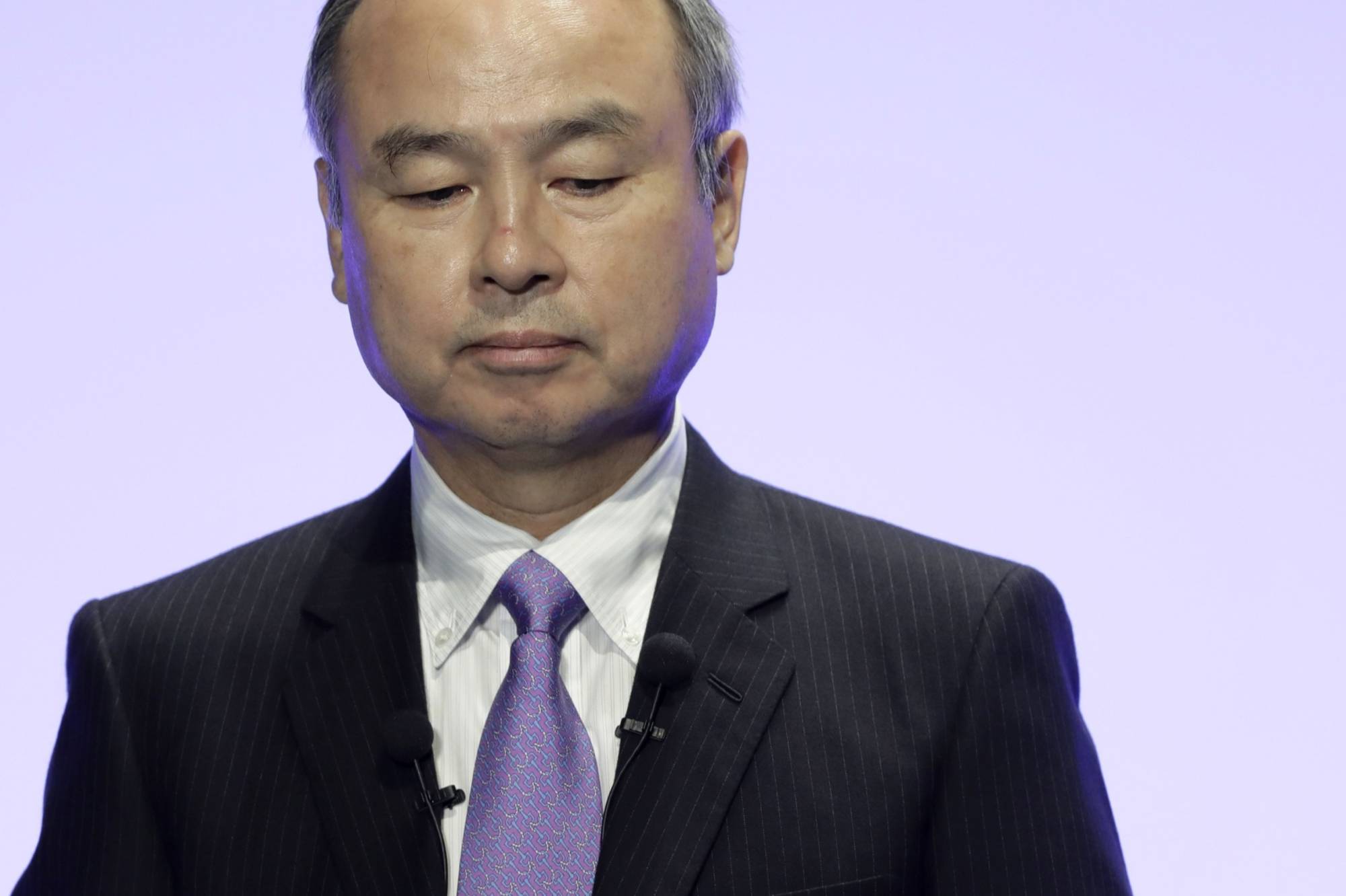

Masayoshi Son has now lost more than $4 billion (¥532.4 billion) on a series of side deals he set up at SoftBank Group to boost his compensation, a painful blow triggered by the broad downturn in the technology market.

The Japanese billionaire took the unusual step of establishing personal stakes in a series of SoftBank ventures in recent years, a mixing of company and executive interests that drew the ire of investors. Son holds 17.25% of a vehicle set up under SoftBank’s Vision Fund 2 for its unlisted holdings, as well as 17.25% of a unit within its Latin America fund, which also invests in startups. He has a 33% stake in SB Northstar, a vehicle set up at the company to trade stocks and derivatives.

Son has racked up a deficit of $2.1 billion from his Vision Fund 2 interest, and $205 million at the Latin America fund, according to disclosures for the June quarter. His cumulative loss at SB Northstar is ¥274.6 billion. The amount Son owes SoftBank from his interests in Vision Fund 2 and the Latin America fund rose about $1.9 billion in the last quarter.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.