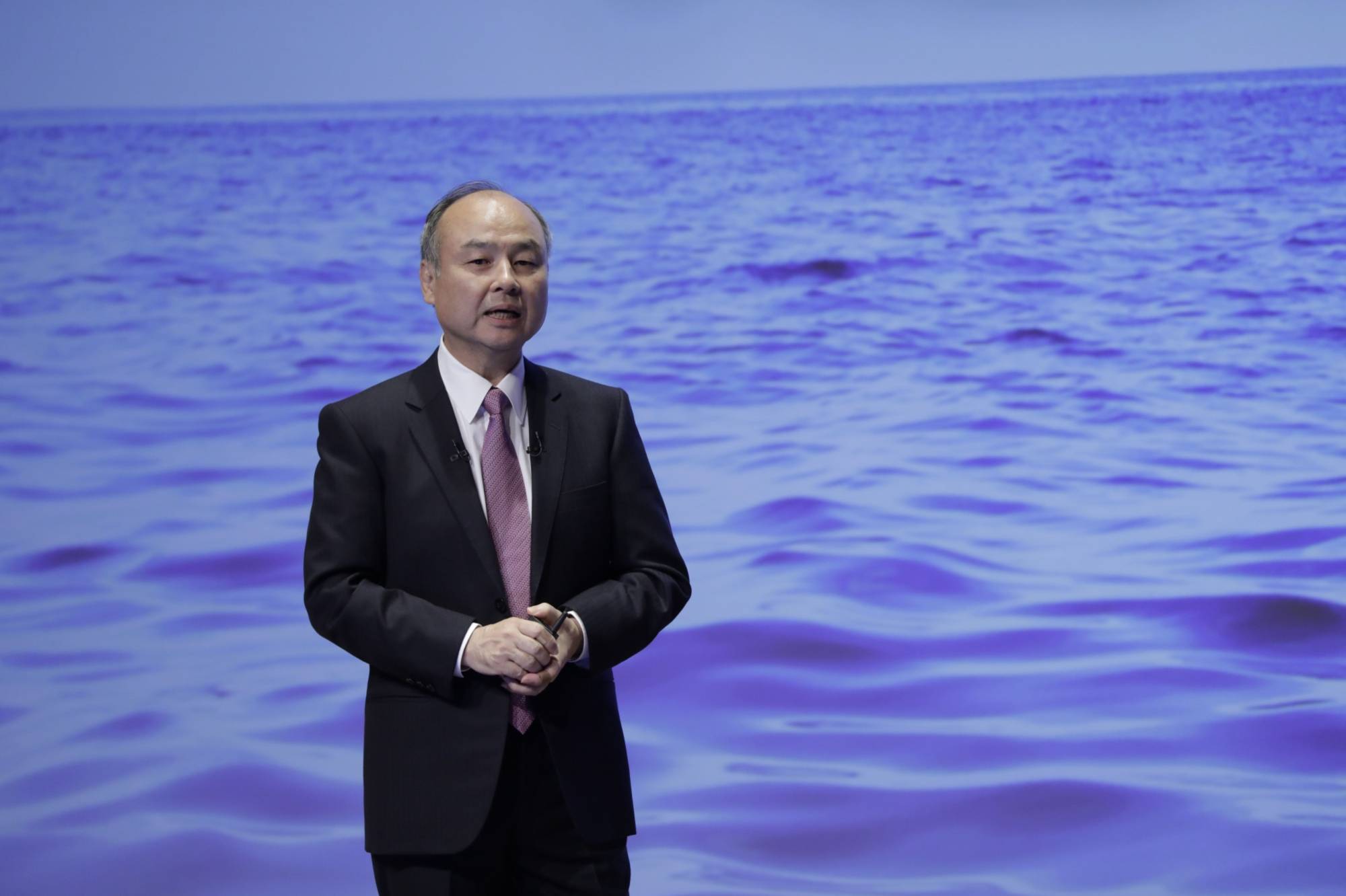

SoftBank Group Corp. founder Masayoshi Son is used to praise and encouragement from shareholders. But the company’s loss of ¥4.6 trillion ($34 billion) in market value over the last year is a test for even his most faithful admirers when they gather for the annual shareholders’ meeting on Friday.

Investors stuck by Son when SoftBank announced a holding company strategy in 2015 to hive out its staid but profitable domestic telecom business to become the world’s largest investor in volatile tech startups. When the Vision Fund booked a ¥2.4 trillion loss on investments like WeWork and Uber Technologies Inc. in 2020, they pointed to Son’s ability to win thousandsfold returns on Alibaba Group Holding Ltd. When Son preached patience as the stock began a downward trajectory from a March peak last year, they listened and hung on.

But five years of deploying ¥19.2 trillion has now resulted in a record ¥2.1 trillion loss for the company in the quarter ended in March. Much of that can be pinned on the recent global selloff in tech and a crackdown on China’s biggest technology companies, but much can also be attributed to SoftBank’s pressure on companies to make big, aggressive bets.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.