Japanese equities are primed to close the gap with global peers in 2022, analysts and strategists say, with the country’s cheap valuations, low inflation and high vaccination rates set to make up for a disappointing 2021.

Goldman Sachs Group Inc. and Morgan Stanley have 12-month targets of 2,250 for the benchmark Topix index, implying a gain of 12% from Thursday’s close, while UBS SuMi Trust Wealth Management sees it hitting that level by June. In a boon for the country’s many exporters, the yen is seen worsening its drop against the dollar after the Federal Reserve’s abrupt policy pivot this week.

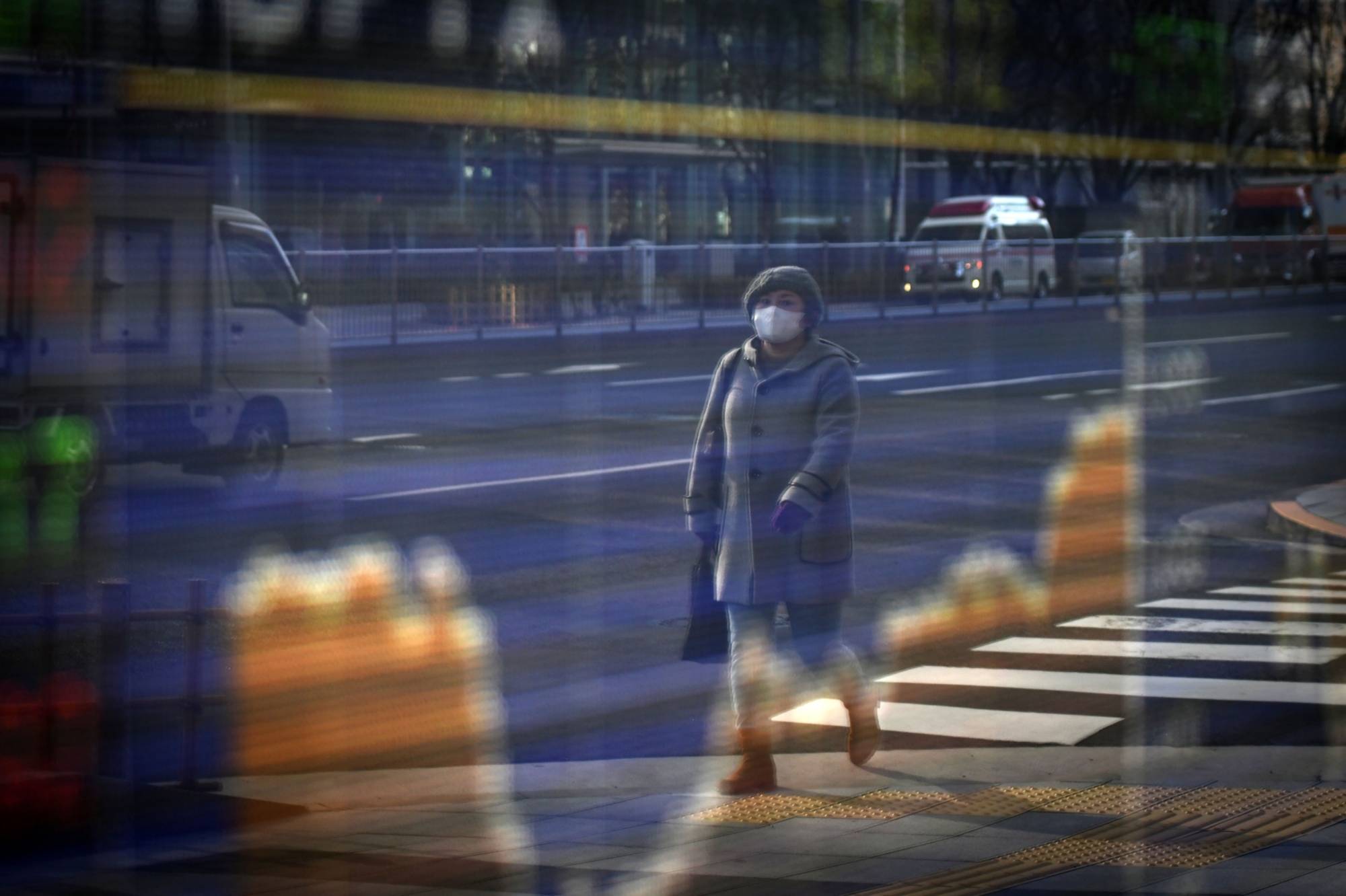

The bullish predictions come after Japan fell behind its developed peers this year, with lengthy COVID-19 states of emergency sapping spending and growth.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.