Prices for digital collectibles like art and sports memorabilia are sliding, turning the focus back on whether the nascent market for so-called non-fungible tokens is any more than a fleeting mania.

Average prices for NFTs — essentially tradable digital certificates that use blockchain technology to prove ownership and provenance of online assets — have tumbled almost 70% from a peak in February to about $1,400, according to Nonfungible.com, which tracks a variety of NFT marketplaces.

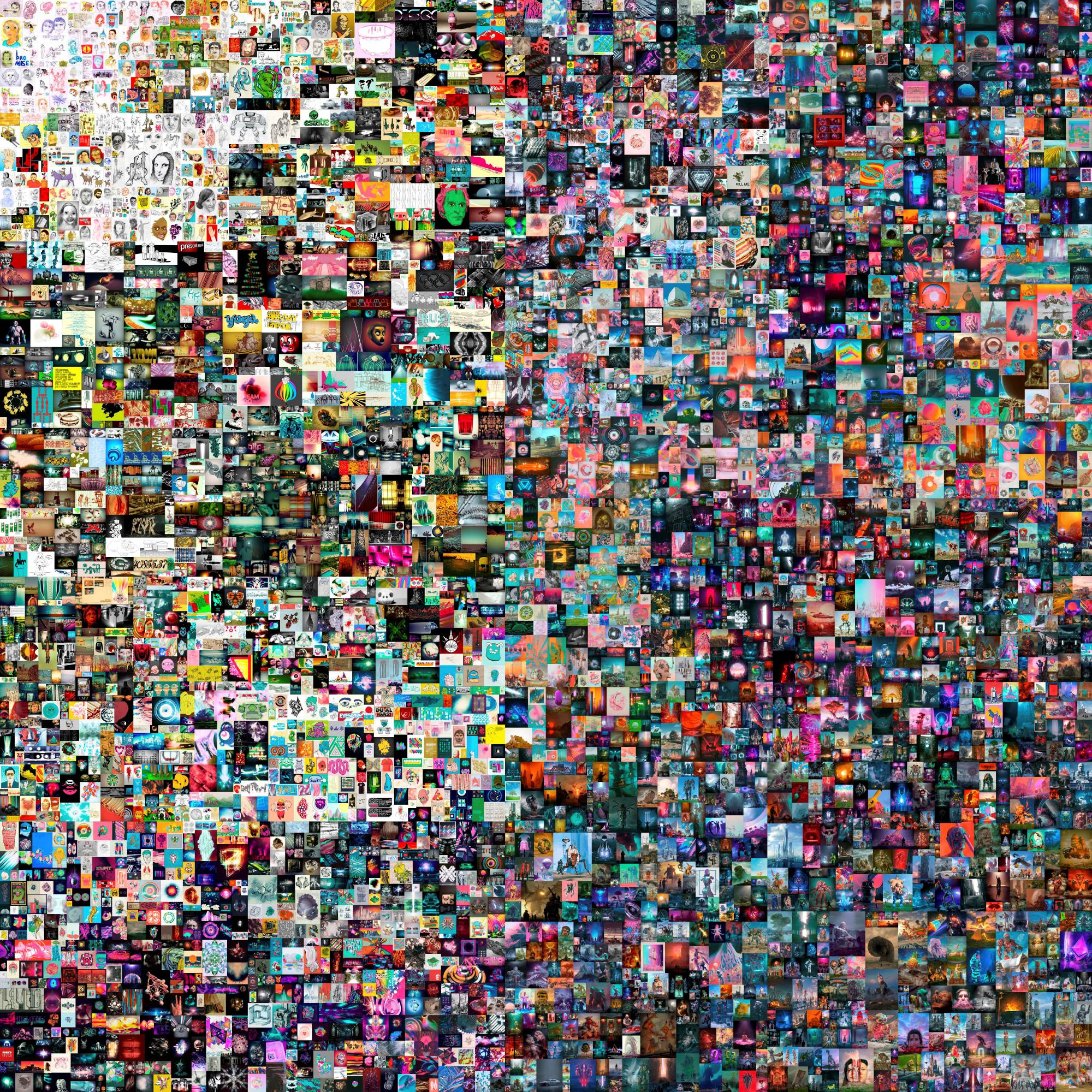

A burst of interest in NFTs hit a peak last month when a digital artwork by Beeple sold for a staggering $69.3 million. For some, that sum showed NFTs were in the grip of investor excess in a world full of stimulus, and destined to fizzle. Others who study the technology argue the use of blockchain to create scarcity for digital collectibles is a lasting innovation rather than a price fad.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.