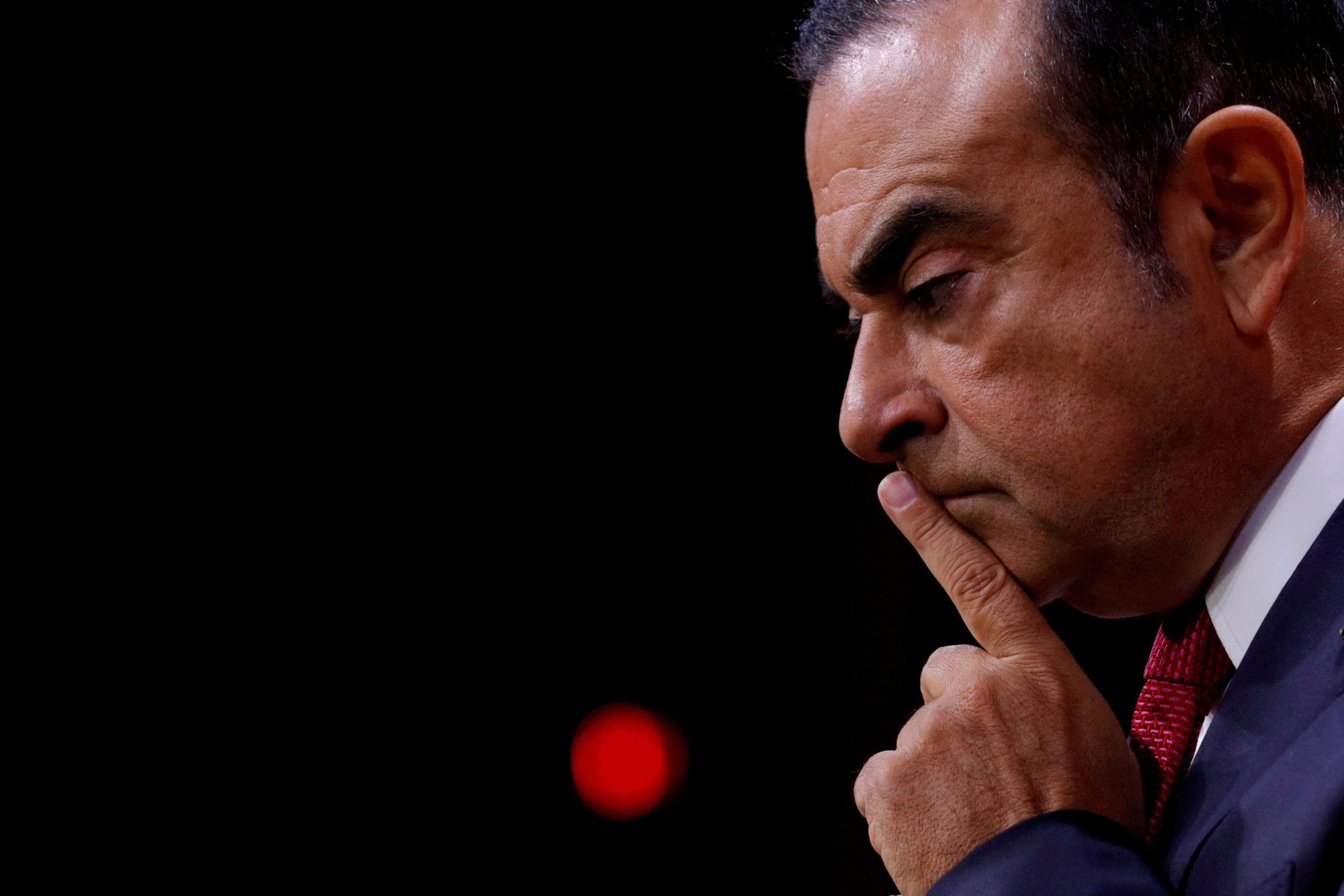

Sources with knowledge of Nissan Motor Co.'s probe into its former Chairman Carlos Ghosn have said that an individual involved in fresh misconduct allegations against Ghosn is Khaled Al-Juffali, vice chairman of one of Saudi Arabia's largest conglomerates and a member of the board at the Saudi Arabian Monetary Authority.

The latest allegations, brought last week by Tokyo prosecutors, center on use of company funds to pay a Saudi businessman unnamed in the prosecutor's statement who is believed to have helped the ousted Nissan chairman out of financial difficulties, two company sources with knowledge of the matter have said.

Prosecutors arrested Ghosn for a third time on Friday, accusing him of aggravated breach of trust in transferring personal investment losses to the automaker. The prosecutors' statement said they believed that around October 2008, Ghosn was trying to deal with losses on paper of ¥1.85 billion ($16.6 million) incurred on a swap contract he held with a bank, which was not named.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.