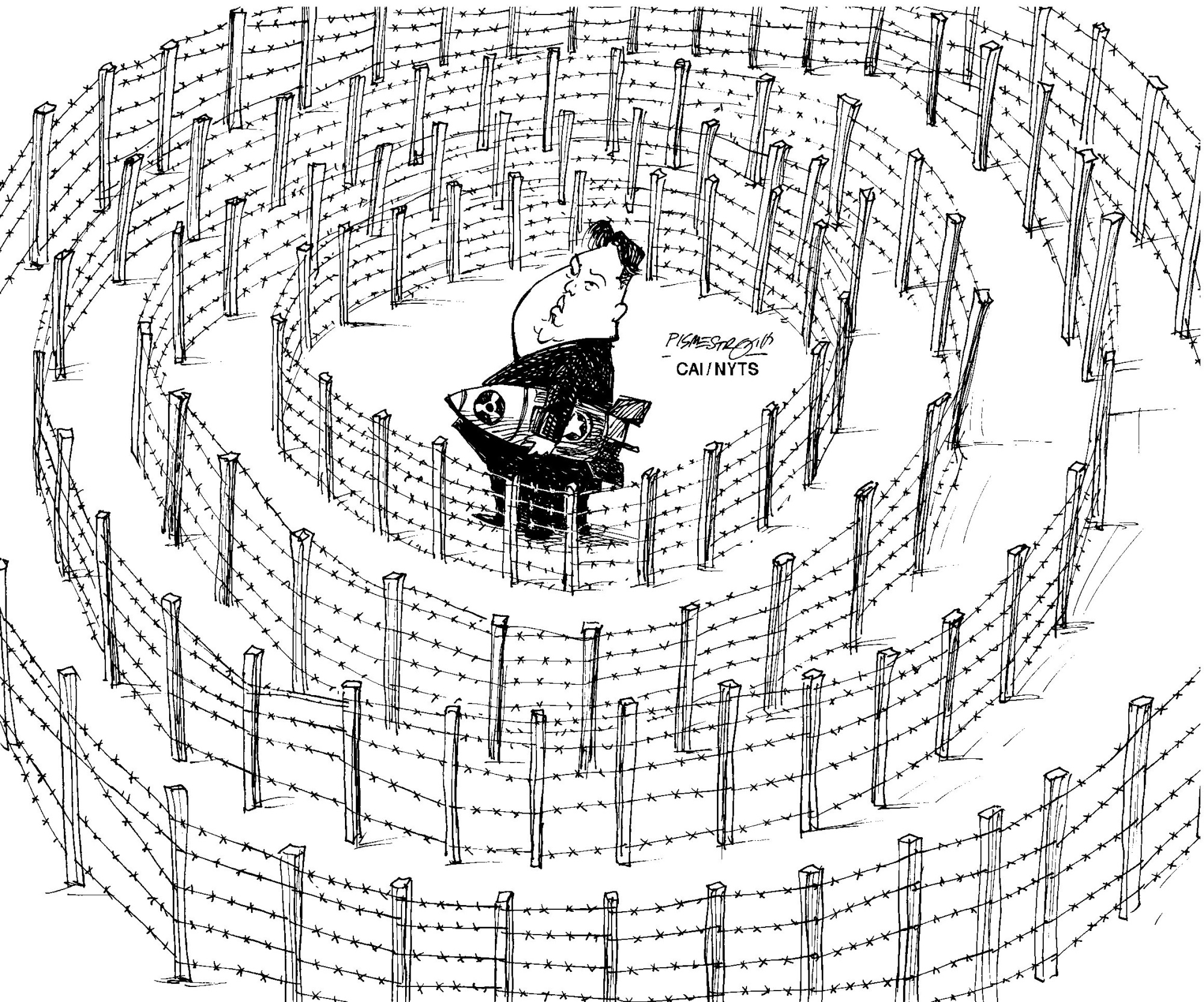

While the Pyeongchang Winter Olympic Games opened the door to rapprochement between the two Koreas, tension between the United States and North Korea showed no sign of easing as Washington maintained its hard-line stance against Pyongyang. Japan has been in lockstep with the U.S. on North Korean issues, and Prime Minister Shinzo Abe reiterates that Tokyo stands shoulder to shoulder with Washington in dealing with the rogue state. Against this backdrop, a bank transaction scandal threatens to shake the Japan-U.S. alliance. How will the U.S. react to money sent from Japan that could possibly end up financing North Korea's nuclear development program?

The money transfers in question took place in Ehime Prefecture, a tranquil region in Shikoku. Ehime Bank is a typical second-tier regional bank. It started as Ehime Mujin Kabushiki Kaisha and assumed its current name in 1989. Local residents call it "Himegin." In late May 2017, the bank's Ishii branch in the city of Matsuyama was visited by a company president, who had an account at the bank's Osaka branch, according to Ehime Bank sources. The man asked the bank to remit ¥10 million to an account at Hang Seng Bank of Hong Kong. On the remittance form, the president described the money as a "loan" and named the recipient as "K Company." Because it does not deal with Hang Seng Bank, Ehime Bank entrusted Mizuho Bank, a major bank with which it has a correspondent contract for foreign exchange dealings, to remit the money. Ehime Bank did not consider the remittance to be strange because the company president had an account at its Osaka branch.

The company president showed up again at the Ishii branch several days later and asked to remit ¥50 million. This time, the branch chief asked the president why he was sending money from Ehime when he had an account at the Osaka branch. The branch chief asked the president to wait in a room, while he consulted with the transaction screening division at the bank's headquarters about what to do.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.