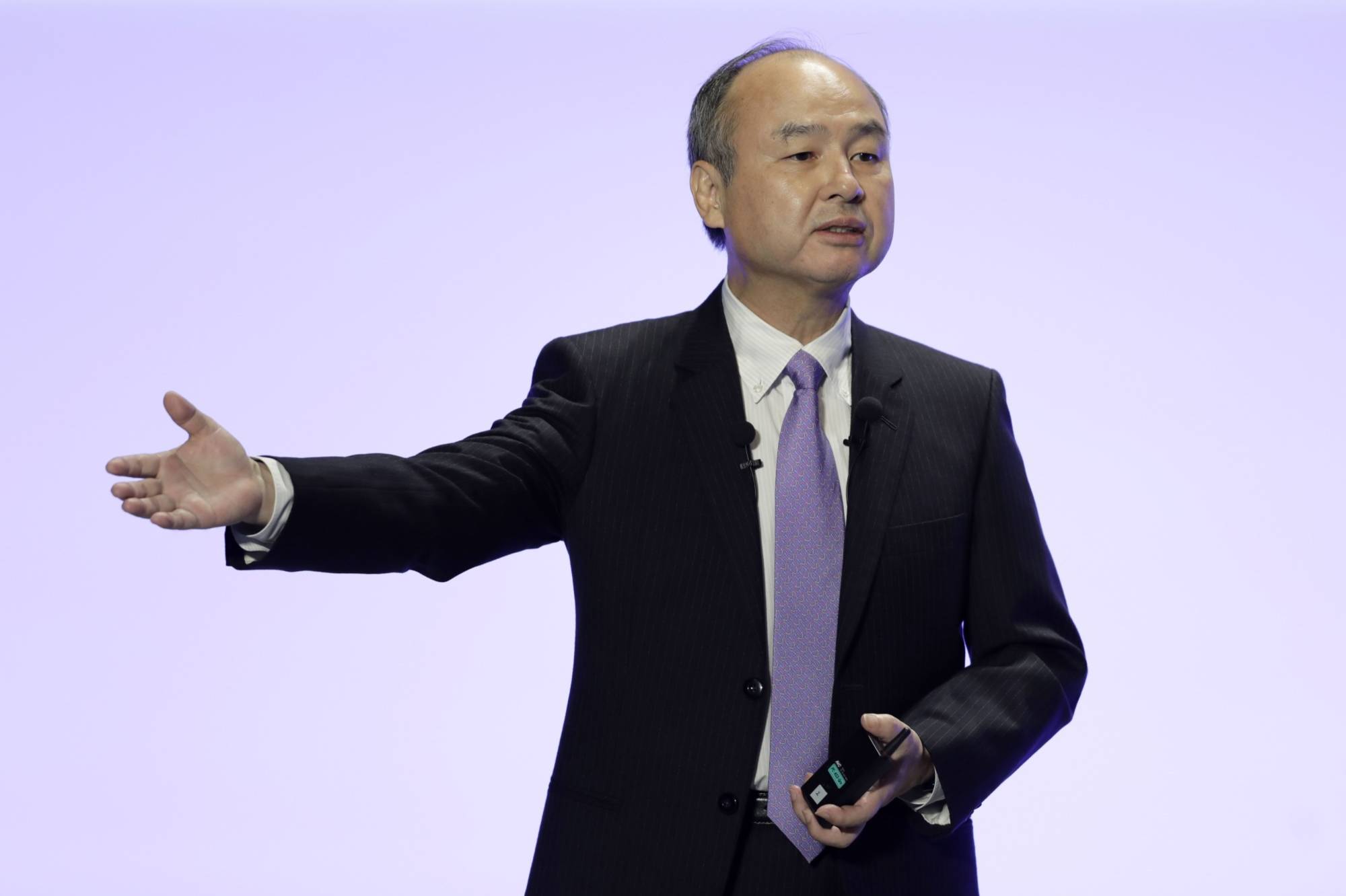

SoftBank Group has accelerated the pace of its share buybacks, reigniting speculation that founder Masayoshi Son is laying the groundwork to take the company private.

The tech investor bought ¥197.6 billion ($1.4 billion) of its shares in ten days in late October — almost half of the amount allotted in a buyback scheme planned for a full year. It bought another ¥132.3 billion of shares from Oct. 3 to 17 under an earlier program, pushing its monthly total to more than $2 billion.

The first round of purchases is more than three times the pace of repurchases over the prior three months, making it SoftBank’s most aggressive push since 2020, when the company was implementing a ¥2.5 trillion buyback program.

SoftBank is using the cash proceeds from recent sales of assets — including shares of Alibaba Group Holding and T-Mobile U.S. — to accelerate buybacks, while curbing its investments, SMBC Nikko analyst Satoru Kikuchi said in a research note.

"We have already argued that changes in company structure, for example an MBO, could be coming in the not-too-distant future,” he said, referring to a management buyout.

Son has repeatedly talked internally about taking SoftBank private. When asked about the option in the past, he has declined to comment publicly.

"It is important to always consider both options strategically,” SoftBank Chief Financial Officer Yoshimitsu Goto said last year, regarding the choice of staying public and an MBO to take the company private. "The main objective of any MBO should be what is good for investors.”

SoftBank’s buybacks helped the company’s stock price rally 31% in October in its best monthly performance since November last year, making it one of the top performers so far in the 225-issue Nikkei Stock Average this quarter.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.