A canceled or postponed Olympics would likely result in Japan's economy shrinking for the longest stretch since the global financial crisis, according to some economists.

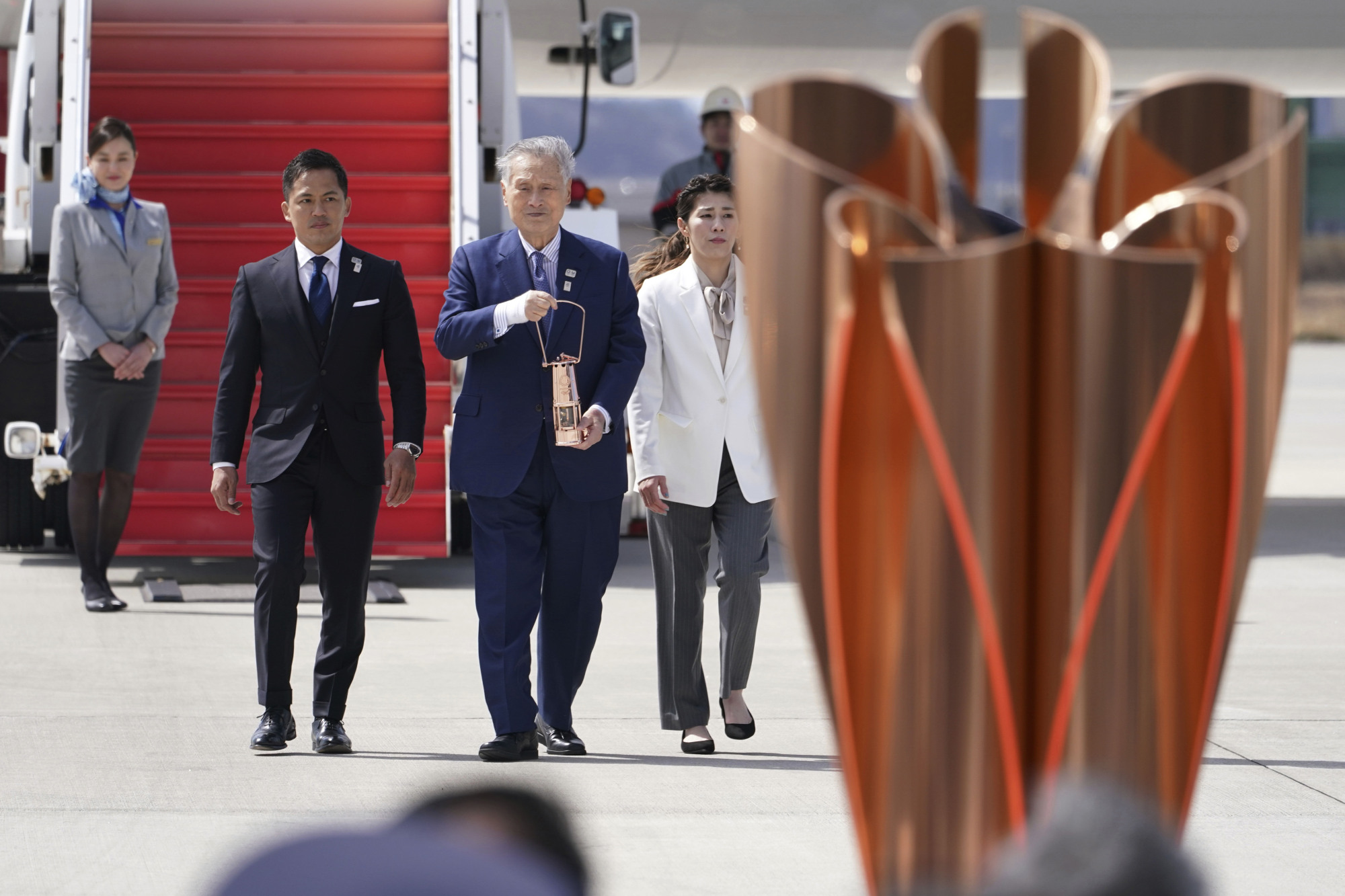

Ahead of the arrival of the still-flickering Olympic flame on Friday, economists contacted by Bloomberg said a scrapped or delayed Tokyo Games would probably mean the economy shrinking for a fourth quarter straight.

"I think it's almost certain that the economy will contract in the first and second quarters. So now the question for everyone is whether it also shrinks in the July-September quarter," Nomura Research Institute economist Takahide Kiuchi said.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.