SoftBank Group Corp. is seeking to raise a record ¥2 trillion ($18 billion) from Japanese individuals in the initial public offering of its mobile phone unit, targeting investors who often get no interest on their savings, sources have said.

Nomura Holdings Inc., a joint global coordinator, will sell the biggest part of the shares to the retail investors, part of an IPO that could raise about ¥3 trillion in total, said the people, asking not to be named because the target is private. Tokyo-based SoftBank will announce the details for the debut sale as early as next week, they said.

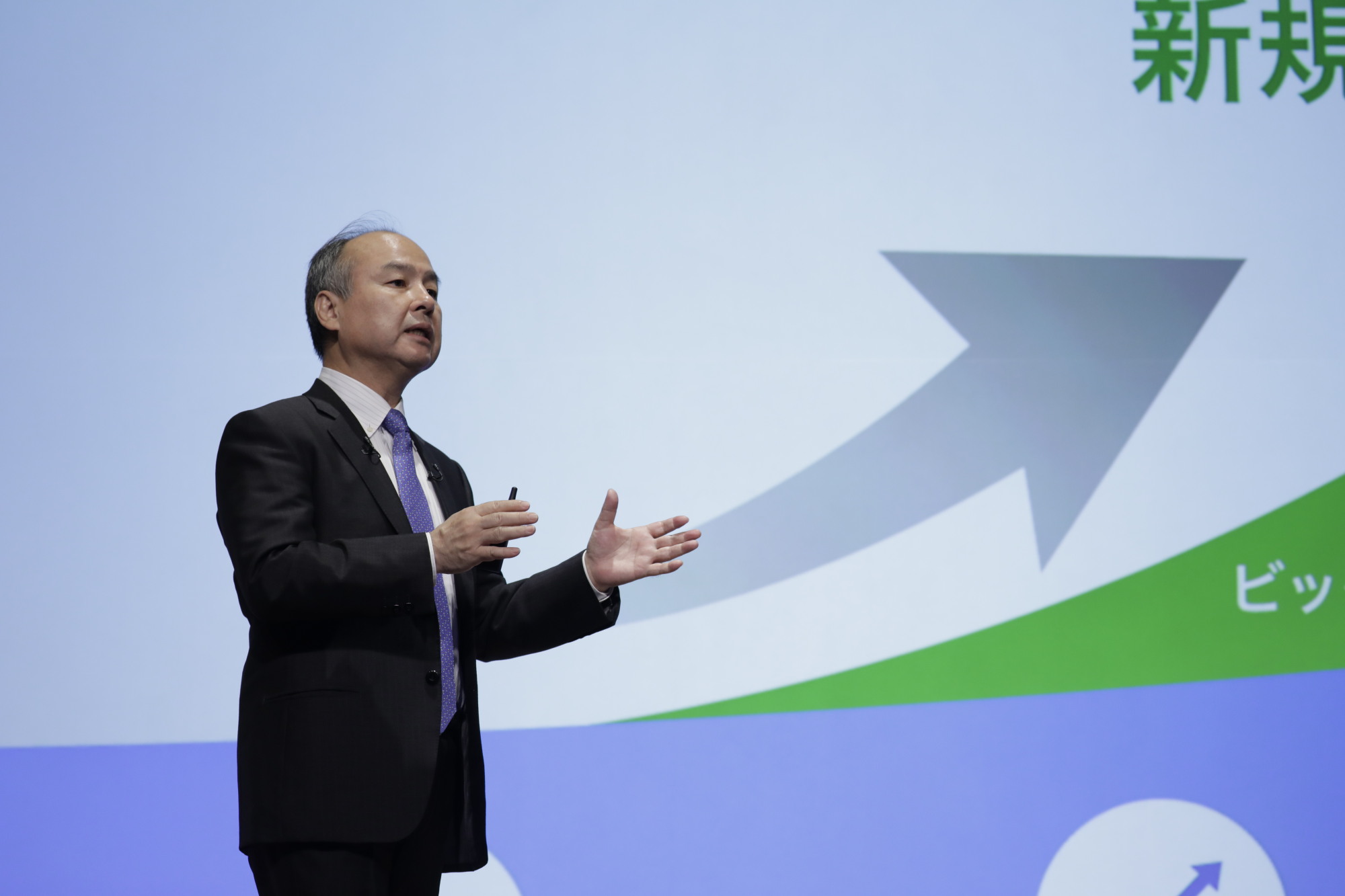

The amount of IPO stock allocated to individuals varies from country to country — and indeed from offering to offering — with institutions often taking a majority and retail investors settling for the leftovers. SoftBank's target suggests the company's bankers anticipate strong demand from Japan's yield-starved individuals. Chief Executive Officer Masayoshi Son plans to pay healthy dividends to attract investors.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.