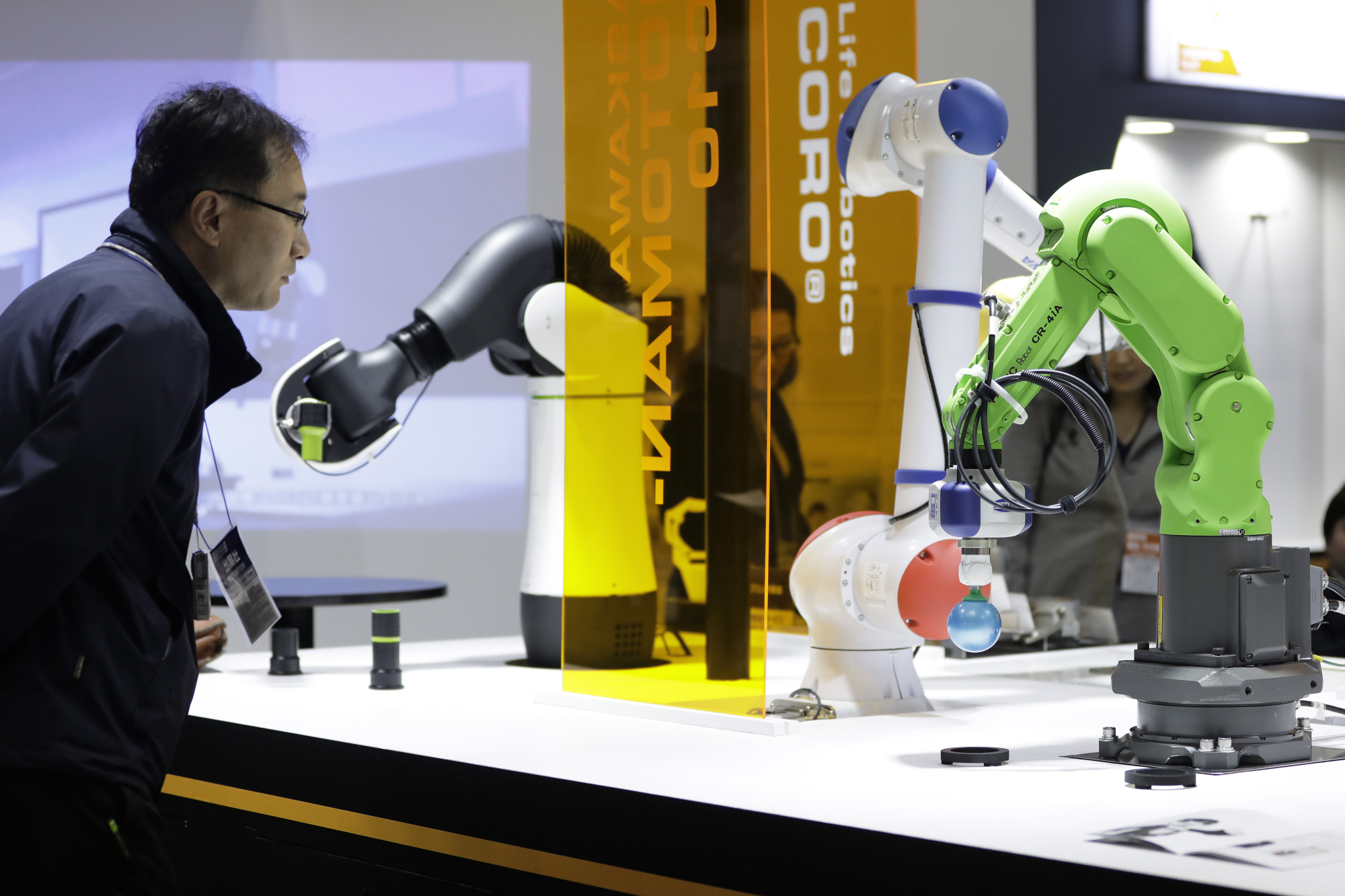

What's that whirring noise? It's Japan's machinery-makers at work, in contrast to investors' expectations.

Results from Fanuc Corp. and Komatsu were a mixed bag Monday. Factory-automation giant Fanuc reported an 8.4 percent drop in fiscal first-half operating income and saw its shares rise, while construction-equipment-maker Komatsu posted an 80 percent profit surge that was rewarded with a stock decline. Put that perplexing share reaction down to the topsy-turvy world of machinery-makers, where investors tend to view dismal earnings as a sign that a company is nearing the bottom, and good results as a warning that it's close to the top.

The overall picture, though, is that concerns sparked by U.S. bellwether Caterpillar Inc. last week of late-cycle cost pressures and a deteriorating China outlook have been overdone, at least as far as the Japanese firms are concerned.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.