SoftBank Group Corp. is getting ready to return to the overseas debt market for the second time in two months, after issuing $4.5 billion in subordinated notes in July.

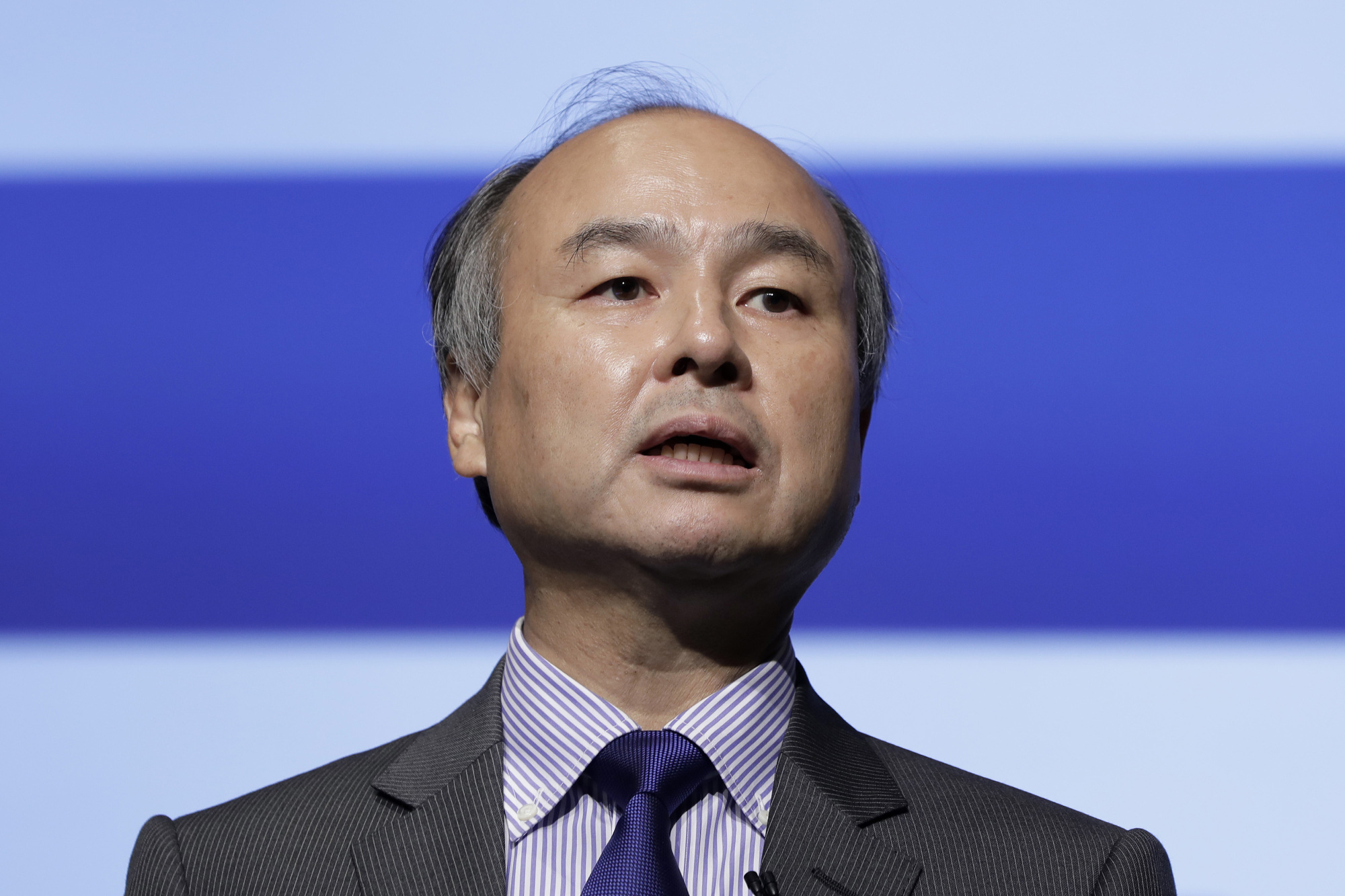

The Tokyo-based company headed by billionaire founder Masayoshi Son is accelerating deal-making around the world, and has been in discussions to combine its U.S. wireless operator Sprint Corp. with a potential partner. The SoftBank Vision Fund has also kicked off investments, with deals ranging from ride-sharing, co-working and robotics to agriculture, cancer detection and autonomous driving.

SoftBank will hold investor calls on Sept. 8 for potential U.S. dollar, euro note sales, according to a person familiar with this offering, who is not authorized to speak publicly and asked not to be identified. The Japanese internet giant has mandated Deutsche Bank AG, Citigroup Inc., Goldman Sachs Group Inc. and Morgan Stanley for the deal.

SoftBank's bond issuance swelled since 2013, when it bought Sprint, and the company had net debt of ¥13.6 trillion ($125.4 billion) at the end of June. That debt is offset by the company's unrealized profits in a plethora of companies, led by Alibaba Group Holding Ltd.

Operating profit at SoftBank was ¥479.3 billion in the fiscal quarter ended June 30, topping analysts' projections, as Sprint returned to profit for the first time in three years. Sales came in at ¥2.19 trillion, matching predictions.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.