The initial public offering (IPO) of Ant Group, originally scheduled for Nov. 6, was much, much more than the coming-out party of a successful finance operation. The $37 billion offering would have been the world’s largest and conferred a value of $316 billion on the Chinese financial giant. Listing in Hong Kong and Shanghai would show the world that Chinese companies had no need to go to New York to access capital; that the besieged special administrative region of Hong Kong remained a force to be reckoned with in international finance; and that China could produce corporate giants that mastered 21st century technologies.

With all that in the balance, Chinese authorities still pulled the plug on the IPO just two days before the scheduled event. Earlier that week, China’s financial watchdogs published draft rules that significantly changed the regulatory environment, which in turn prompted suspension of the IPO. While that was the official explanation for the move, the decision was in fact an assertion of power and a reminder to Chinese business professionals that their government and not entrepreneurs — no matter how successful — are in charge.

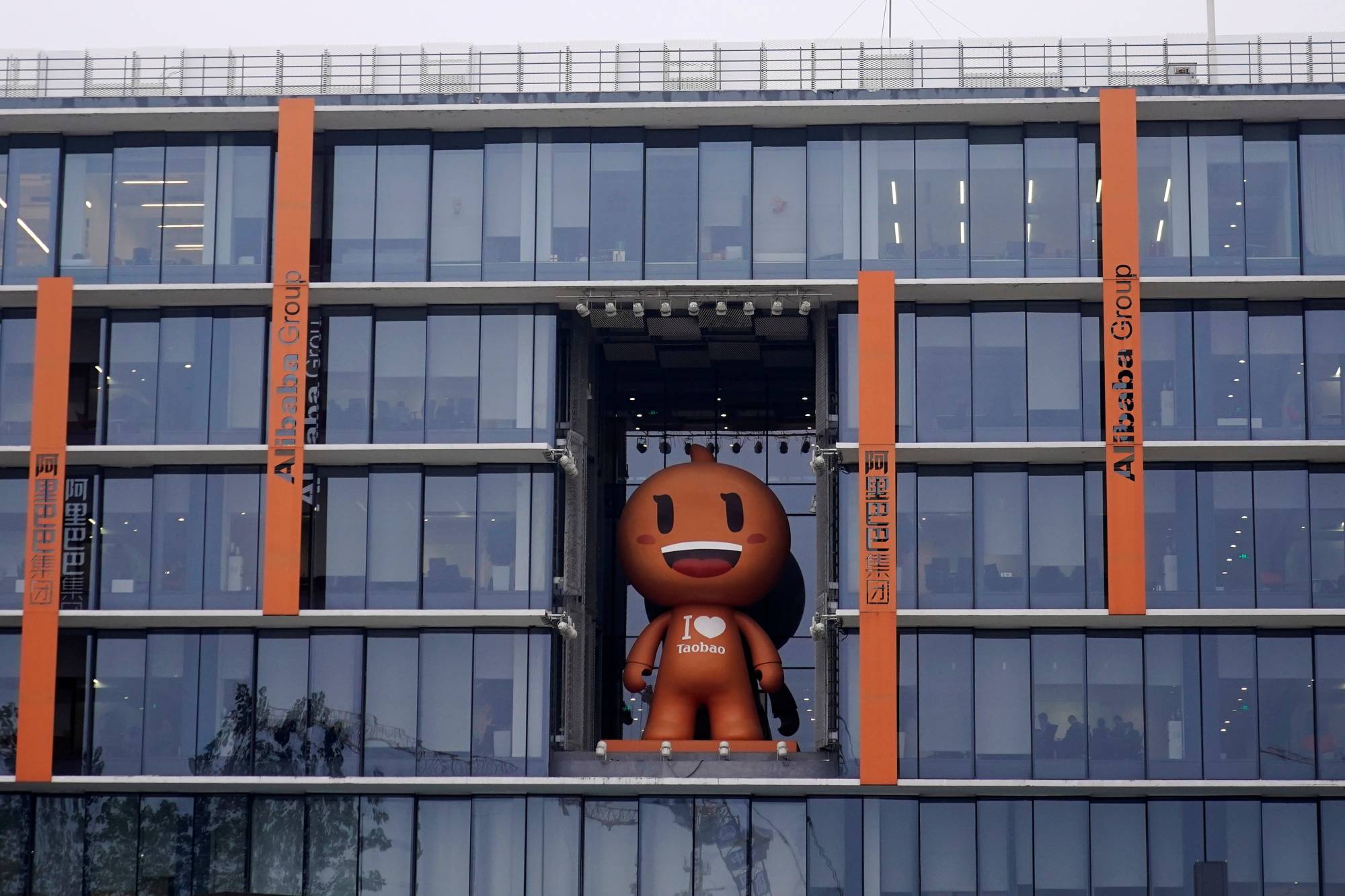

By virtually all accounts, the draft regulations were released in response to a late October speech by Jack Ma, founder of Alibaba (which evolved into the Ant Group), in which he charged the main actors in China’s financial system were neglecting the poor and most needy. He blasted China’s banks, most of which are state-owned, for having “a pawnshop mentality,” in which borrowers relied too heavily on collateral and other guarantees. Financial authorities used “yesterday’s methods to regulate the future.” As a result, growth was stunted because innovation was stifled. Ma was blunt: “Many of the world’s problems,” he said, were a result of “only talking about risk control, not talking about development, not thinking about young people’s or developing countries’ opportunities.”

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.