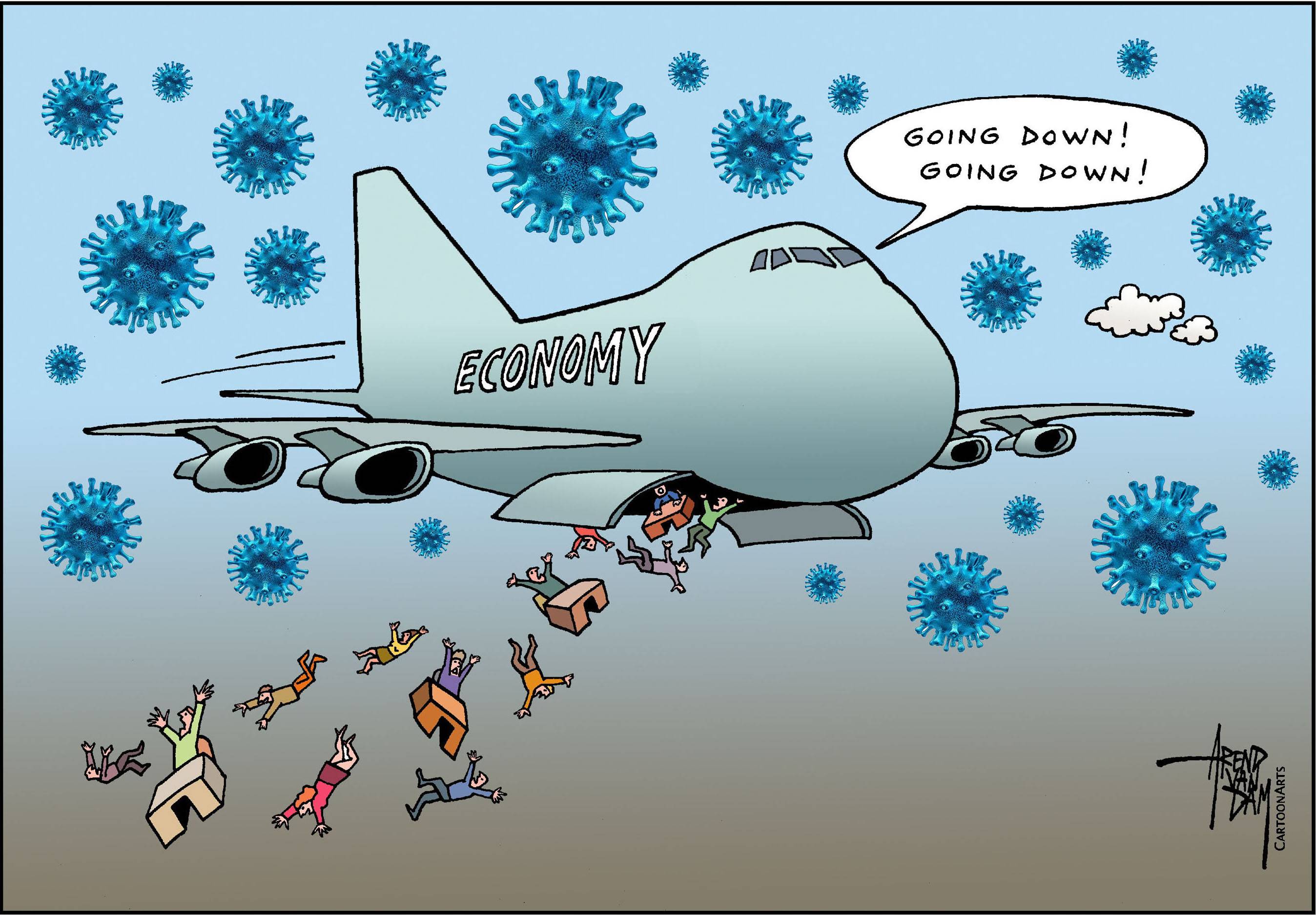

Given COVID-19’s reach through the economy, cascading bankruptcies loom as a major threat. These happen when one company’s failure to pay its bills weakens the financial health of another, which in turn undermines the viability of yet another and so on, causing a chain reaction.

To mitigate this risk, countries need a “too connected to fail” policy— to provide liquidity to companies whose bankruptcies stand to have the largest ripple effects. This is the real economy equivalent of the too-big-to-fail strategy during the last financial crisis.

To combat potential bankruptcy chains, policy makers have four options. First, governments can improve companies’ cash flow by boosting demand for their products, including by providing additional income to displaced workers. This approach is already being adopted aggressively, but for many reasons— including that many companies simply can’t open while urgent social distancing measures are in place— this won’t be enough to stem the risk of substantial numbers of bankruptcies.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.