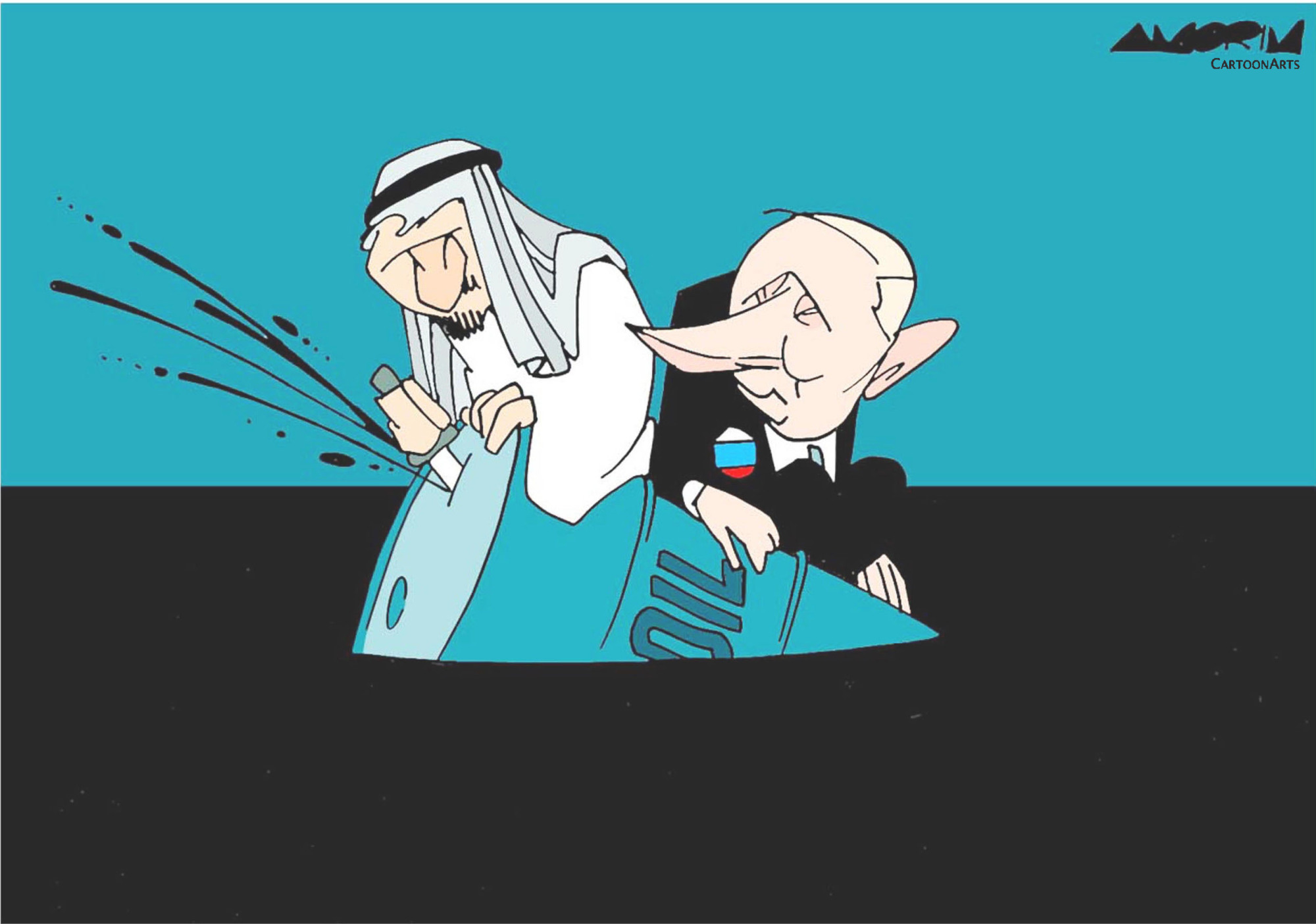

When global stock markets tanked last week, most analysts blamed the new coronavirus outbreak. The pandemic contributed to the plunge but equally, if not more, important was the oil price war that erupted between Saudi Arabia and Russia. The two oil producers are slugging it out over market share, but the fight looks like a personal struggle between the leaders of the two states as well as a broadside at the U.S. fracking industry.

The timing could not be worse. Oil is flooding the market just as demand is collapsing because of the COVID-19. Consumers might temporarily benefit, but the disruption is so severe that there will likely be no winners in this fight.

Three years ago, the Organization of Petroleum Exporting Countries and 10 nonmember oil-producing countries agreed to coordinate production to reduce a supply glut. At the heart of "OPEC plus" (as the deal was known) was a meeting of the minds between Saudi Arabia and Russia, the world's second- and third-largest oil producers, to restrain their output and put a floor on prices. In the face of weak global demand, the group agreed earlier this year to production cuts that were set to expire at the end of March. With demand plummeting still further because of the coronavirus outbreak, Saudi Arabia called on OPEC members to cut another 1 million barrels per day, with the other 10 countries reducing their own supply by half a million barrels per day.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.