Stephanie Kelton, a professor at the State University of New York at Stony Brook, is a leading advocate for Modern Monetary Theory who is known for her seemingly radical argument that as long as a government can pay back its debt in the nation's own currency, there are no limits to the fiscal deficits that it can incur. She stirred up a controversy when she cited Japan's situation as evidence to prove her theory.

A stereotypical criticism of MMT is that inflation will rise if fiscal deficit expands in an uncontrolled manner. As a rebuttal to this criticism, Kelton pointed out that Japan has no inflation at all even as its budget deficit accumulates every year and the balance of government debt tops 200 percent of the nation's GDP.

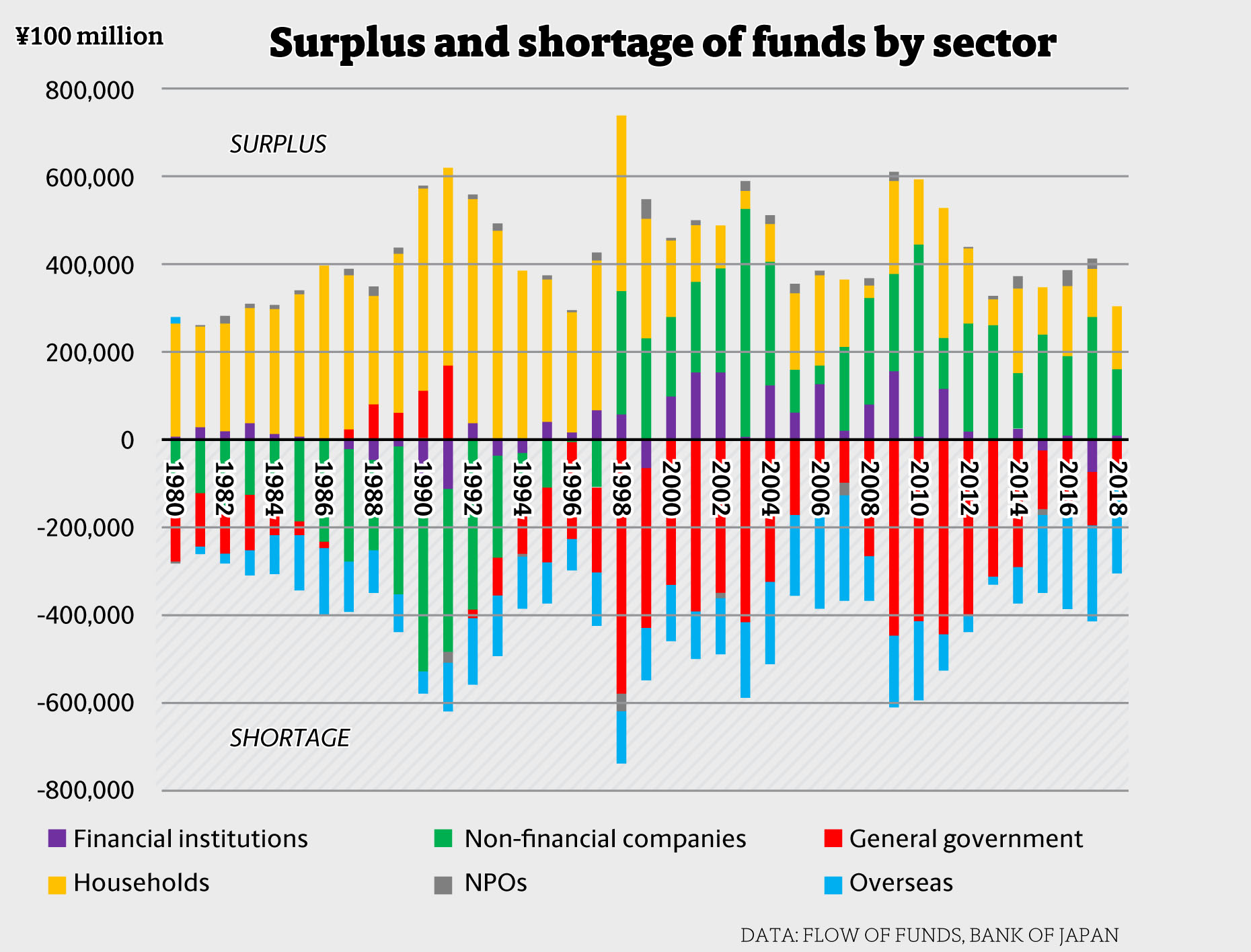

Instead of discussing the reliability of MMT as an economic theory, this column aims to explain what is the condition that makes it possible for Japan to sustain budget deficits over a long period of time — or to go even further, the condition that in a sense makes budget deficits inevitable.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.