The economic recovery since 2013 has increased employment for both regular and irregular workers, brought record profits to businesses and more than doubled share prices. But compared with these changes, wage trends are not that promising. Perhaps because of that, 60 to 80 percent of respondents in various surveys reply "no" when asked whether they share the sense that the economy is recovering.

What then is the long-term trend of average wages? It is deplorable that the labor ministry's inappropriate handling of wage statistics, which surfaced earlier this year, has spoiled the long-term consistency in wage data. But there are other sets of wage data, compiled by the National Tax Administration Agency. In fact, the tax agency data is even more reliable because they are based on records of withholding income tax on individuals' wage income. The disadvantage is that they show only the annual data, and since it takes time to tally them and make them public, the latest statistics currently available are the ones from 2017.

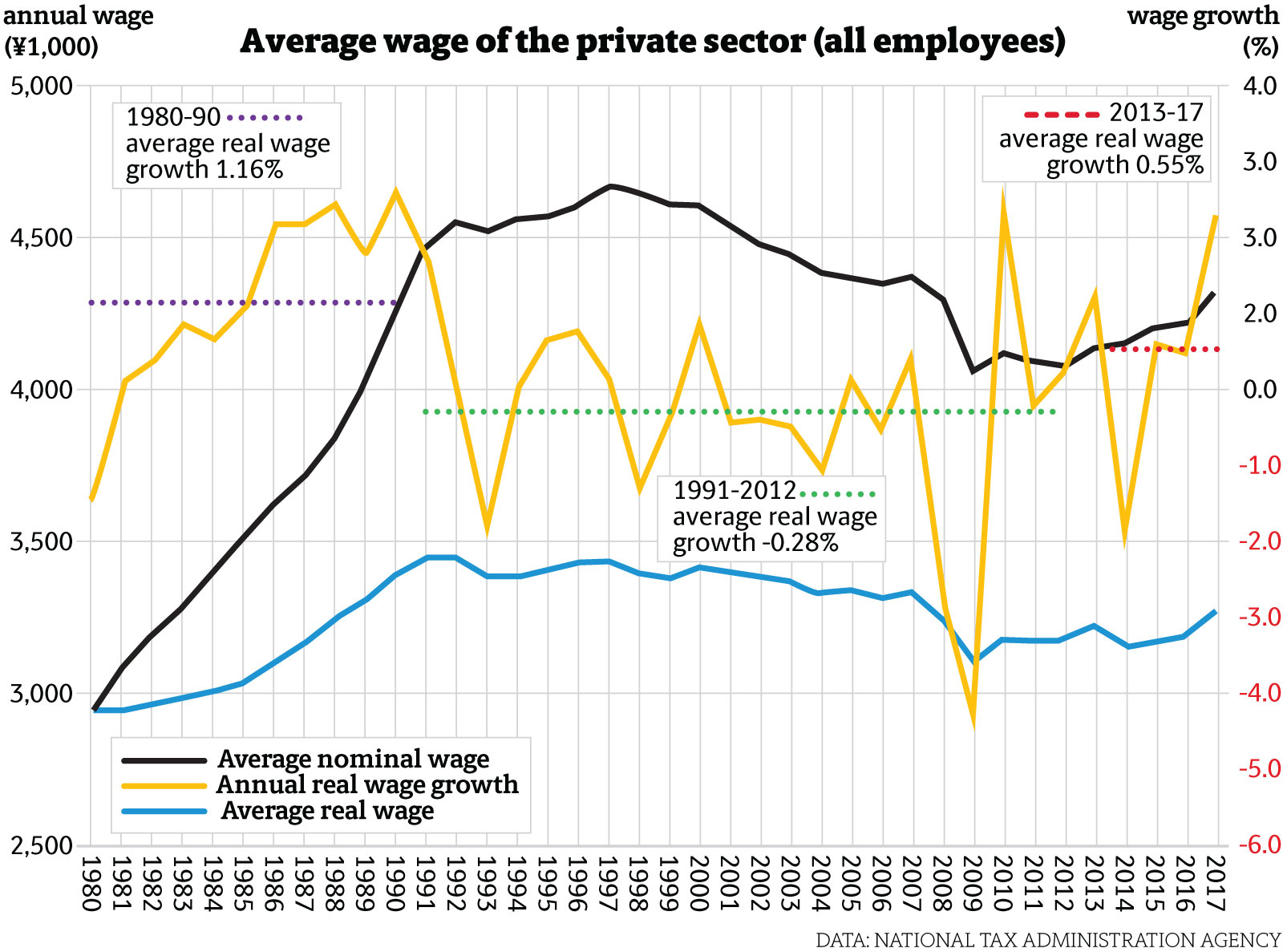

The movement of average wages since 1980 — both nominal and real (with the latter adjusted by consumer prices in the base year of 1980) — shows that nominal wages increased rapidly until the beginning of the 1990s, after which growth lost speed. Although their growth dipped into the negative territory in the 2000s, they returned to a trend of moderate increase in 2013.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.