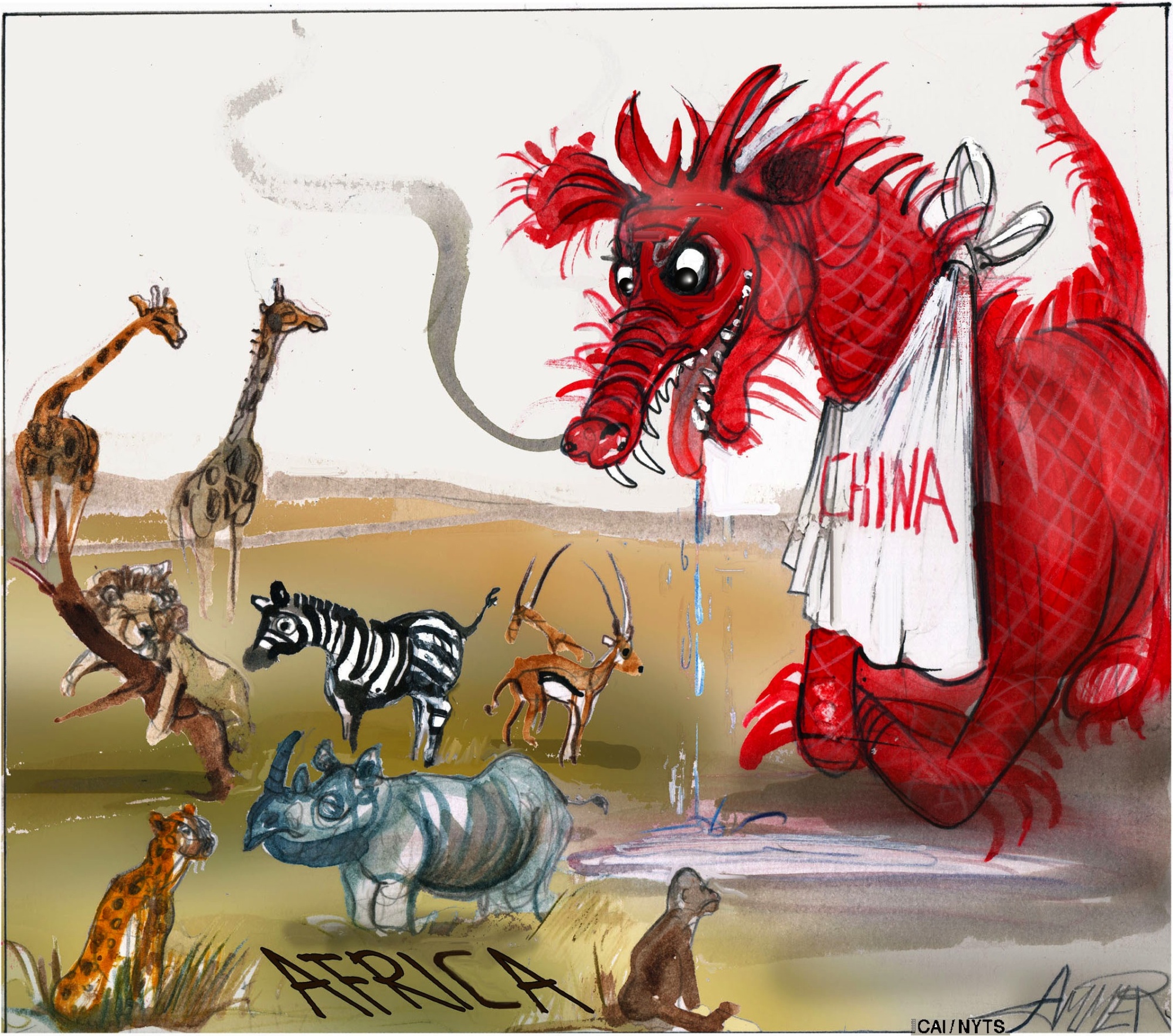

On a recent official visit to China, Malaysian Prime Minister Mahathir Mohamad criticized his host country's use of major infrastructure projects — and difficult-to-repay loans — to assert its influence over smaller countries. While Mahathir's warnings in Beijing against "a new version of colonialism" stood out for their boldness, they reflect a broader pushback against China's mercantilist trade, investment and lending practices.

Since 2013, under the umbrella of its "Belt and Road" initiative, China has been funding and implementing large infrastructure projects in countries around the world, in order to help align their interests with its own, gain a political foothold in strategic locations, and export its industrial surpluses. By keeping bidding on the initiative's projects closed and opaque, China often massively inflates their value, leaving countries struggling to repay their debts.

Once countries become ensnared in China's debt traps, they can end up being forced into even worse deals to compensate their creditor for lack of repayment. Most notably, last December, Sri Lanka was compelled to transfer the Chinese-built strategic port of Hambantota to China on a 99-year, colonial-style lease because it could longer afford its debt payments.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.