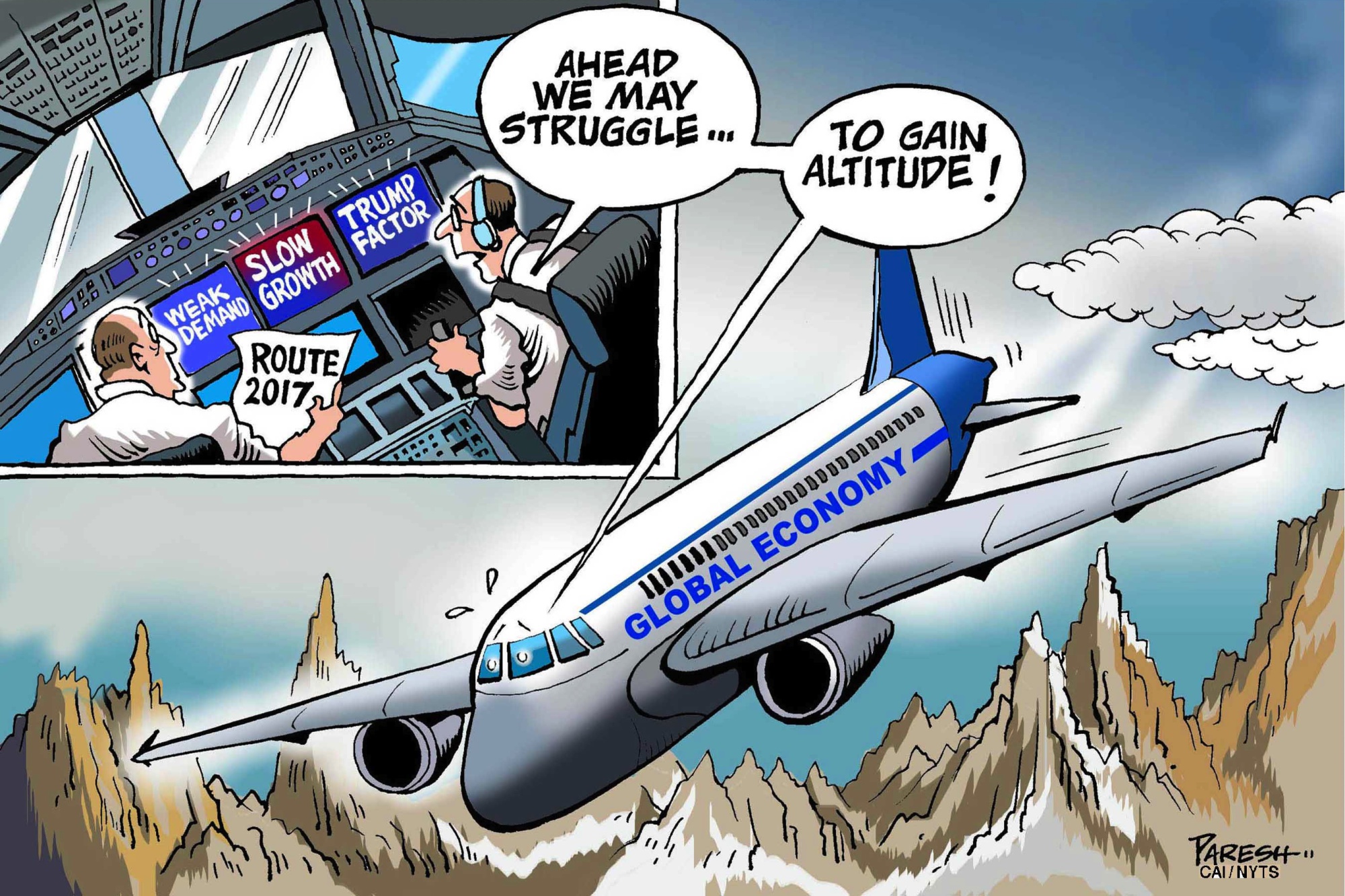

"Economics in crisis" is the latest theme exciting journalists and commentators on both sides of the Atlantic as they contemplate the performance of the economic forecasting profession during 2016.

This performance has certainly not been happy. First the economists, or most of them, predicted dire consequences following the Brexit vote by the United Kingdom, none of which have so far materialized. Then they predicted even greater disasters following the Trump victory in the United States, but these, too, have so far failed to appear.

On the contrary, both the U.K. and the U.S. economies are performing well. Stock markets in New York and London are bounding ahead, unemployment is low, economic growth is picking up, and in the U.K.'s case the fastest by far in Europe. The pound sterling took a hit, but buoyant trading seems to be overcoming this.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.