The Liberal Democratic Party scored a big win in the July 10 Upper House election, with it and other forces in favor of constitutional revision grabbing a two-thirds majority in the chamber — enough seats to initiate a revision of the supreme law, which would then be put to a referendum.

For its campaign strategy, the LDP avoided issues like constitutional revision and security-related legislation, having gotten a taste of success in the Lower House election in late 2012, when it regained power from the Democratic Party of Japan by focusing solely on the economic issue of ending deflation.

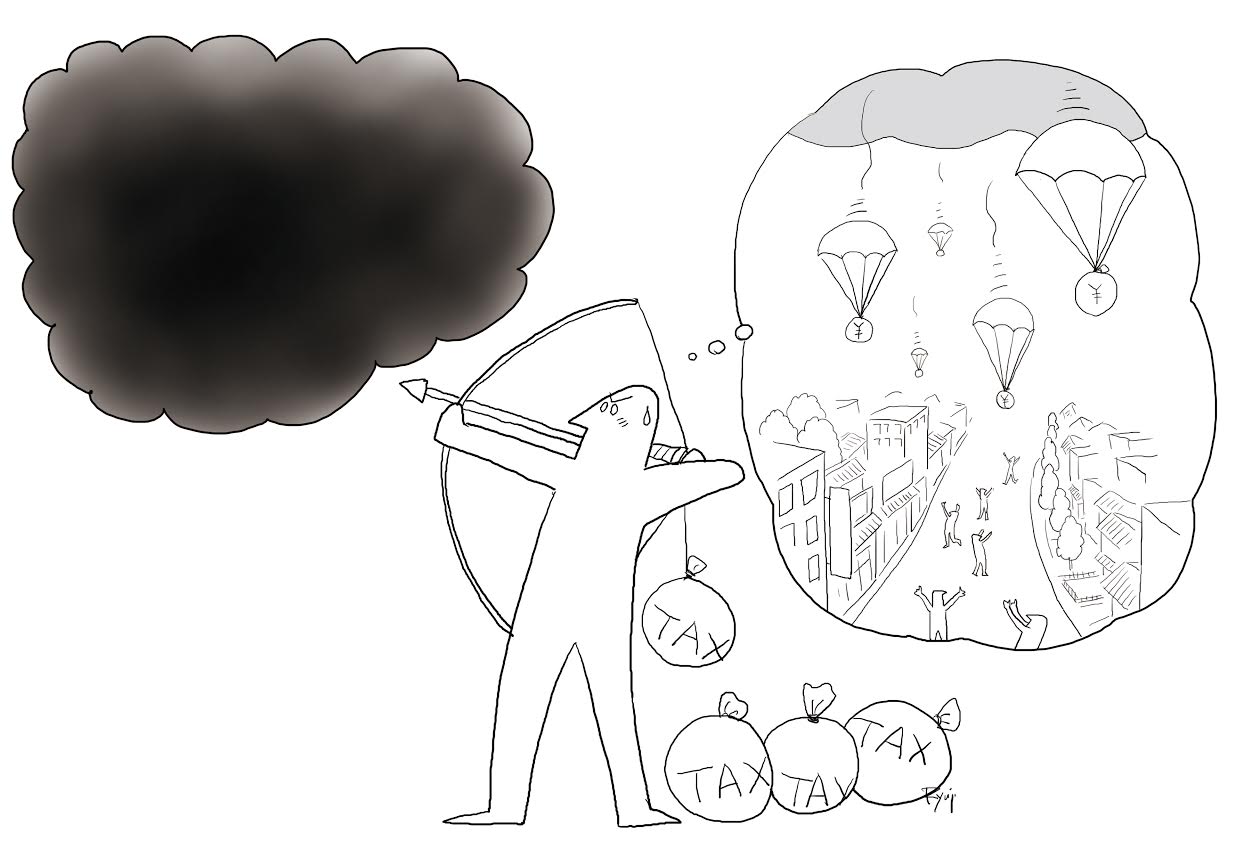

Just before the start of the latest campaign, the LDP decided to put off the next consumption tax increase and thus eliminated it as an election issue. It has been proven time and again that raising the consumption tax rate seriously hurts the political party in power, as exemplified by the DPJ's crushing defeat in the 2012 general election.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.