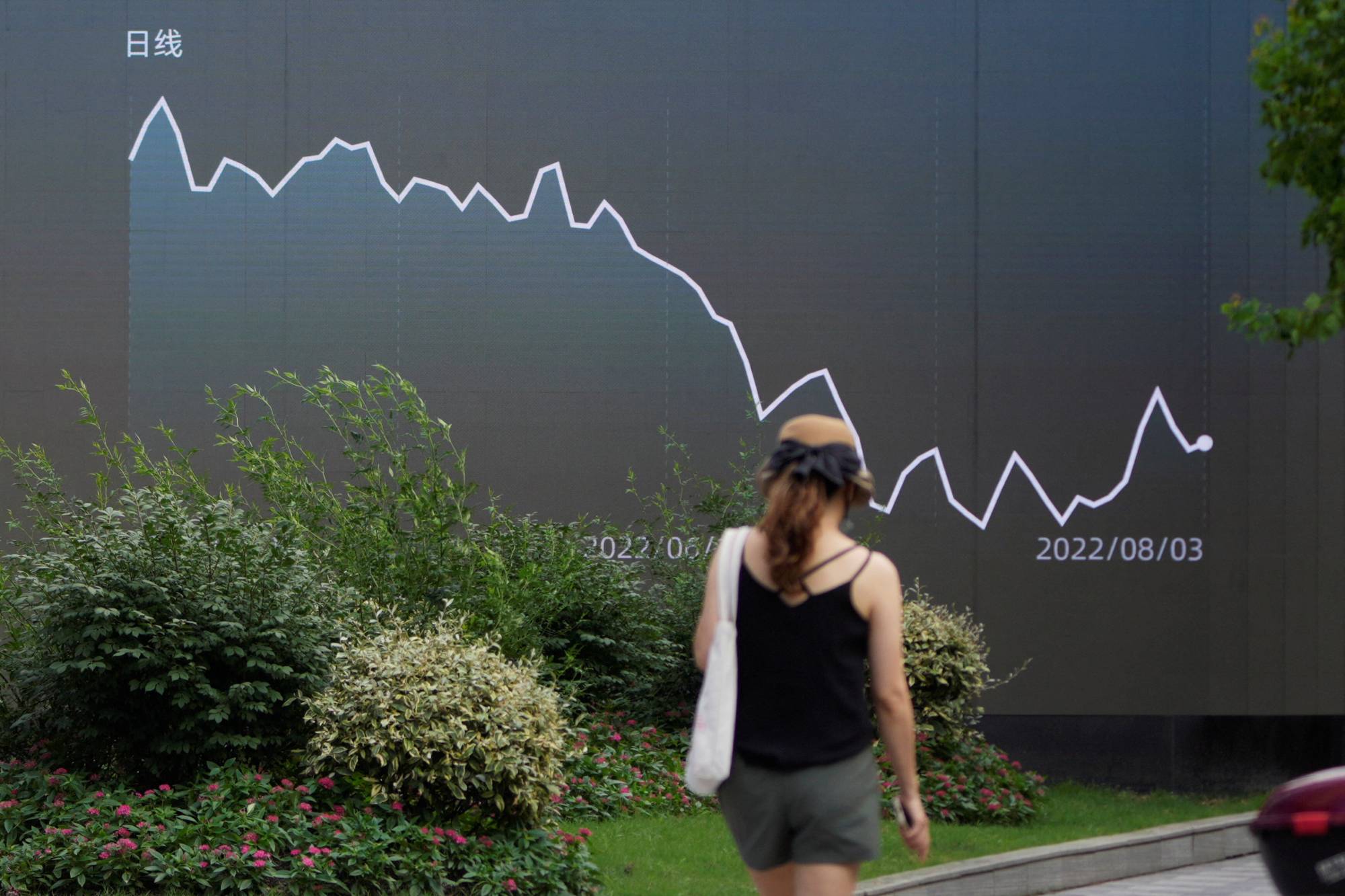

A gulf has opened up between Chinese stocks and the rest of emerging-market equities in recent weeks as pandemic recoveries have diverged. That parting of ways is likely to be short-lived, fund managers say.

Chinese equities are seen making up lost ground as the extreme pessimism toward its economy recedes and authorities take further steps to revive stuttering growth. At the same time, the gathering enthusiasm over other developing-nation equities could peter out amid a global slowdown, causing their correlation with China to reassert itself.

"I’ve seen this decoupling story many times in the last two plus decades, it never pans out,” said Zhikai Chen, head of Asian and global emerging market equities at BNP Paribas Asset Management, which oversaw the equivalent of $504 billion (¥68.9 trillion) globally at the end of June. "From a trade flows perspective, and how big the Chinese economy is for commodity demand, it seems a heroic assumption.”

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.