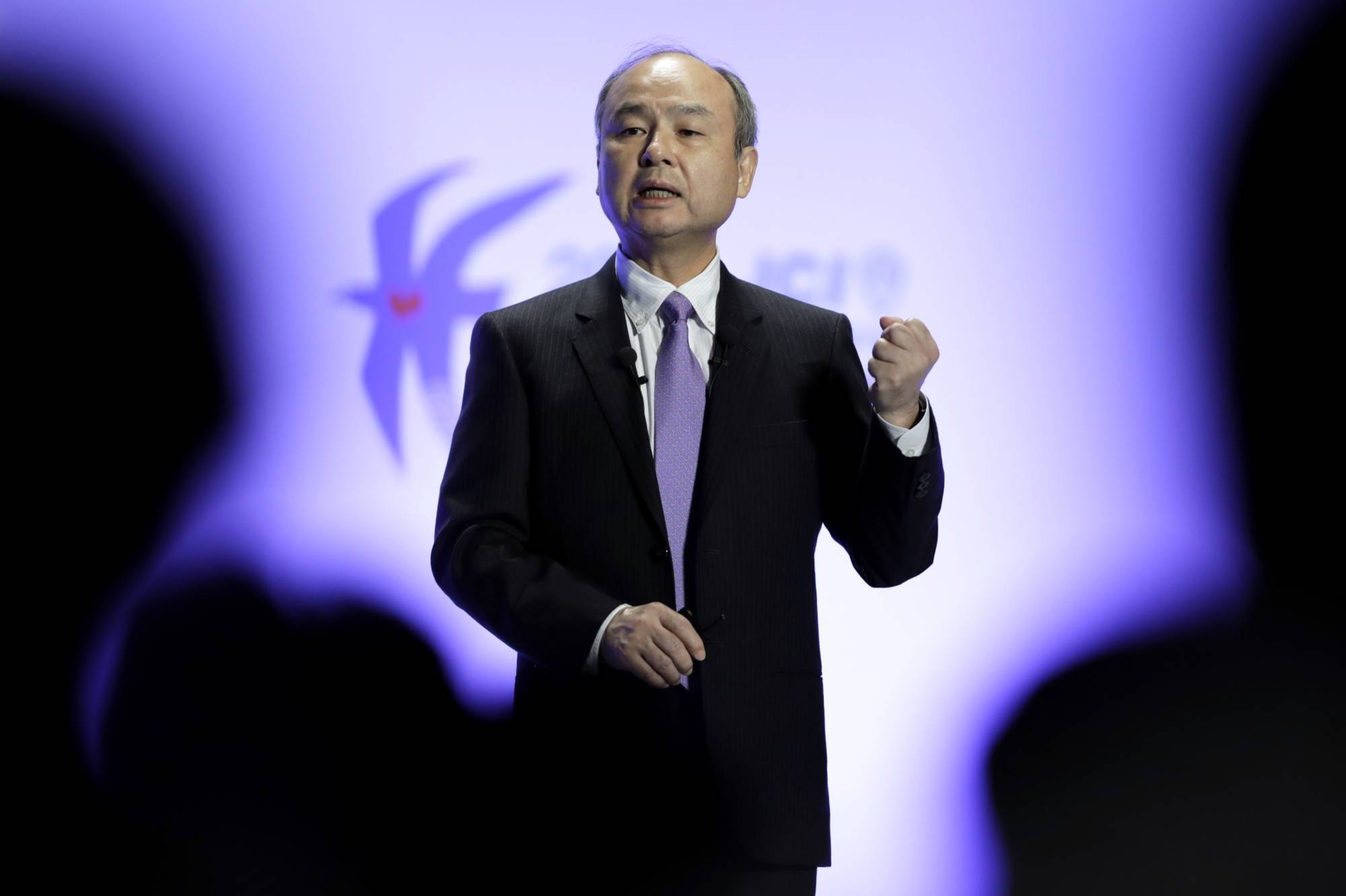

SoftBank Group Corp. is debating a new strategy to go private, by gradually buying back outstanding shares until founder Masayoshi Son has a big enough stake he can squeeze out remaining investors, according to people familiar with the matter.

The approach would likely take more than a year and would involve the Japanese company continuing to sell assets to fund successive buybacks, the people said, asking not to be identified because the plan is private.

Son wouldn’t buy more shares himself, but his ownership stake — currently about 27% — would increase as other investors sell stock. Under Japanese regulations, Son could compel other shareholders to sell when he gets to 66% ownership, perhaps without paying a premium, the people said.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.