SoftBank Group Corp. is quietly winding down its controversial derivatives strategy after a sustained backlash from investors, according to people familiar with the matter.

The conglomerate is letting its options expire, instead of maintaining its positions, the people said, who declined to speak publicly. About 90% of the contracts will close out by the end of December because they are short-term, according to one of the people. SoftBank will hold on to its underlying portfolio of big tech stocks, which include Amazon.com Inc. and Facebook Inc., the person said.

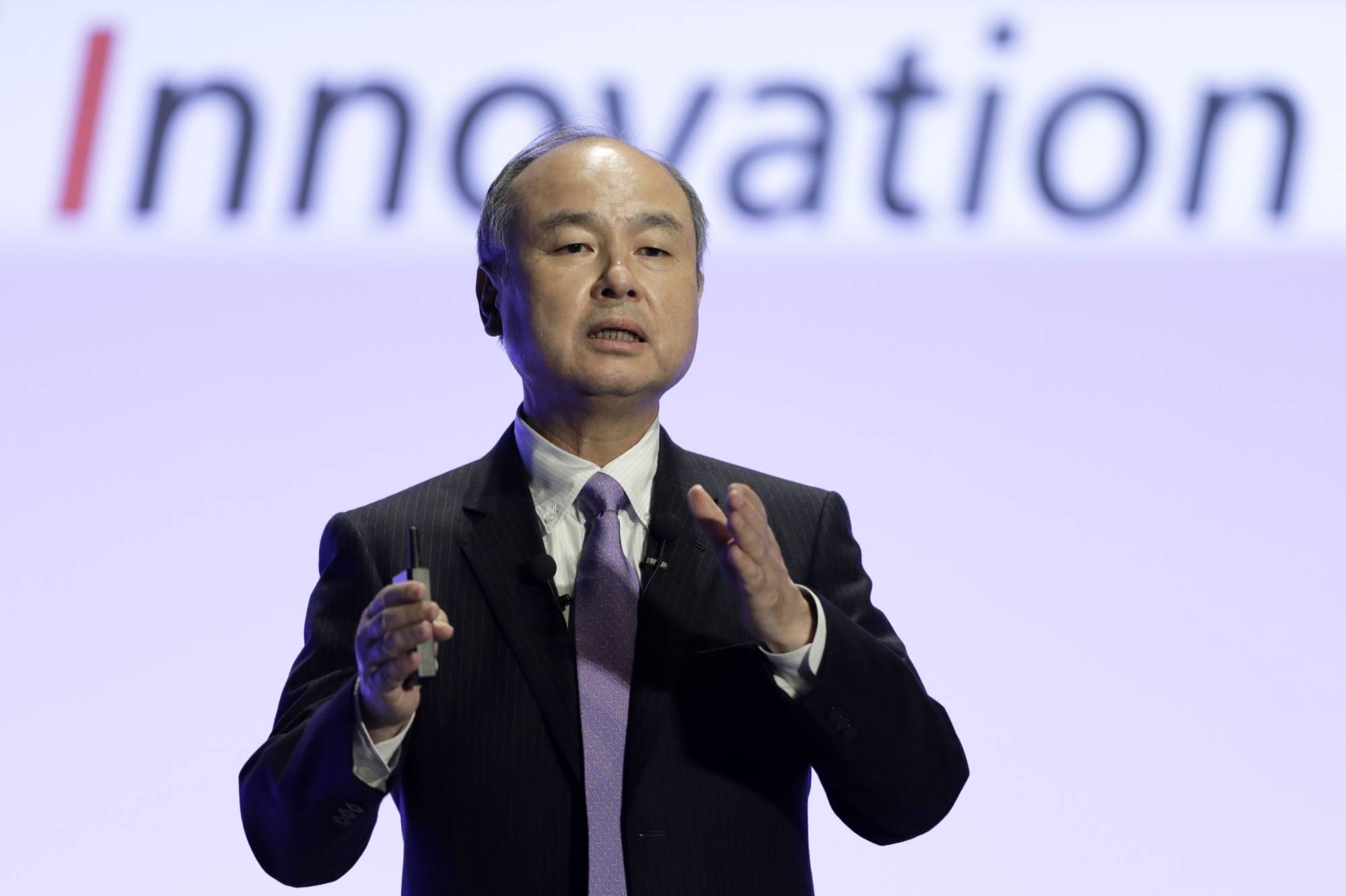

SoftBank shareholders balked after SoftBank’s foray into derivatives trading was first disclosed in September, cutting the company’s market value by as much as $17 billion. Investors have questioned the rationale of a company known for its yearslong bets on technology startups dabbling in public securities, especially derivatives. They have also criticized founder Masayoshi Son for taking a personal stake in the trading.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.