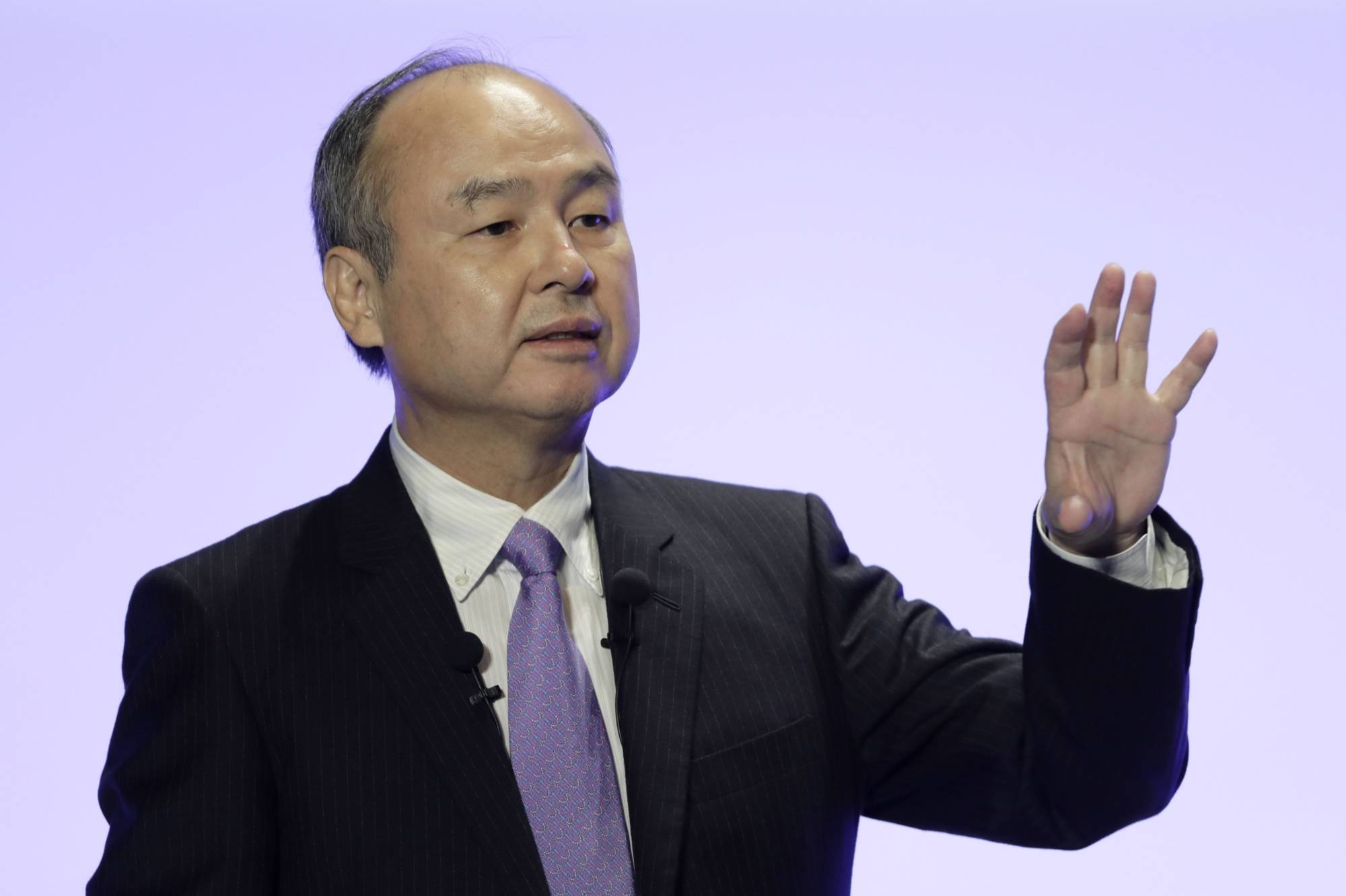

SoftBank Group Corp.’s founder Masayoshi Son said he has $80 billion (¥8.3 trillion) in cash to buy back more shares and continue investing in both private and public companies.

"If our shares drop down, I will buy back more shares more aggressively,” the chief executive officer said at the New York Times DealBook conference Tuesday. "We have $80 billion in cash at hand.”

After a record fall in its share price in March, SoftBank unveiled plans to offload ¥4.5 trillion in assets and buy back ¥2.5 trillion of its own stock. The idea of going private through a buyout has been discussed within SoftBank for at least five years, but Son declined to comment on whether he would take his company off the stock market.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.