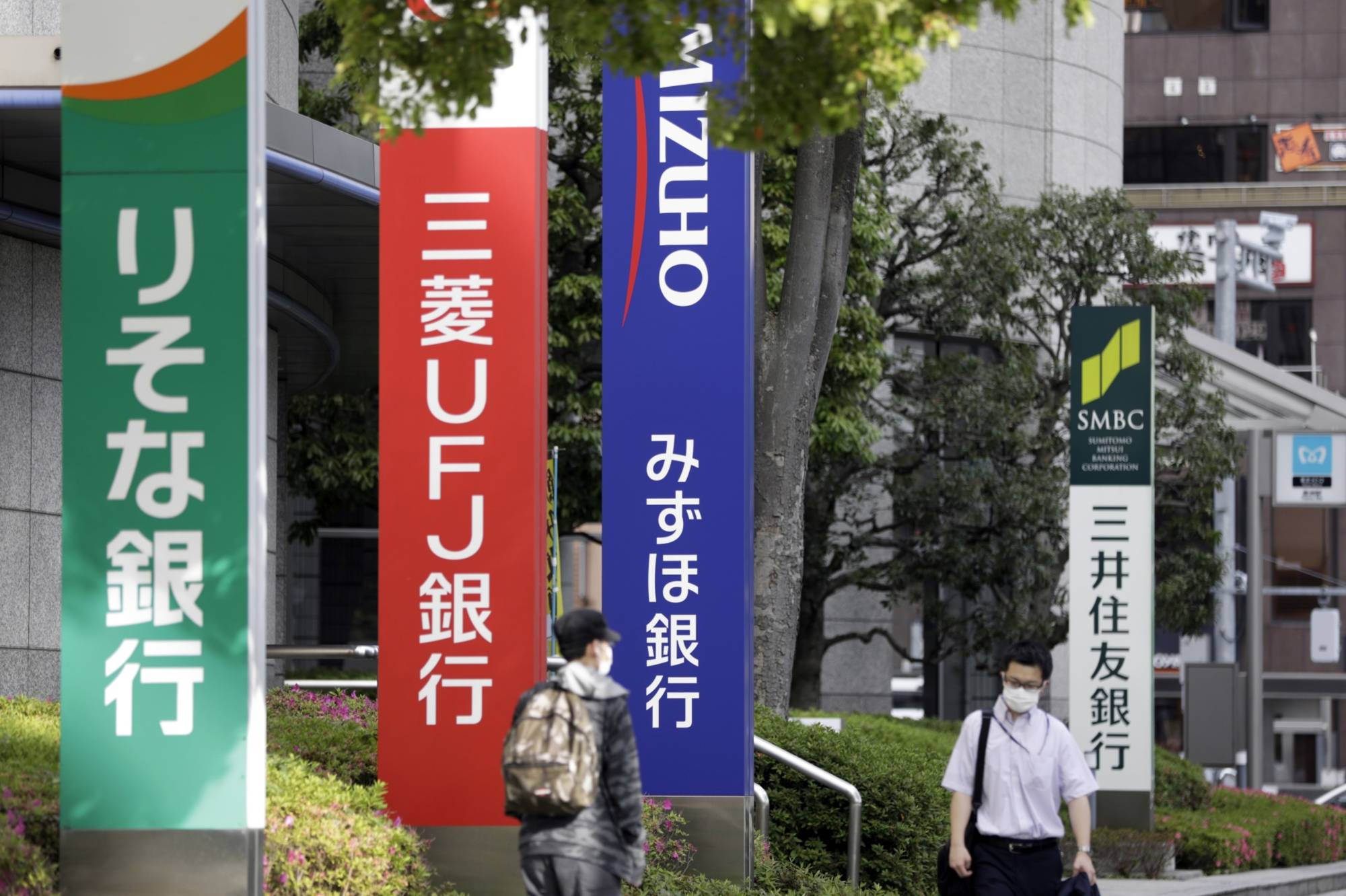

Japan’s three biggest banks are likely to stay on course toward achieving their annual profit goals as bad-loan costs remain in check, analysts said ahead of fiscal second-quarter results due this week.

Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. are expecting credit costs — which include provisions as well as actual losses on soured loans — to almost double to ¥1.1 trillion in the year ending March, the highest combined amount in 11 years.

Massive government and central bank aid has spurred lending and kept companies afloat during the pandemic-fueled recession, reducing the need to ramp up provisions. Investment banking has been picking up, helping to alleviate the impact of rock-bottom interest rates that are squeezing lending profitability at home and abroad.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.