The Trump administration’s increased scrutiny of college endowments and pension funds backing Chinese firms is creating more roadblocks for venture funds looking for the next big tech winner.

Just six U.S.-dollar funds with exposure to China have sought to raise capital this year, down from 21 last year, according to researcher Preqin. Of those, only one has managed to complete a preliminary closing, compared with 10 last year.

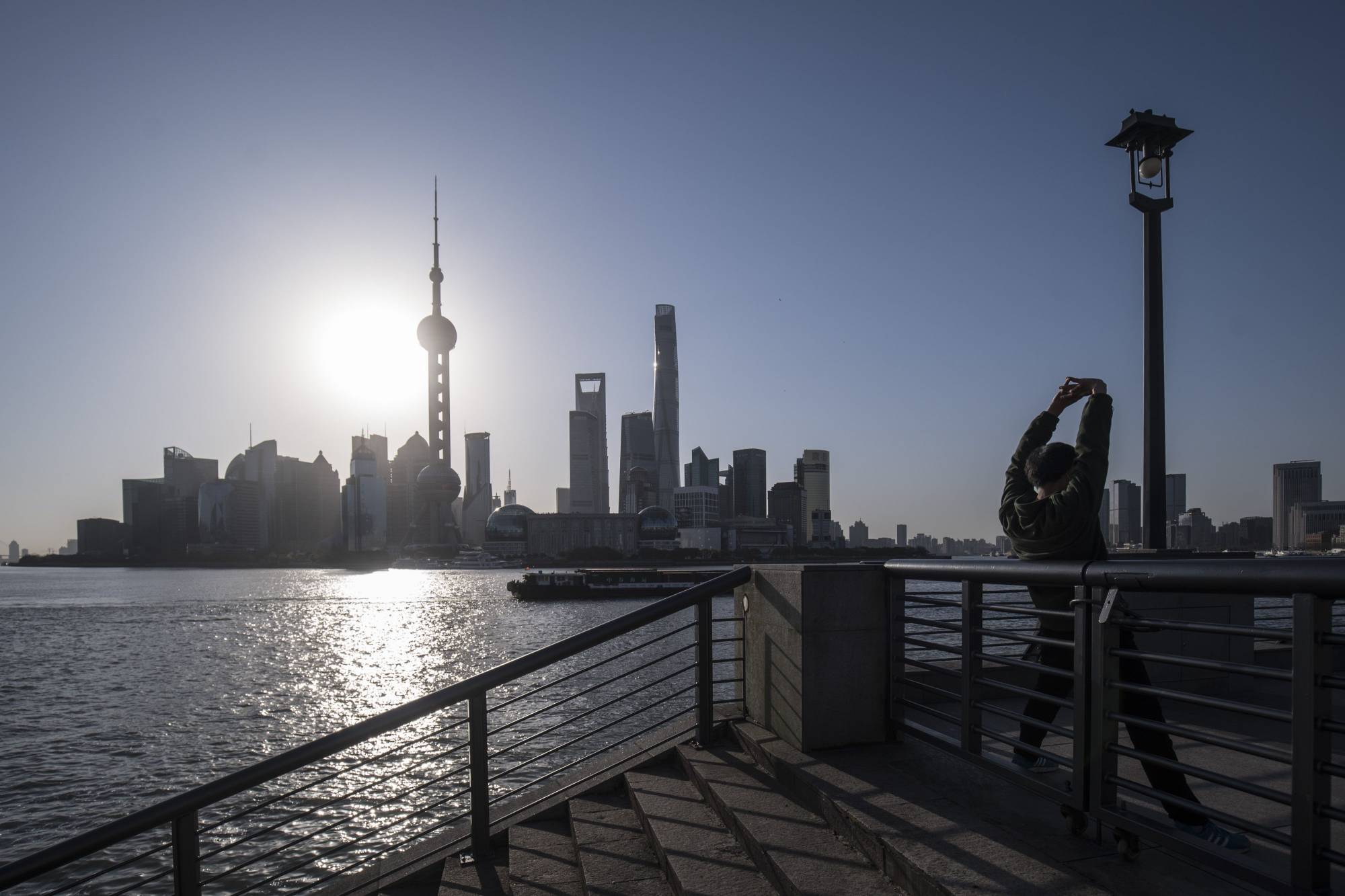

It’s a drastic reversal of the venture boom that fueled China’s tech industry in the past decade. The U.S. State Department has asked colleges and universities to divest from Chinese holdings in their endowments, warning of potentially more onerous measures on holding the shares. That’s on top of a wider campaign to curb Chinese tech champions and slow the money flowing into what are some of the world’s largest tech companies, including Alibaba Group Holding Ltd. and TikTok owner Bytedance Ltd.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.