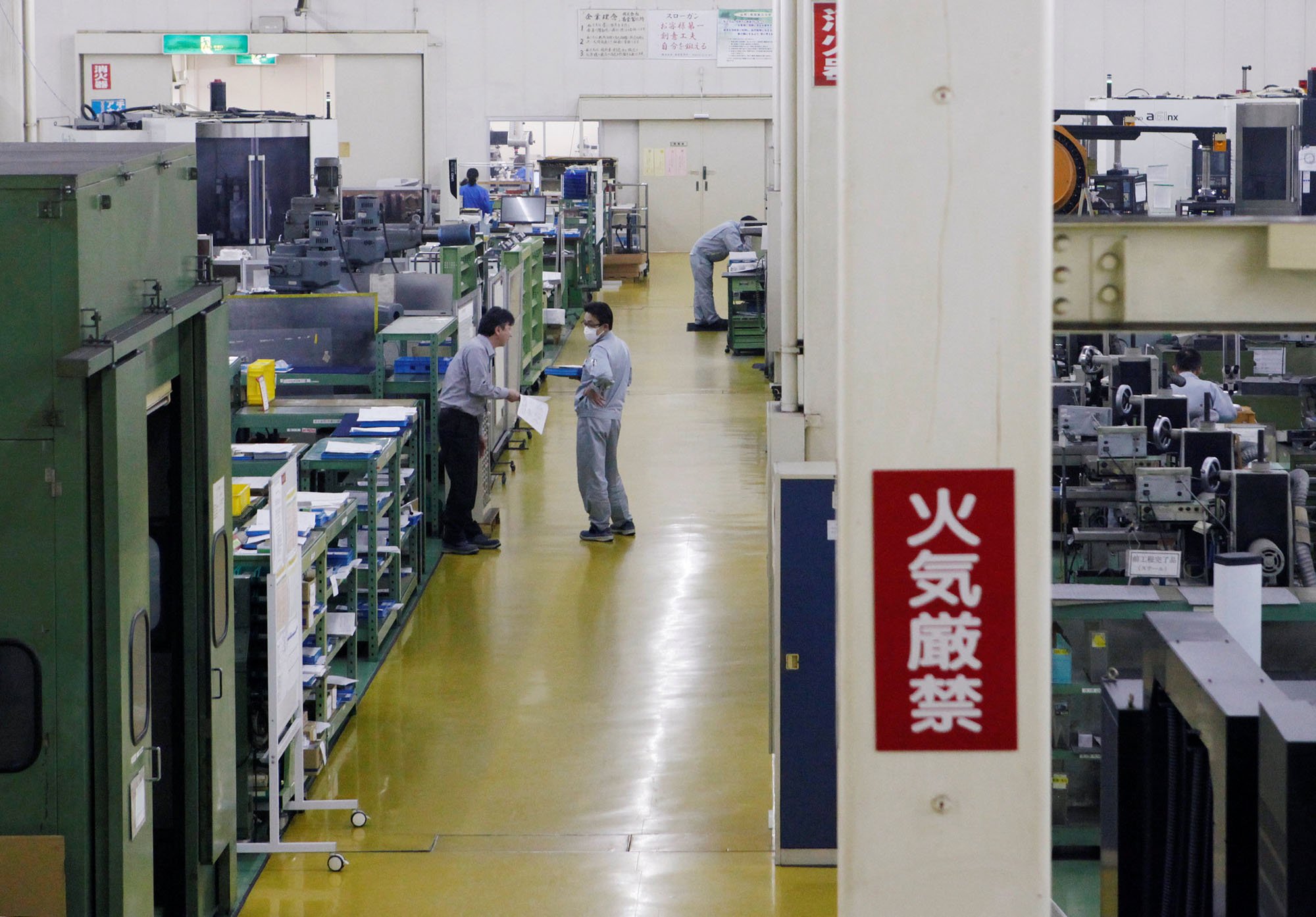

In snow country along the northwest coast of Honshu, a small manufacturer of precision molds is feeling the pain of China's economic slowdown.

Orders have slowed to a trickle at Nagumo Seisakusho Co., a supplier to big auto-parts makers such as Denso Corp. and Aisin Seiki Co. And the company might keep salaries flat or even reduce them in fiscal 2019.

Manufacturers across the country depend heavily on customers in China, the world's second-biggest economy, to buy their products, especially the parts and equipment that reach its factory floors and fuel its domestic and export growth.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.