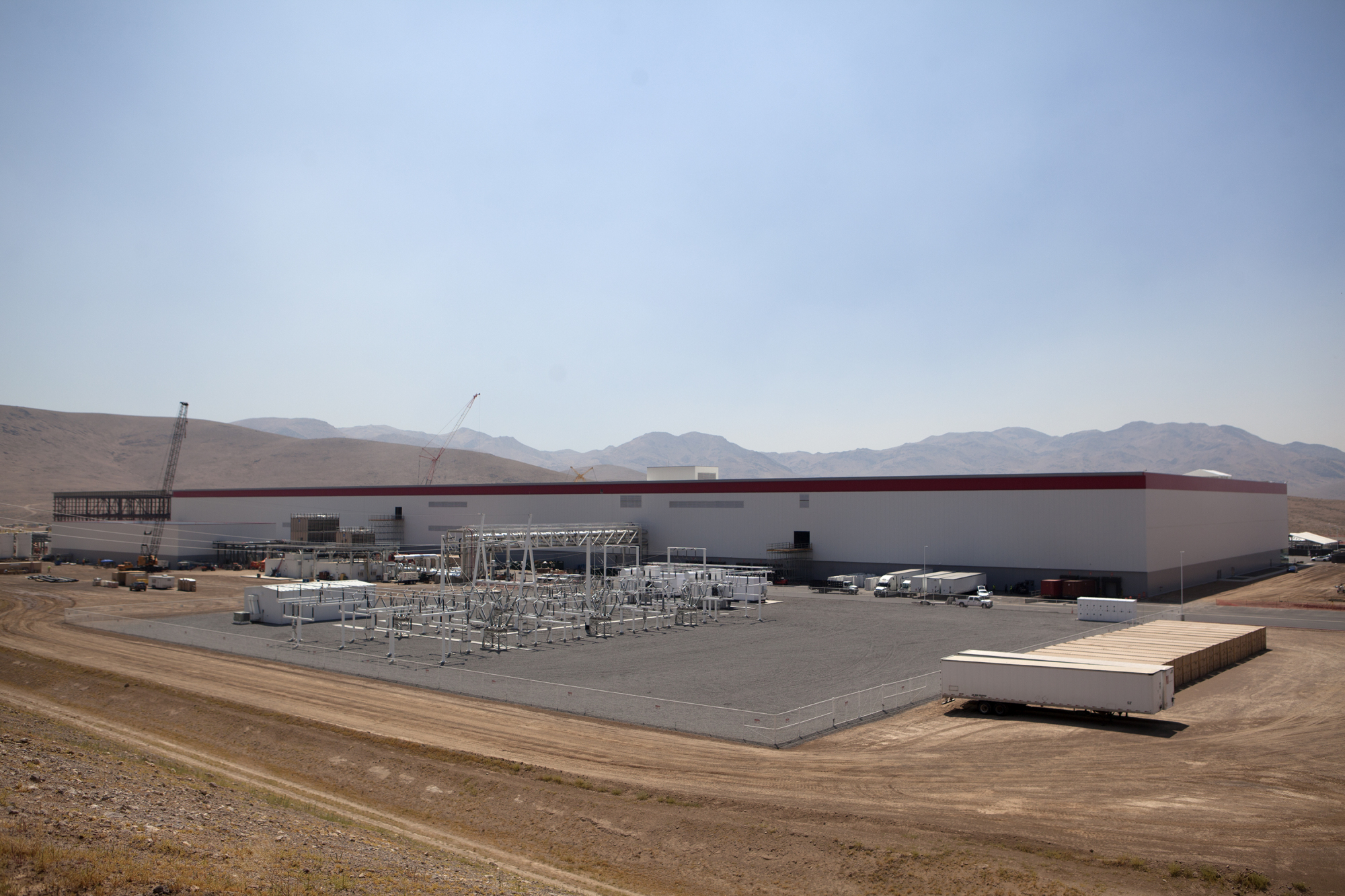

Tesla Motors Inc. is making a huge bet that millions of small batteries can be strung together to help kick fossil fuels off the grid. The idea is a powerful one — and has been used to help justify the company's $5 billion factory near Reno, Nev. — but batteries have so far only appeared in a handful of true, grid-scale pilot projects.

That is now changing.

Three massive battery storage plants — built by Tesla, AES Corp., and Altagas Ltd. — are all officially going live in Southern California at about the same time. Any one of these projects would have been the largest battery storage facility ever built. Combined, they amount to 15 percent of the battery storage installed planet-wide last year.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.