Toyota Motor Corp. sees the technological revolution shaking up the auto industry as a serious enough threat to its survival that the world's most valuable carmaker will consider partnering with one of its fiercest Japanese rivals.

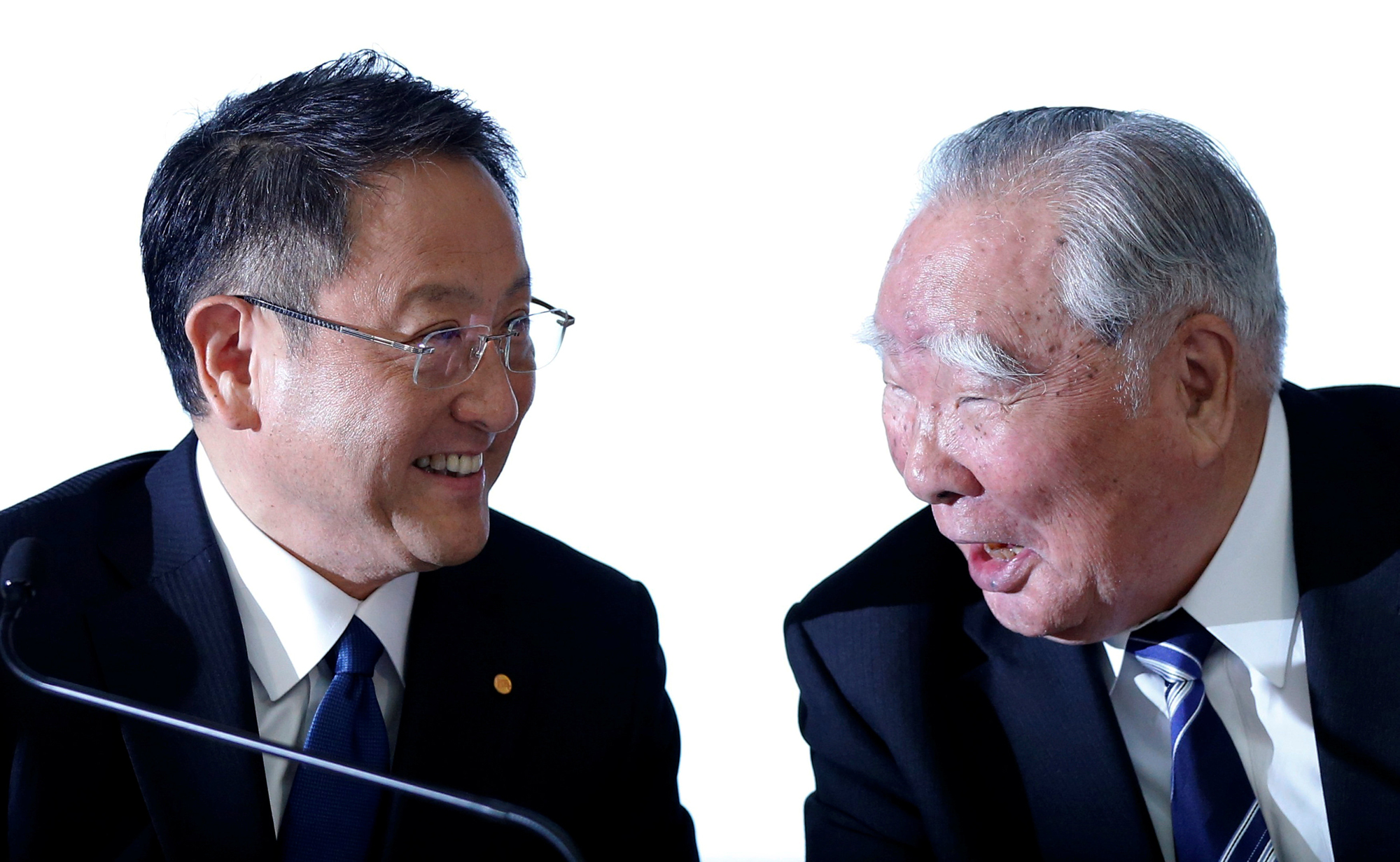

In exploring collaboration between Toyota and Suzuki Motor Corp., chieftains Akio Toyoda and Osamu Suzuki seek to tie together companies with a history of failed alliances.

The two will overlook Toyota's short-lived partnership with Tesla Motors Inc. and Suzuki's acrimonious breakup with Volkswagen AG due to the daunting financial demands of keeping up with technological advances in areas such as electrification and autonomous driving.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.