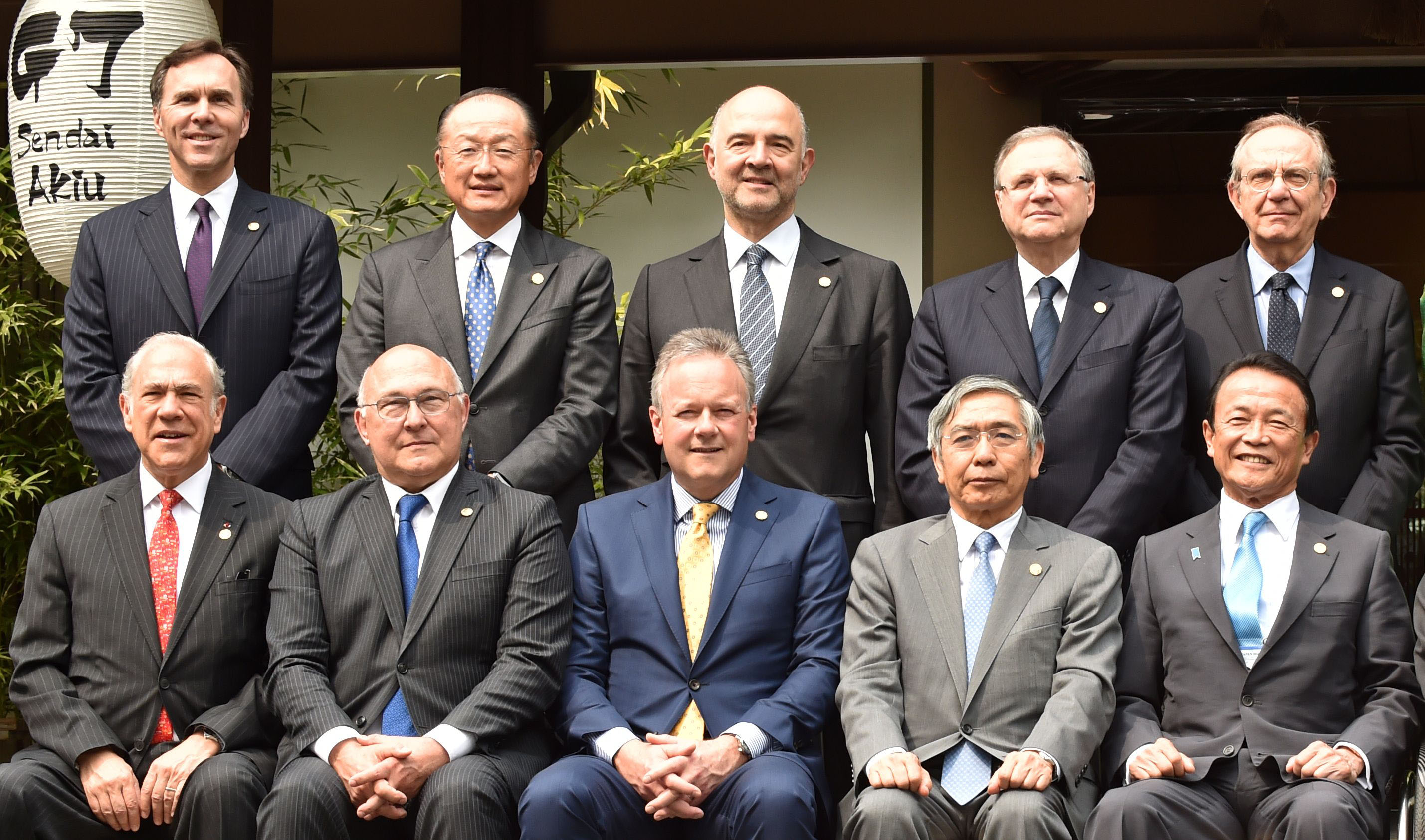

Finance ministers and central bank chiefs from the Group of Seven developed nations kicked off the first day of their meeting in Sendai on Friday unable to find common ground on how to boost the global economy in a coordinated manner.

"There are countries that can and can't use government spending, depending on their own reasons," Finance Minister Taro Aso told reporters soon after the first meeting ended. "We know we can't force them to do it."

The gap stems from how much room they have in their budgets, or the kinds of regulations they have, Aso explained. "For G-7 countries, the most serious point is we don't have enough demand," he added.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.