Fanuc Corp., one of Japan's most reclusive companies, has spent decades building a wall of secrecy around its ultra-profitable industrial-robotics business.

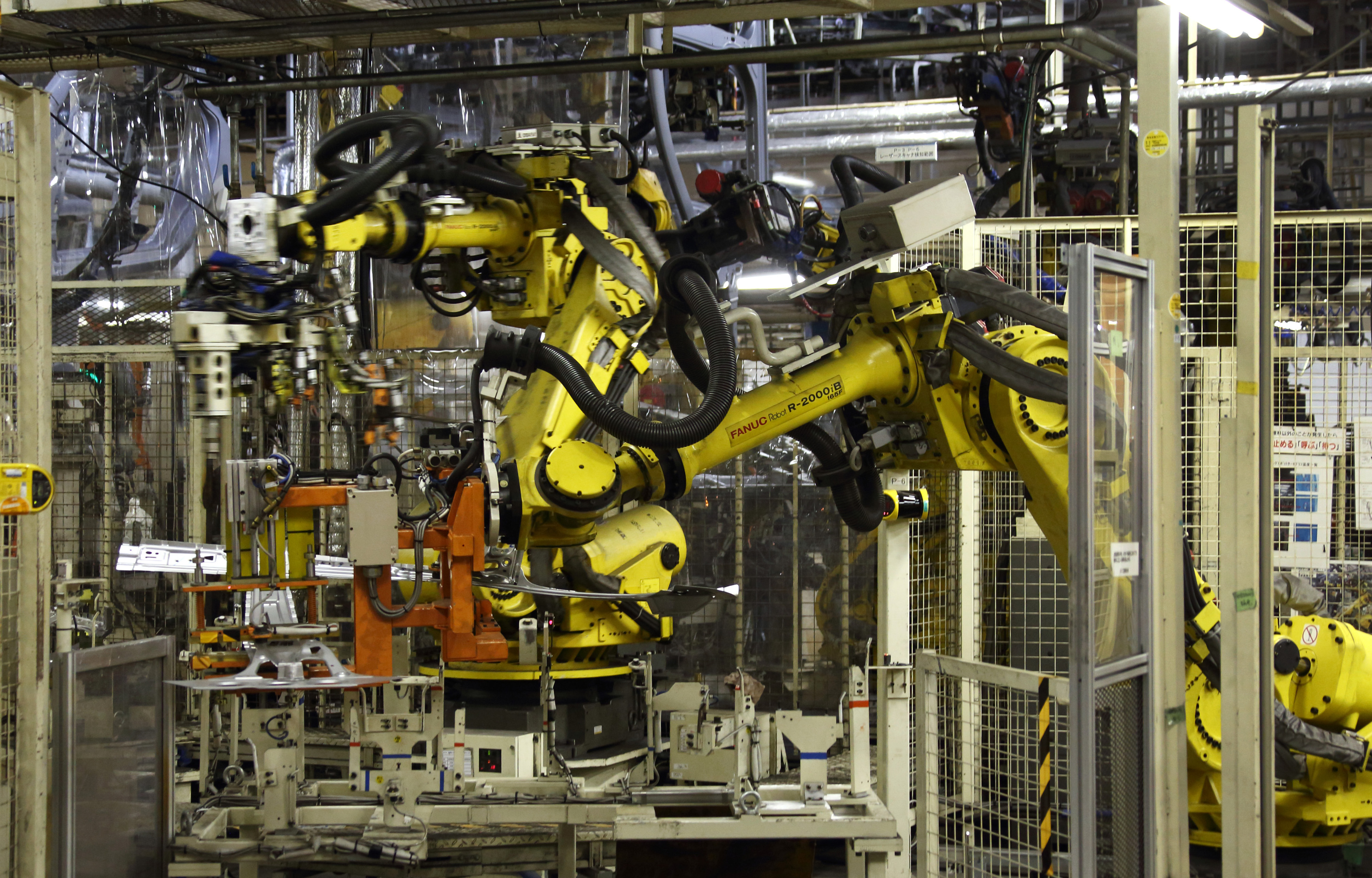

Outsiders are rarely allowed at its complex in Yamanashi Prefecture on the slopes of Mount Fuji, where an army of yellow robots work 24/7 making more robots in windowless yellow factories.

Business is often done by fax to keep computer viruses out and technology in.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.