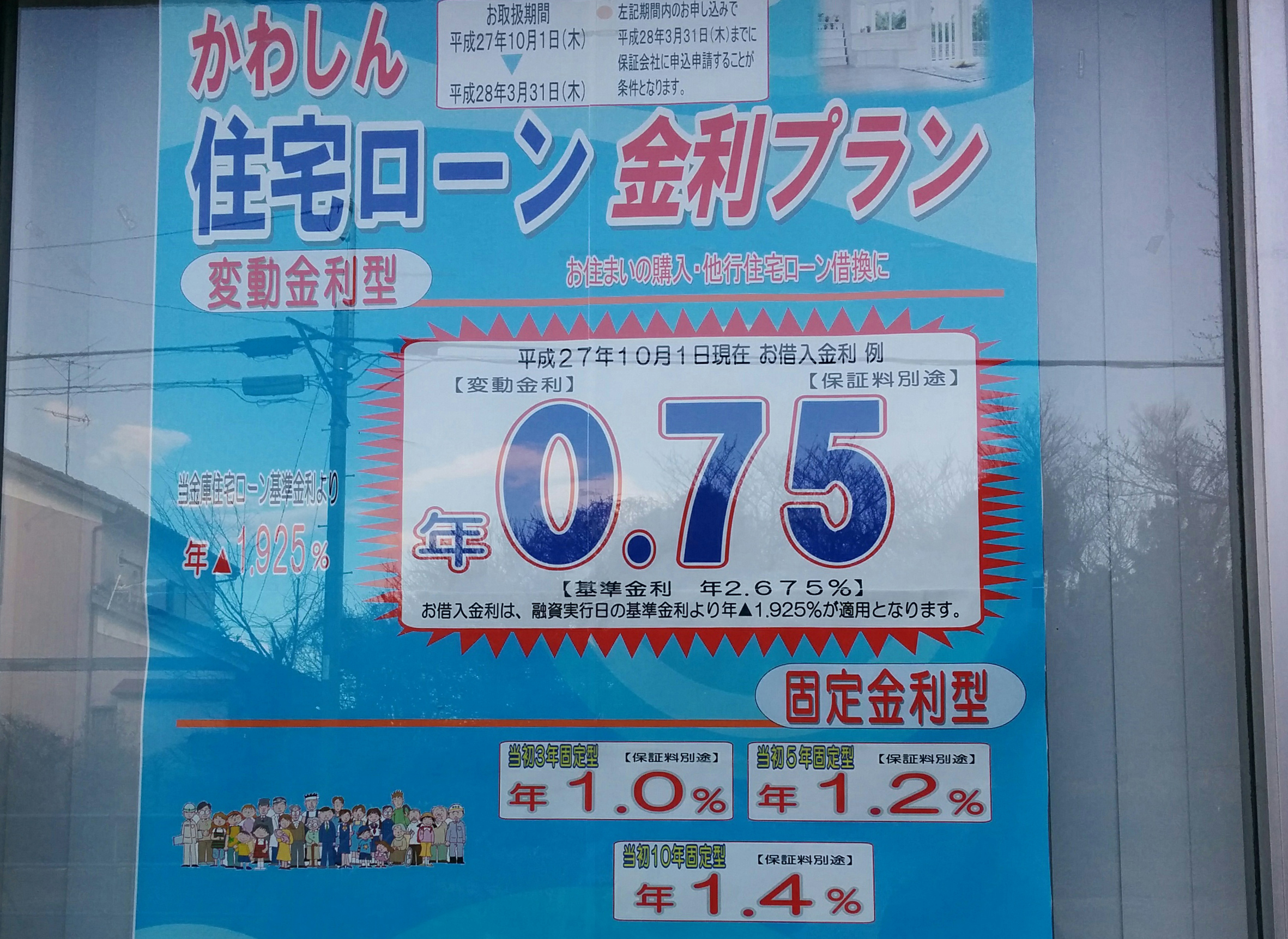

It has been more than a month since the Bank of Japan introduced negative interest rates in its bid to revitalize the economy. For consumers, the rate change is a mixed blessing. Obviously, interest on deposits will not go up any time soon, but anyone thinking of buying a house or condominium can get cheaper loans.

According to the Real Estate Economic Institute, the average price of a condominium in Japan in 2015 was ¥46.18 million, which is 7.2 percent higher than it was in 2014. Over the past three years, spurred by material and labor shortages, the price of condos has increased by almost 20 percent, the steepest rise ever. In the Tokyo metropolitan area, realtors think that a 70 percent monthly rate for contract signings is acceptable, but in January the rate was only 58.6 percent. The Asahi Shimbun recently reported that one "large condominium complex" in Saitama has been on sale for over a year with apartments priced in the ¥40-¥50 million range, and there are still a lot of units unsold, despite the fact that prices have been reduced by about 10 percent. According to a salesperson, house hunters right now are "very tight with money."

They may be waiting for prices to come down. Experts say that when looking for new homes people should ideally limit themselves to properties priced at five to six times the buyer's annual income, and since the average yearly income of a Japanese worker in 2014 was ¥4.5 million, an average condo price of ¥46 million could be considered out of reach. In addition, the tax exemption for gifts from parents for home purchases was recently reduced from ¥7 million to ¥3 million, though the government is talking about increasing the exemption to ¥25 million if and when the consumption tax goes up to 10 percent. Anyone who is not in a hurry may feel it's better to wait.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.