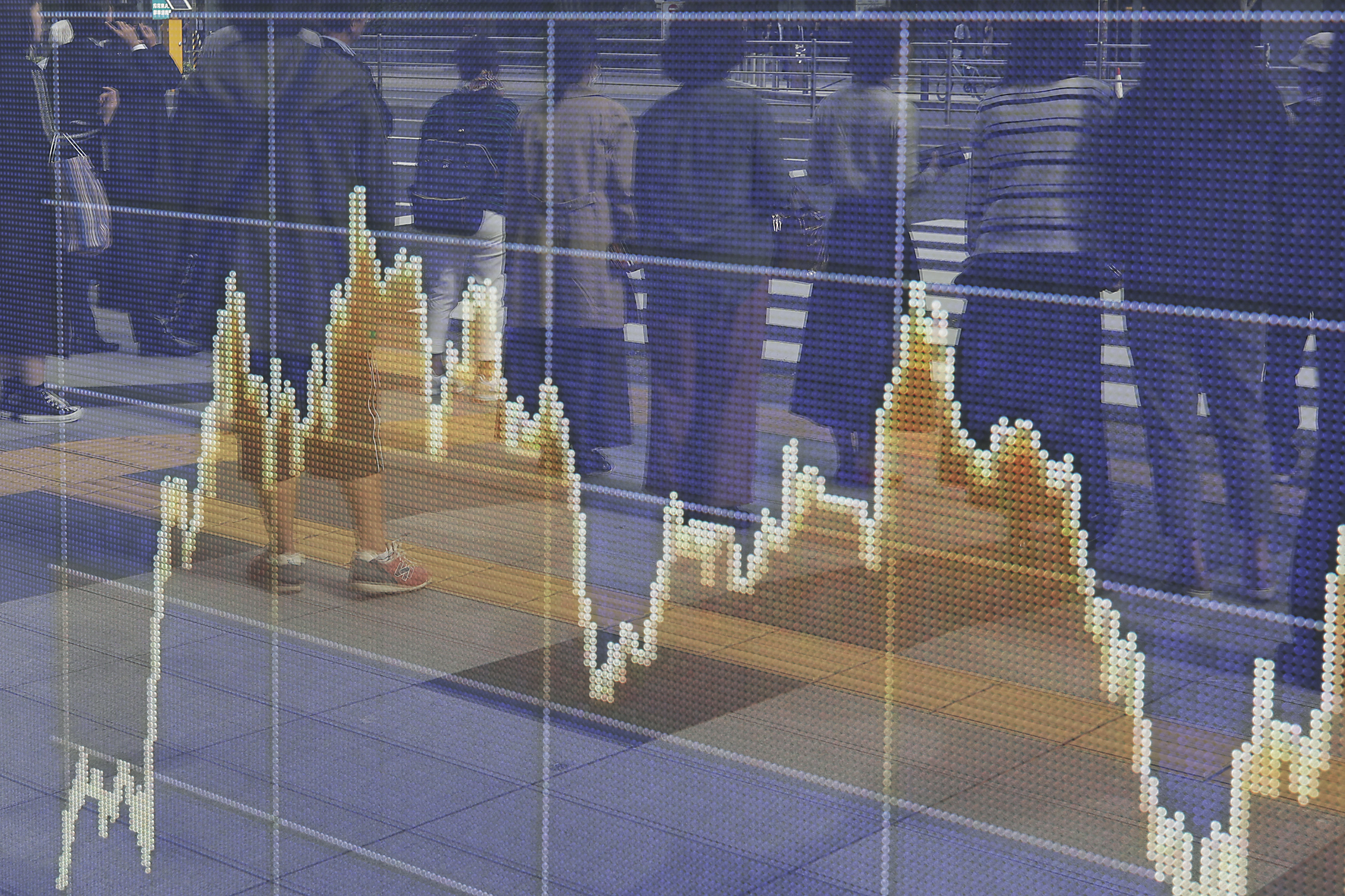

Some of us have waited a quarter of a century for this. The Japanese stock market has finally pierced the "iron coffin lid" otherwise known as 1,800 on the benchmark Topix index. There have been four failed breakouts since Japan's stock market bubble collapsed in 1990. Each time the reversal was quick and nasty, leading to lower lows and deep recessions.

With markets you never say never. External shocks, whether financial or geopolitical, can derail positive trends in an instant. Yet this time the market's underpinnings look much more solid. Indeed, the Topix is lagging several other Japanese indexes. If it had kept pace with the Jasdaq Index of smaller, higher growth stocks this century, it would be closing in on 3,000!

Crucially, the better mood among investors is validated by the surge in corporate profitability and the better performance of the Japanese economy as a whole. Government data last Friday showed that the economy expanded at a faster-than-expected 2.5 percent rate in the three months ended Sept. 30, marking seven straight quarters of growth and the longest expansion since the mid-1990s. This is a remarkable turnaround, given Japan's reputation as economic basket-case and imminent financial disaster zone of interest only to short-sellers.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.