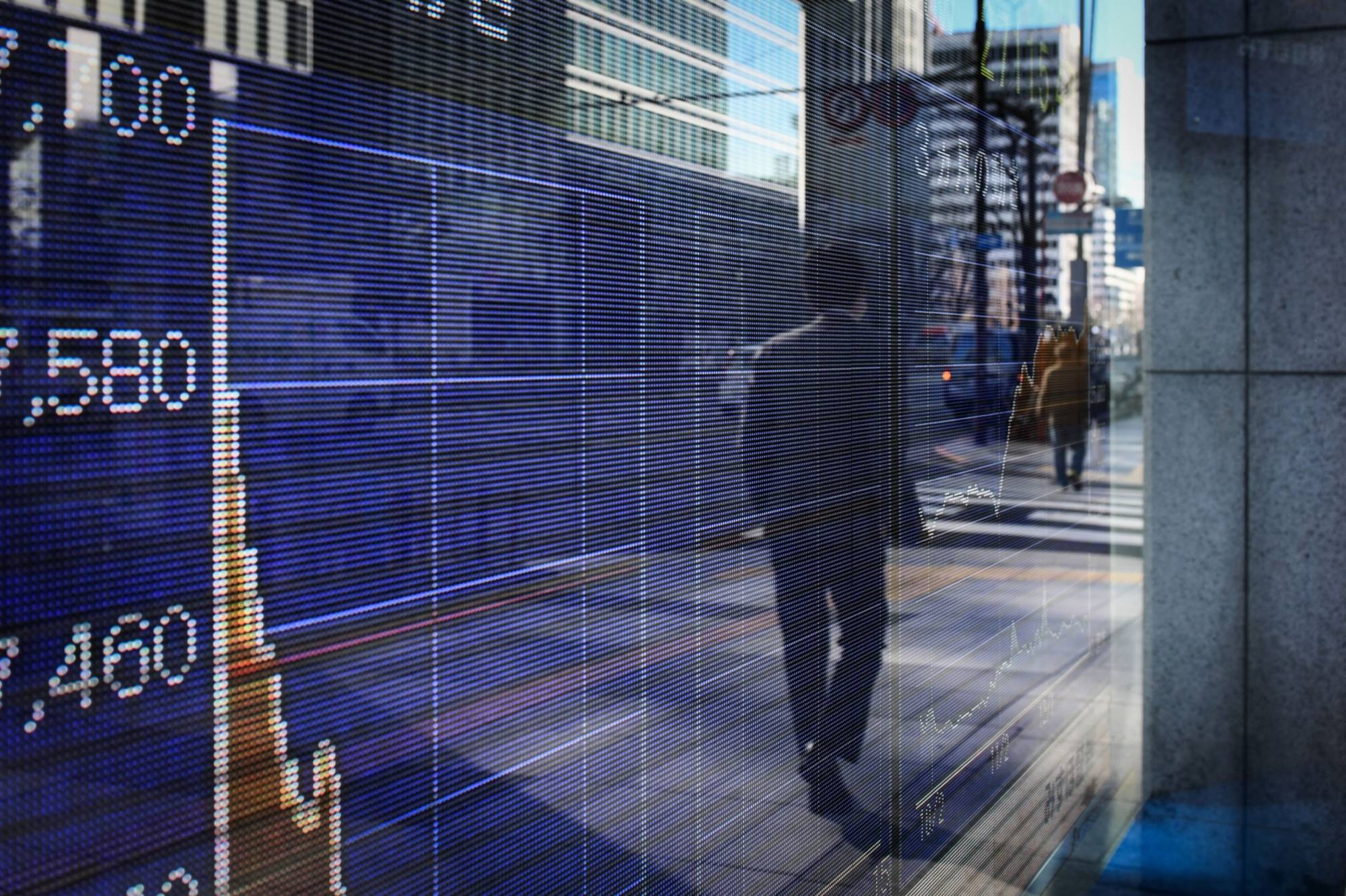

Samurai bond issuance is rebounding from a record low as selling debt in yen for foreign issuers turned more favorable after the Bank of Japan diverged from a more hawkish pivot by many of its peers.

Malayan Banking Berhad is currently marketing samurai bonds, adding to a deal from Korean Air Lines Co. this year and a sovereign offering by Uruguay in December. Sales of the yen notes have risen 47% to ¥632.7 billion ($5.56 billion) so far in the 12-month period ending March 31 from the year-earlier period, according to data compiled by Bloomberg.

Issuers are slowly returning to yen debt markets after borrowers pulled back from the niche funding source when they could get cheaper funding in other currencies as global central banks unleashed unprecedented stimulus to fight the economic impact of the pandemic. BOJ Gov. Haruhiko Kuroda reiterated this week that rapid inflation isn’t a problem for Japan, even as investors await a Federal Reserve meeting Wednesday where economists expect the U.S. central bank to signal plans to start hiking rates.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.