Even for Masatsugu Nagato, an experienced business executive who has worked in prominent companies, making Japan Post Holdings Co. stand on its own two feet as a private company comes as a daunting challenge.

But Nagato, its president, says he is confident he can accomplish the task by taking advantage of its network of over 24,000 post offices nationwide and its abundant real estate resources.

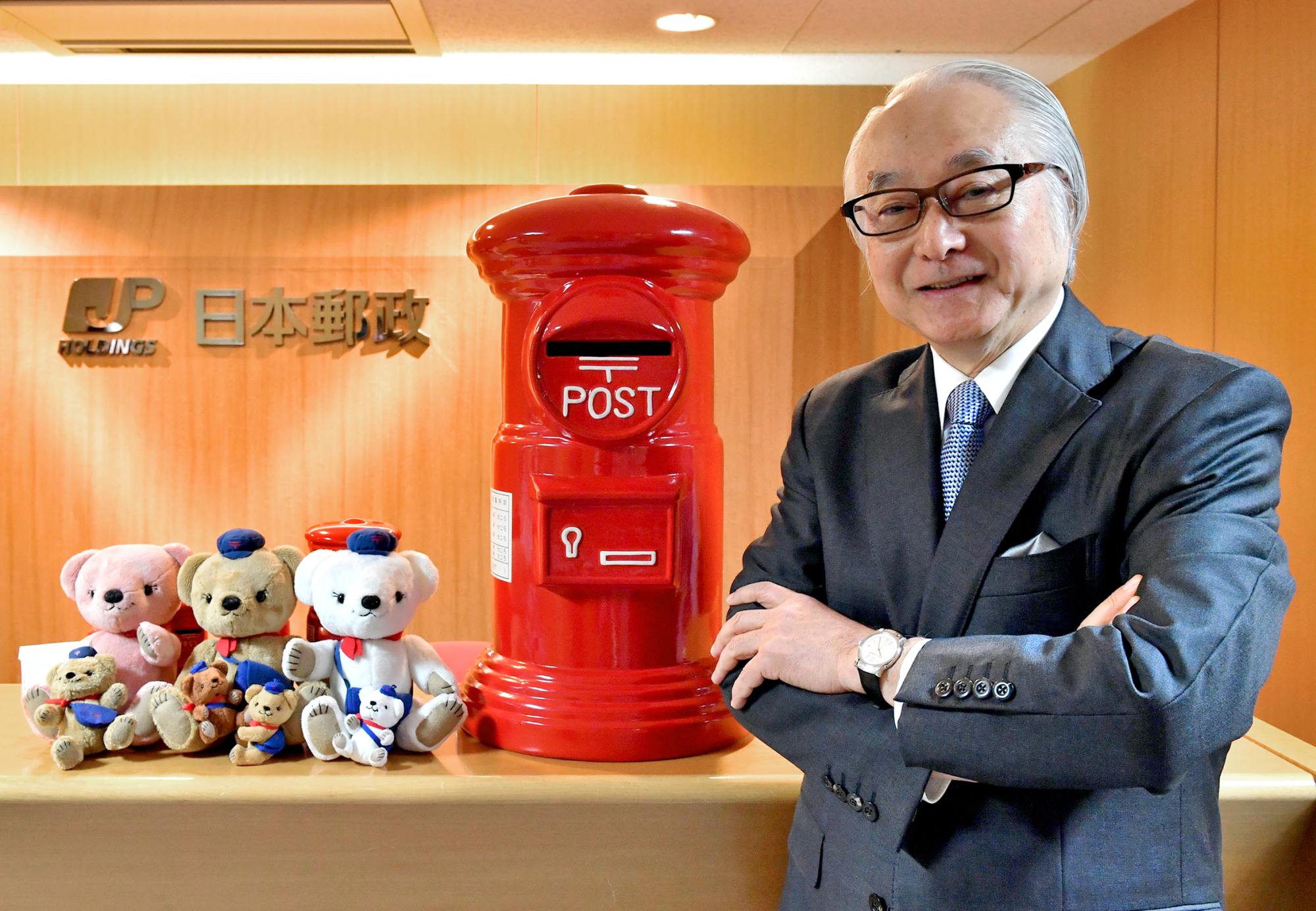

"The IPO was indeed a great step for us — like a ship departing from a harbor to embark on an ocean voyage," Nagato, 69, said during a recent interview with The Japan Times at the postal giant's headquarters in Tokyo's Kasumigaseki district.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.