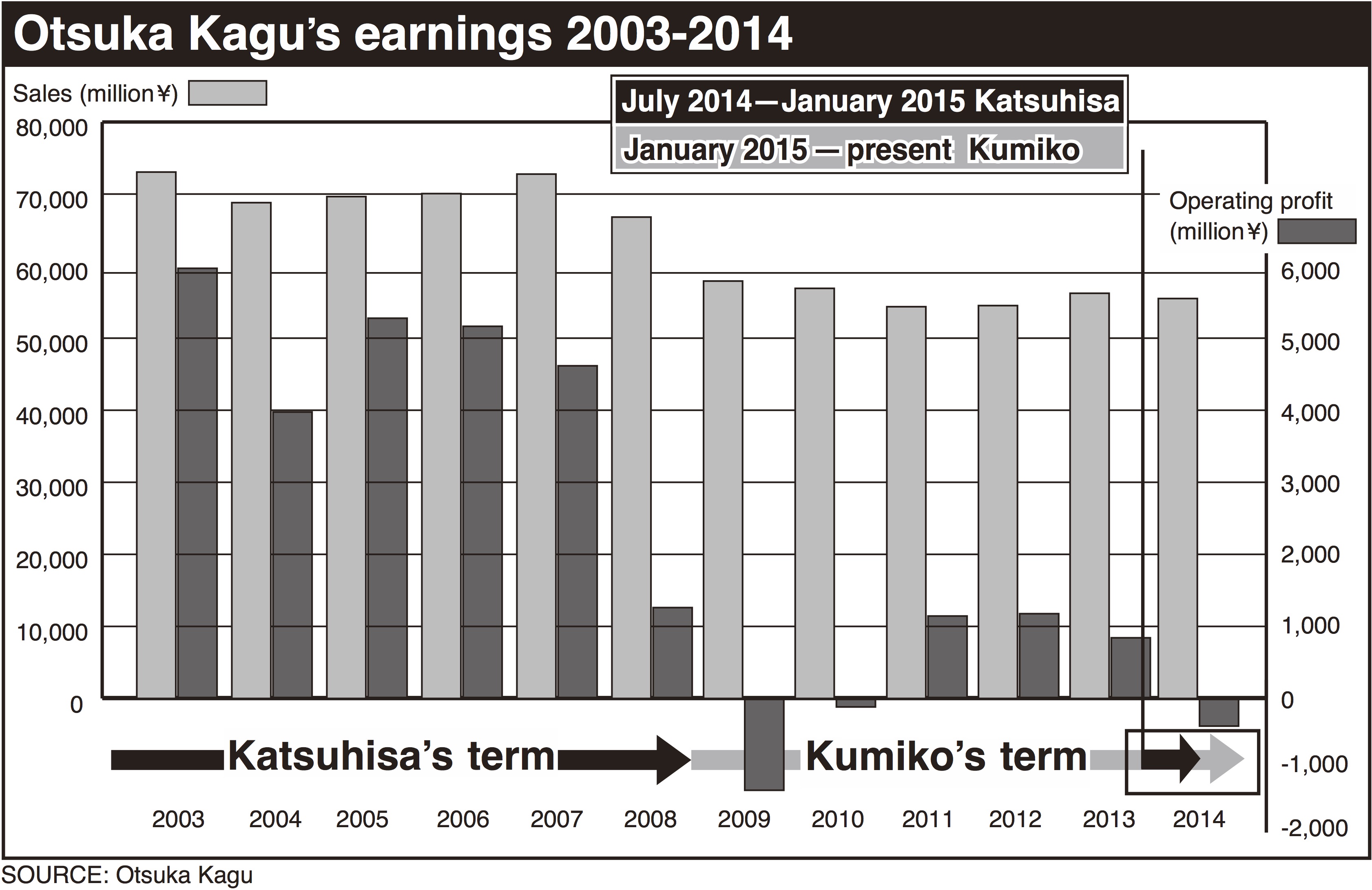

A battle between the founder of Otsuka Kagu Ltd. and its current president, who also happen to be father and daughter, is expected to turn into a proxy fight at the company's annual shareholders' meeting scheduled for Friday, with the result deciding the fate of the struggling furniture giant.

Founder and Chairman Katsuhisa Otsuka, 71, and his eldest daughter and company President, Kumiko Otsuka, 47, said they remain divided over the Tokyo-based firm's business strategy and have both made proposals to the board to oust the other.

Otsuka wants to stick with his original business strategy, which offers consulting services to customers on selling sets of premium furniture. His daughter, on the other hand, plans to promote more midpriced products to expand the customer base.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.