State-backed Japan Investment Corp. is in talks to buy the country's top chip firm, JSR Corp., for about ¥1 trillion ($7 billion), the Nikkei business daily reported on Saturday.

The fund aims to make a tender offer as early as this year after clearing the buyout with domestic and foreign antitrust authorities, the report said. The newspaper did not cite a source for its information.

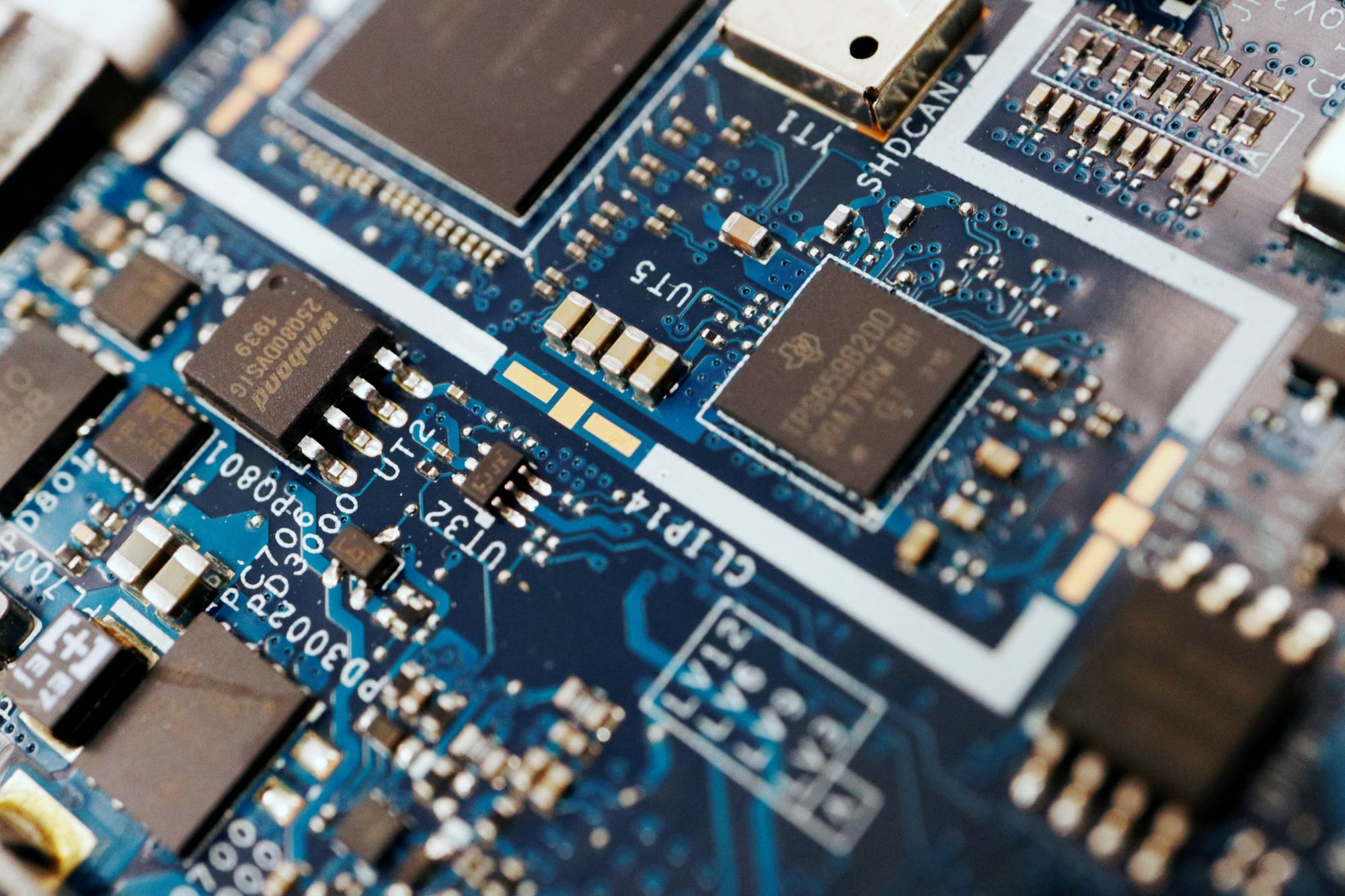

The deal would have major implications for Japan's semiconductor strategy, as the government regards microchips as strategic products to strengthen its economic security, and seeks to bolster supply chains.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.